Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693495

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693495

Southeast Asia Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 341 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

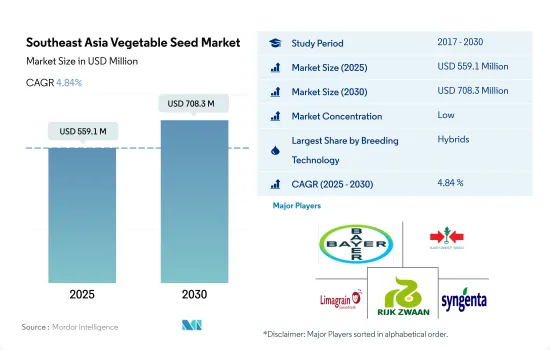

The Southeast Asia Vegetable Seed Market size is estimated at 559.1 million USD in 2025, and is expected to reach 708.3 million USD by 2030, growing at a CAGR of 4.84% during the forecast period (2025-2030).

The demand for high-yielding and disease-resistant varieties is anticipated to increase during the forecast period

- Hybrid and open-pollinated varieties and hybrid derivatives are two major technologies in the region. Hybrid seeds dominated the vegetable seed market by holding a share of 75.2% in 2022 in terms of value.

- Hybrids have a higher share due to higher productivity, wider adaptability, and a high degree of resistance to biotic and abiotic stresses. For instance, in Solanaceae crops, hybrids give 50% more yield than conventional varieties. Hybrids' wider adaptability is mainly due to their high buffering capacity to environmental fluctuations.

- In 2022, Indonesia and Myanmar together accounted for about 46.0% of the total open-pollinated varieties market in the region by value. Open-pollinated varieties require fewer inputs, such as fertilizer and pesticides, and are less expensive and more affordable for low-income farmers, thus boosting the market in the region.

- Similarly, in Southeast Asia, the open-pollinated varieties and hybrid derivatives held a market share of 24.8% by value in 2022. The low share can be mainly due to the preference for high-yielding and disease-resistant hybrids.

- All crops are non-transgenic hybrids, as no countries in the region have approved commercial cultivation of transgenic hybrid vegetable seeds. The hybrid seeds segment is anticipated to be the fastest-growing segment in the region, registering a CAGR of 5.0% during the forecast period, owing to the advantages, such as high yield, disease resistance, and early maturity.

- Therefore, with increasing food demand and the implementation of commercial hybrid varieties, hybrid breeding technology is expected to dominate the market during the forecast period.

Indonesia dominated the Southeast Asian vegetable seed market in 2022

- In Southeast Asia, the vegetable seed market was valued at USD 483.5 million in 2022. Indonesia, Vietnam, and Myanmar are the major contributors to the vegetable seed market in the region. In 2022, these countries together accounted for 49.7% of the regional market. These countries have the highest acreage in terms of vegetable cultivation, accounting for 4.7 million hectares, i.e., 53.7% of the total vegetable acreage in the region in 2022.

- Indonesia dominated the vegetable seed market, accounting for 33.4% of the market in 2022, the highest share in the region, primarily due to its large adoption of commercial seeds and increased vegetable cultivation. The country held the maximum vegetable acreage in the region, recorded at 2.0 million hectares in 2022, i.e., 23.4% of the vegetable acreage in the region.

- Vietnam and Myanmar are the other major contributors to the regional vegetable seed market. In 2022, the vegetable seed market in these countries was valued at USD 64.7 million and USD 55.5 million, respectively. The increased acreage, adoption of protected cultivation methods, and awareness about the benefits of vegetable consumption led to the growth of the seed market in these countries.

- The Philippine and Thai vegetable seed markets were valued at USD 53.8 million and USD 45 million in 2022, respectively. The local governments in these countries initiated pilot projects to encourage the local farmers to cultivate vegetables by providing financial assistance.

- Therefore, factors such as government measures, increasing production and population, growing awareness about the health benefits of raw vegetables, and the demand from processing industries are anticipated to boost the region's vegetable seed market during the forecast period.

