Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693493

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693493

Thailand Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 287 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

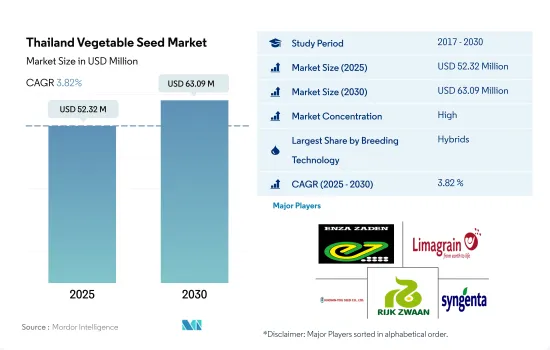

The Thailand Vegetable Seed Market size is estimated at 52.32 million USD in 2025, and is expected to reach 63.09 million USD by 2030, growing at a CAGR of 3.82% during the forecast period (2025-2030).

Hybrids are in high demand owing to their usage in the protected cultivation of vegetables

- In 2022, the share of hybrids was more than the open-pollinated varieties in Thailand's vegetable seed market. The demand for hybrid seeds is high due to benefits such as drought tolerance, adaptability to different soils, and higher yield than open-pollinated seed varieties.

- The share of hybrid seeds in protected cultivation is 100% because open-pollinated varieties (OPVs) face constraints like lower yields, delayed maturity, and inferior quality. An increase in the area under protected cultivation is driving the demand for hybrids in Thailand.

- In 2022, hybrids accounted for 83.5% of the vegetable seed market in Thailand. The increase in awareness about the advantages of hybrids, such as early bearing, disease resistance, and high yielding, is responsible for the increased use of hybrids in the country for vegetable production.

- In 2022, hybrids under protected cultivation accounted for 0.1% of the hybrid vegetable seed market in the country. The low share is due to the requirement of high initial investments for protected cultivation. During the forecast period, the hybrid seeds market under protected cultivation is projected to witness a CAGR of 7.1% due to the year-round demand for vegetables and government support for protected cultivation.

- Open-pollinated varieties require fewer inputs, such as fertilizer and pesticides, and are more affordable for low-income farmers. Therefore, the open-pollinated varieties segment concerning vegetables is projected to witness a CAGR of 4.3% during the forecast period.

- Due to the development of hybrids and improved open-pollinated varieties, agricultural production increased in the country. Thus, the demand for commercial seeds is estimated to increase during the forecast period.

Thailand Vegetable Seed Market Trends

The growing demand for vegetables and the government initiatives to support vegetable cultivation are driving the overall vegetable acreage in the country

- In Thailand, vegetables occupied 12.7% of the total cultivated area in 2022. The demand for vegetables has been increasing mainly due to rising consumer awareness regarding healthy diets. Among vegetables, cucurbits, brassicas, and roots and bulbs are primarily cultivated. Roots and bulbs alone occupied 79.3% of the total area under vegetables in 2022 due to their high demand in the country. Under Solanaceae crops, chili is the major crop grown in the country, and their cultivation has increased by 4.5% since 2017 and reached 90.1 thousand hectares in 2022. The increased area reflects the high economic value of chilies and the demand from the growing population.

- Among cucurbits, cucumbers and gherkins are primarily cultivated. In 2022, the total area cultivated under cucumber and gherkins was 19.1 thousand ha. Under brassicas, cabbage is a major crop. It alone occupied 10.4 thousand hectares in 2022. The availability of multiple tolerant and resistant varieties with high-yielding traits is the major factor that allows year-round production. Under roots and bulbs, garlic is the major bulb crop, occupying a cultivation area of 11.2 thousand hectares in 2022. The area increased by 1.0% between 2021 and 2022. The large share of the cultivated area was due to high incomes during off-seasons, providing high profits to farmers.

- Asparagus, lettuce, and peas were other small crops cultivated in the country. The cultivated area of lettuce increased by 2.1% between 2017 and 2022. With growing health awareness and rising disposable incomes, the demand for vegetables has increased. Due to government support and subsidies for vegetable farmers and other varied applications, the vegetable acreage in the country is anticipated to increase during the forecast period.

Cabbage and lettuce seeds with quality attributes and wider adaptability are cultivated extensively to meet the growing demand for new crop varieties

- Cabbage and lettuce are among the major crops grown in Thailand. Seeds with multiple traits are cultivated in the country, such as disease tolerance (Alternaria leaf blight, rots, downy mildew, big veins, and wilts), quality attributes such as the size of the head, the color of head leaves, and shape of the head. Furthermore, the growers widely use other traits such as uniform maturity of heads and wide adaptability to different soil conditions and seasons. Additionally, the size of heads and head weight are the major traits that have a significant demand, as they help increase yield productivity per hectare. Companies such as Syngenta AG and Rijk Zwaan provide cabbage seeds with these traits to grow in adverse weather conditions with high quality.

- Lettuce is a cool-season vegetable crop. Due to the increasing demand for lettuce in the off-season, farmers are using protected cultivation for the crop. High summer temperatures in a greenhouse can cause lettuce to bolt prematurely. Therefore, the demand for bolting-resistant varieties is expected to grow in the future to prevent bolting and increase the cultivation of lettuce in the summer. Moreover, due to the high demand for lettuce in salads and the rising demand for the crop by the food industry, the demand for early maturity traits with wider adaptability is increasing. For instance, Groupe Limagrain's products, such as Early Impulse and Early Income, help in early maturity crop production.

- The prevalence of different diseases, high-quality crop requirements by the food industry, changes in weather conditions, and new cultivation methods are expected to increase the demand for new seed varieties during the forecast period.

Thailand Vegetable Seed Industry Overview

The Thailand Vegetable Seed Market is fairly consolidated, with the top five companies occupying 91.65%. The major players in this market are Enza Zaden, Groupe Limagrain, Known You Seed Co. LTD, Rijk Zwaan Zaadteelt en Zaadhandel BV and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92556

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cabbage & Lettuce

- 4.2.2 Tomato & Cucumber

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Peas

- 5.3.5.4 Other Unclassified Vegetables

- 5.3.1 Brassicas

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Acsen HyVeg Pvt. Ltd

- 6.4.2 Charoen Pokphand Group (CP Group)

- 6.4.3 East-West Seed

- 6.4.4 Enza Zaden

- 6.4.5 Groupe Limagrain

- 6.4.6 Known You Seed Co. LTD

- 6.4.7 Lion Seeds Co. Ltd

- 6.4.8 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.9 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.