Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693463

Europe Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 369 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

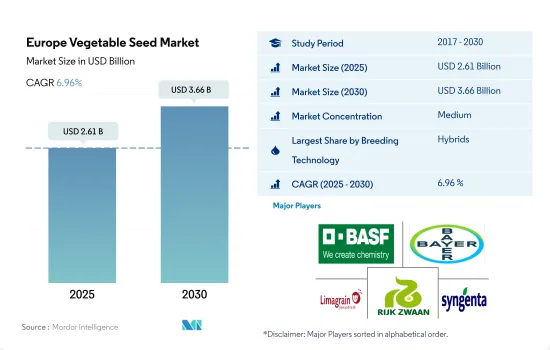

The Europe Vegetable Seed Market size is estimated at 2.61 billion USD in 2025, and is expected to reach 3.66 billion USD by 2030, growing at a CAGR of 6.96% during the forecast period (2025-2030).

Hybrids dominate the vegetable seed market in the region with increasing demand for protected and organic cultivation methods

- The hybrid seed segment dominated the European vegetable seed market. Hybrids are largely developed in peas, tomatoes, onions, and carrots, which occupied 37.2%, 7.6%, 6.9%, and 6.8% of the European hybrid vegetable seed market, respectively, in 2022. These are the most traded and consumed vegetables in the region.

- In 2022, unclassified vegetables and roots & bulbs segments held a major share of 55% and 13.1%, respectively, in the region's hybrid vegetable seed market. Hybrid vegetable seeds have improved shelf-life traits and higher yields, boosting their preference among vegetable growers.

- The open-pollinated varieties are largely developed in peas, pumpkin & squash, and lettuce, which together accounted for 45.9% of the OPV vegetable seed market in 2022. Russia, Italy, and Germany were the major vegetable-producing countries using open-pollinated varieties (OPVs), which accounted for 37.5% of the European OPV vegetable seed market in 2022.

- The organic farming area in Europe increased by 26% between 2016 and 2021. The organic area under farming was 17.09 million ha in 2021. Therefore, non-transgenic hybrid seeds and OPVs are estimated to experience huge demand during the forecast period.

- Bayer intended to expand its vegetable seed offerings under the new segment to include organically produced seeds. The launch will concentrate on certified organic production of three major crops for the greenhouse and glasshouse market, namely, tomato, sweet pepper, and cucumber.

- Therefore, the increase in demand for vegetables from the fresh food market and higher yield with commercial varieties are estimated to drive the hybrids faster in the region, with a CAGR of 7% during the forecast period.

Russia dominated the region's vegetable seed market due to higher area under cultivation and higher usage of commercial seeds

- In Europe, the demand for vegetables is growing rapidly. It contributed 19.3% to the global vegetable seed market in terms of value in 2022. The region is a significant producer of brassicas, holding a share of 26.4% in the global brassicas seed market in 2022.

- Russia is the major market in the Europen region. In 2022, the vegetable seed segment accounted for 28.2% of the seed market in Russia. The major vegetables grown in the country are Solanaceae vegetables. Tomato is a major vegetable in the Russian market, accounting for USD 32.2 million in 2022. The ban on Turkish tomato imports made Russia self-sufficient in tomato production by cultivating more tomatoes in the country.

- Spain held second in the region by accounting for a 12.3% share in 2022. The vegetable sector plays a crucial role in Spain's economy, and it fulfills vegetable demand not only from the domestic market but also from the rest of Europe. The vegetable cultivation area in the country accounted for about 5.0% of the total acreage in 2022.

- In 2022, France accounted for 9.0% of the region's vegetable seed market. Unclassified vegetables are France's major crop segment, accounting for 60.8% of the French vegetable seed market in 2022. This is because the demand for leafy vegetables is growing in the country. Other major countries in the region include Ukraine, Germany, and Italy.

- In Europe, the area under cultivation for vegetables decreased from 8.7 million ha to 8.3 million ha between 2017 and 2022. However, there is an increasing demand for vegetables for consumption, which can be catered to by increased productivity through improved varieties. Therefore, the demand for improved seeds is anticipated to increase in the region during the forecast period.