Southeast Asia Vegetable Seed Market Trends

Root and bulbs dominate vegetable cultivation in Southeast Asia as they are well-suited to the soil types found in the region

- Southeast Asia has a favorable climate and agronomic conditions for vegetable cultivation. As a result, in 2022, the region dedicated 8.7 million hectares to vegetable cultivation, which accounted for 10.7% of the total cultivation area in Southeast Asia. Roots and bulbs are the largest segment in Southeast Asia, and it accounted for 51.2% of the vegetable area in 2022, with 4.4 million ha. This is because they are well-suited to the soil types found in the region. These crops have a relatively low cost of production and can be grown without huge amounts of inputs, making them the preferred choice by farmers in the region.

- Chili is the dominant vegetable in terms of cultivation area in Southeast Asia, and it accounted for 7.1% of the total vegetable cultivation in the region in 2022. In Southeast Asia, Indonesia was the major chili-producing country, which held a share of 52.2% of the region's overall cultivation area in 2022, with 324.7 thousand ha. The highest share is due to the demand by processing industries and the adoption of advanced mechanisms for chili cultivation in the country. The other major vegetable crops cultivated in Southeast Asia are tomato, potato cabbage, and cucumber. Between 2017 and 2022, Southeast Asia's tomato area increased by 6.8% due to the increase in the prices of tomatoes and higher consumer demand.

- Indonesia is the largest country in the region with respect to the area under cultivation of vegetables, and it accounted for 23.5% of the region's vegetable area in 2022. The area was increasing as the farmers shifted toward vegetables due to the increase in the demand from the domestic and international markets. Therefore, the adoption of advanced mechanisms is expected to drive the growth of vegetable acreage in the region.

Cabbage, pumpkin and squash are vital vegetable crops in Southeast Asia, with a rising demand for disease resistant and quality attributes varieties to meet the higher consumer demand

- Cabbage is one of the most important vegetable crops in Southeast Asia. Different types of cabbages grown in the region are Vietnamese cabbages, Chinese cabbages, and Bak Choy. Varieties with disease tolerance (Alternaria leaf blight, wilts, and rots), quality traits such as the size of the head, the color of head leaves, the shape of the head, and other traits such as pest resistance and wider adaptability are the major traits widely adopted. Additionally, the size of heads and head weight are the major traits that have a significant demand, as they help in increasing yield productivity per hectare. Companies such as Limagrain and Rijk Zwaan are providing cabbage seeds with these traits to grow in adverse weather conditions with high quality.

- Pumpkin and squash are the major cucurbits widely grown in the region. The popular traits of the crop are quality attributes such as good shape, size, and color, longer storage life, disease resistance, especially against the geminin virus, and wider adaptability to different climatic and soil types. It is expected that in the future, disease resistance and quality attribute traits will be more widely available as companies develop new varieties with mildew tolerance and virus resistance, as well as uniformity, color, and flavor. Moreover, East-West Seed has varieties, such as 18880 F1 and Pujitha F1, which provide resistance to geminin and potyvirus in the crop. In the Philippines, Enza Zaden launched new seed varieties through a partnership with Vitalis Organic Seeds in 2021.

- Factors such as the introduction of new seed varieties with higher resistance to viruses, quality attributes, and high yield are expected to help in the growth of the vegetable seed market during the forecast period.

Southeast Asia Vegetable Seed Industry Overview

The Southeast Asia Vegetable Seed Market is fragmented, with the top five companies occupying 21.57%. The major players in this market are Bayer AG, East-West Seed, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel BV and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92558

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cabbage, Pumpkin & Squash

- 4.2.2 Tomato & Chilli

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Okra

- 5.3.5.4 Peas

- 5.3.5.5 Spinach

- 5.3.5.6 Other Unclassified Vegetables

- 5.3.1 Brassicas

- 5.4 Country

- 5.4.1 Indonesia

- 5.4.2 Myanmar

- 5.4.3 Philippines

- 5.4.4 Thailand

- 5.4.5 Vietnam

- 5.4.6 Rest of SouthEast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Bejo Zaden BV

- 6.4.4 Charoen Pokphand Group (CP Group)

- 6.4.5 East-West Seed

- 6.4.6 Enza Zaden

- 6.4.7 Groupe Limagrain

- 6.4.8 Known You Seed Co. LTD

- 6.4.9 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.10 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.