Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693479

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693479

United States Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 335 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

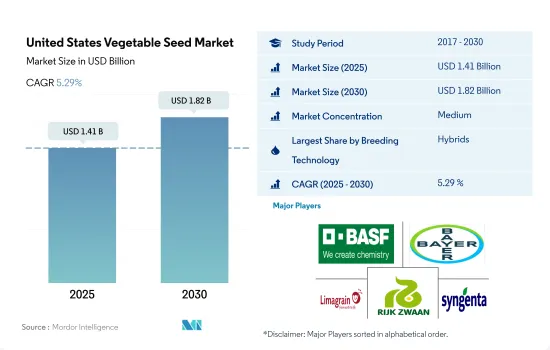

The United States Vegetable Seed Market size is estimated at 1.41 billion USD in 2025, and is expected to reach 1.82 billion USD by 2030, growing at a CAGR of 5.29% during the forecast period (2025-2030).

Hybrids dominated the vegetable seed market due to the availability of traits such as disease resistance and wider adaptability

- The United States is the leading vegetable-producing country. It is the largest vegetable seed consumer globally, valued at USD 1.21 billion in 2022. The hybrids and OPV varieties accounted for 94.9% and 5.1%, respectively, of the country's vegetable seed market value in 2022, which is the result of an increase in the usage of hybrids in vegetable production.

- The usage of hybrid varieties is growing because farmers are being influenced by this trend to switch from conventional varieties of crops to packaged seeds that offer higher yields in less area. The demand for hybrid tomato, lettuce, and sweet pepper seeds is high. A large portion of the vegetable-growing community in the country prefers hybrid, high-yielding, and disease-resistant varieties of vegetables. For instance, traits with resistance to diseases such as tomato mosaic virus, tomato yellow leaf curl virus, powdery mildew, wilt diseases, and nematodes are popularly used for cultivation in the country.

- Open-pollinated varieties are highly efficient in adaptability and tolerant to varied local climatic conditions. Despite the low market value, many farmers in the country still prefer open-pollinated varieties due to their specific benefits.

- Widespread mergers and acquisitions, fast expansion in private research and development, shifts in the relative proportions of public and private R&D, and enhanced agricultural biotechnology all contributed to the growth of the hybrid sector in the country. Therefore, the sales of hybrid seeds are estimated to increase during the forecast period due to benefits such as higher yield and the production of high-quality vegetables.

United States Vegetable Seed Market Trends

Potatoes and tomatoes are the largest cultivated vegetables in the United States, mainly because they are staple vegetables in the country with a high export demand and a significant per capita consumption rate

- Vegetables are largely produced and consumed in the United States. Major vegetables cultivated in the country are tomato, pumpkin, cauliflower, onion, potato, lettuce, and spinach. However, the area cultivated under vegetables was 0.77 million ha in 2022, accounting for less than 1% of the cultivable land in the country due to higher adoption of hybrid seeds as well as higher profit margins from field crops. Potato is a largely cultivated vegetable in the country because of the high demand from food chains such as Wendy's and McDonald's, as well as higher usage in American breakfast dishes. Moreover, it will increase with production starting in Florida as the supply is lower than the demand for the crop, and tabletop potatoes have been developed to meet this high demand.

- There was a decrease in the area of cultivation from 2017 to 2022 because of the growers shifting from vegetables to the cultivation of more field crops such as oilseeds and corn as they are highly profitable, as well as a decrease in the demand for potatoes and lettuce during the pandemic as the major food chains were not operating. Furthermore, the area of cultivation for tomatoes decreased by 10.6% during 2017-2022 as it was majorly affected by drought and extreme heat conditions in California, which accounted for 95% of the tomato production for processing in the country in 2022. However, it is estimated to increase due to the high demand from tomato processing industries.

- The higher consumption of vegetables, especially potatoes and tomatoes, and the high demand from the food and beverage industry are expected to help increase the cultivation area during the forecast period, which will help in the growth of the market in the country during the same period.

Disease resistance is one of the significant traits in cabbage, cauliflower, and broccoli cultivation due to its ability to resist prevalent diseases, which are common challenges faced by these vegetable growers

- Cabbage is a major Brassica vegetable grown widely in the country. Hybrids with multiple traits are highly cultivated in the country. Varieties with disease-tolerant and high-quality traits, including the size of the head, the color of head leaves, and the shape of the head, along with other traits such as uniform maturity, early and late maturity, and wider adaptability to different seasons and soil conditions, are cultivated in the country.

- Disease resistance to Fusarium, clubroot, the size of heads, and head weight are the major traits in high demand, as they help increase yield productivity per hectare and prevent yield losses. For instance, Bejo Zaden has more than 6 seed varieties with traits that are resistant to diseases such as tip burn and frost, as well as wider adaptability traits. Moreover, some of the major selling brands in this segment are Emiko, Pacifiko, and Savoy Faire, as they contain different traits such as disease tolerance and other characteristics in a single product.

- Cauliflower is another major Brassica vegetable. Major traits available in the country are disease resistance, tolerance to tip burn, early and late maturity, and quality traits such as coloring, curd hardiness, inner wrapping, uniform maturing, strength against summer, and wider adaptability to all seasons. Enza Zaden, Bejo Zaden BV, Bayer AG, and Syngenta are major companies breeding the cucumber traits.

- With the increasing domestic demand, hybrids with multiple traits play a dominant role in overcoming these difficulties. Therefore, the companies developing new traits are helping to create innovative vegetable seed varieties catering to the needs of growers in the country and helping in the market's growth during the forecast period.

United States Vegetable Seed Industry Overview

The United States Vegetable Seed Market is moderately consolidated, with the top five companies occupying 56.32%. The major players in this market are BASF SE, Bayer AG, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel B.V. and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92542

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cabbage, Cauliflower and Broccoli

- 4.2.2 Tomato & Cucumber

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Okra

- 5.3.5.4 Peas

- 5.3.5.5 Spinach

- 5.3.5.6 Other Unclassified Vegetables

- 5.3.1 Brassicas

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Bejo Zaden BV

- 6.4.4 Enza Zaden

- 6.4.5 Groupe Limagrain

- 6.4.6 Nong Woo Bio

- 6.4.7 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- 6.4.8 Sakata Seeds Corporation

- 6.4.9 Syngenta Group

- 6.4.10 Takii and Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.