Europe Vegetable Seed Market Trends

Roots and bulbs dominate the vegetable cultivation in Europe due to their high-income potential and strong domestic demand

- Europe had nearly 9 million hectares of land dedicated to vegetable cultivation in 2022, accounting for 5.4% of the region's total cultivation area. The largest vegetable-growing areas in Europe are located in France, Russia, Ukraine, and Turkey, which collectively accounted for 60.5% of the region's vegetable area cultivated in 2022.

- The roots and bulbs segment was the largest segment in terms of acreage in Europe, accounting for 46% of the total area under vegetable crops in 2022. Among roots and bulb crops, the area under onion increased because of high demand in France, Belgium, Germany, and the Netherlands. The acreage of onions is expanding yearly due to several producers choosing to start growing onions because onion prices are estimated to remain high. This trend is estimated to drive the onion seed market. The area under cultivation of onion increased from 420 thousand ha in 2020 to 433.1 thousand ha in 2022. Potato is a major crop in the region, accounting for 39.8% of the vegetable area in 2022. The acreage of potatoes in Europe has been declining. For instance, in 2022, the area decreased by 9% from 4.9 million ha in 2017 due to a sharp decline from the major producing countries such as Poland and Romania.

- The area under tomato cultivation in Europe increased from 585.2 thousand ha in 2021 to 592.4 thousand ha in 2022 due to the increase in the price of fresh produce coupled with growing consumption and demand from the processing industry. For instance, the consumption of tomatoes in Europe increased from 6,500 metric tons in 2017 to 7,159 metric tons in 2022, and tomatoes for processing accounted for 11,000 metric tons in 2022, which increased by 7% from the previous year. Therefore, these factors are estimated to drive the growth of the seed market.

There has been an increase in the use of hybrids with disease-resistant and high uniformity carrot and cauliflower traits

- The production of carrots and cauliflower & broccoli is becoming increasingly challenging due to climate change, diseases, and pest attacks. Therefore, the demand for seeds with traits such as disease resistance, abiotic stress tolerance, uniformity, and higher yield potential is driving the growth of the market.

- The growth of carrot and cauliflower plants is greatly influenced by abiotic stresses such as low nitrogen content, heat, flooding, drought, and salinity. These adverse conditions significantly decrease the yield of these crops. Consequently, there is a higher demand for seed varieties that possess tolerance to abiotic stresses in the region.

- In recent years, the adoption of hybrid seeds containing disease-resistant traits against powdery mildew, Alternaria spots, and bolting has significantly boosted yield. For instance, the yield of cauliflower and broccoli surged to 167,803 hg/ha in 2021 from 167,168 hg/ha in 2019. Similarly, carrot yield rose to 386,331 hg/ha from 367,359 during the same period.

- Quality traits such as desirable internal and external colors, long carrot roots, and high uniformity in cauliflower crowns and curds are widely valued for their aesthetic appeal to consumers. Because of these factors, key players in the region have developed a diverse portfolio suitable for specific climatic conditions of the countries. For instance, in the United Kingdom, Rijk Zwaan offers cauliflower varieties like Dexter RZ F1, Lavender RZ F1, and Stabilis RZ F1, all of which exhibit high uniformity characteristics.

- Furthermore, farmers are cultivating crops with additional traits such as extended shelf life, prolonged storage capabilities, tolerance to cracking, early to medium maturing varieties, and high dry matter content in the region.

Europe Vegetable Seed Industry Overview

The Europe Vegetable Seed Market is moderately consolidated, with the top five companies occupying 40.80%. The major players in this market are BASF SE, Bayer AG, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel BV and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92526

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Carrot, Cauliflower and Broccoli

- 4.2.2 Tomato & Cabbage

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Okra

- 5.3.5.4 Peas

- 5.3.5.5 Spinach

- 5.3.5.6 Other Unclassified Vegetables

- 5.3.1 Brassicas

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Poland

- 5.4.6 Romania

- 5.4.7 Russia

- 5.4.8 Spain

- 5.4.9 Turkey

- 5.4.10 Ukraine

- 5.4.11 United Kingdom

- 5.4.12 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Bejo Zaden BV

- 6.4.4 Enza Zaden

- 6.4.5 Groupe Limagrain

- 6.4.6 KWS SAAT SE & Co. KGaA

- 6.4.7 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.8 Sakata Seeds Corporation

- 6.4.9 Syngenta Group

- 6.4.10 Takii and Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.