Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693477

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693477

Africa Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 331 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

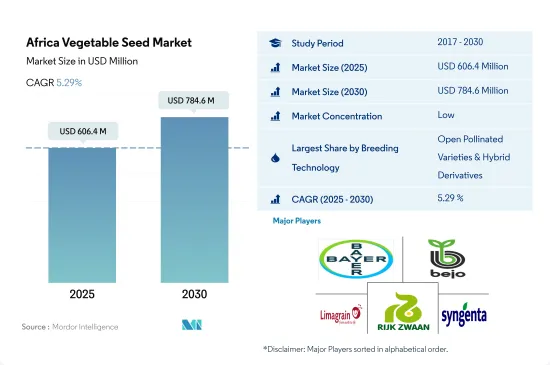

The Africa Vegetable Seed Market size is estimated at 606.4 million USD in 2025, and is expected to reach 784.6 million USD by 2030, growing at a CAGR of 5.29% during the forecast period (2025-2030).

Open-pollinated varieties dominate the market, and hybrid seed usage is increasing due to high yield and disease-resistant characteristics

- In Africa, open-pollinated varieties dominated the market in 2022, with a share of 55.1% of the total vegetable seed market, and hybrid vegetable seeds occupied a share of 44.9%. This is mainly due to an increase in the demand for vegetable production. The higher yield of hybrid seeds is driving the African vegetable seed market.

- In 2022, under the hybrid seeds market, the Solanaceae segment accounted for the highest share in terms of value, with 54.3%, of the regional vegetable seed market. At the crop level, tomatoes and onions are the major vegetable crops in terms of value, accounting for shares of around 47.8% and 5.5%, respectively, of the hybrid vegetable seed market in 2022. The market for hybrid seeds is primarily driven by the modernization of agriculture and the development of new products. The expansion of the organic farming area for vegetables in Africa is contributing to the growth of non-transgenic hybrids.

- The total area under open-pollinated varieties and hybrid derivatives in African vegetable production increased between 2017 and 2022 by more than 2%. The increase was mainly because of the rise in the usage of OPVs in minor vegetable crops in rural and semi-urban areas.

- In 2022, unclassified vegetables accounted for about 30.9% of the region's open-pollinated varieties and hybrid derivatives vegetable seed market. The crops included native types of asparagus, artichokes, and other vegetables.

- The increase in area under cultivation and an increase in the demand for vegetables are estimated to drive the hybrid seed market during the forecast period with a CAGR of 5.7%.

Nigeria dominates the African vegetable seed market with higher area under cultivation and usage of commercial seeds

- In 2022, vegetables held a lower share of the African seed market, accounting for 20.8% in terms of value. The cultivation area under vegetable production in Africa increased from 41 million ha in 2017 to 48 million ha in 2022, owing to the increase in the demand for vegetables, high return on investment, and new technologies.

- Nigeria is the major vegetable seed market in the region. In 2022, it accounted for a 60.4% share of the African vegetable seed market. This large share is mainly due to the high adoption of vegetable cultivation in the country, the increasing consumption demand, and the growing area under cultivation. For instance, the vegetable cultivation area in the country increased from 18.1 million hectares in 2017 to 21.9 million hectares in 2022.

- Egypt is the second major market in the region, with a share of 12.3% in 2022. The cultivation area of vegetables in Egypt increased from 0.9 million hectares in 2017 to 1.0 million hectares in 2022. The increase was mainly due to the increased availability of high-yielding cultivars in the market. The sales of vegetable seeds are expected to increase during the forecast period.

- South Africa is one of the major vegetable-producing countries in the region. The country grows vegetables to a large extent due to the high demand for vegetables from other countries, such as the Netherlands and China. In 2022, the major vegetable crops grown in the country were chili (15.7%), lettuce (13.7%), and pumpkin and squash (13.6%). The other major countries in the region are Tanzania, Ethiopia, and Ghana.

- Therefore, with the increase in demand for vegetables due to the increasing area under vegetable farming, the vegetable seed market is anticipated to record a CAGR of 5.7% during the forecast period.

Africa Vegetable Seed Market Trends

Roots and bulbs are the leading segment in the vegetable cultivation area, primarily driven by the extensive cultivation of onion and potatoes

- In 2022, the area cultivated for vegetables in Africa accounted for 18.6% of the total area under cultivation in Africa. This is because farmers in the region prefer to cultivate row crops as the vegetables require more water for cultivation than for row crops. Additionally, frequent drought conditions in Africa also restrain vegetable cultivation.

- Roots & bulbs accounted for 84.9% of the African vegetable acreage in 2022. This was because the region's diverse agro-climatic zones provide favorable conditions for root & bulb cultivation, particularly for crops such as potatoes, sweet potatoes, cassava, yam, and taro. Additionally, the stability of the roots & bulbs market, combined with its consistent demand, makes it an attractive option for many African farmers. As a result, the acreage for this segment is estimated to reach 46.5 million ha in 2030. Unclassified vegetables accounted for the second largest acreage in Africa, with a share of 7.5% of the overall region's cultivation area in 2022. This is because of the region's high consumption of okra and peas. Additionally, okra and peas are well-suited to African climates and are relatively easy to grow.

- In 2022, Nigeria accounted for the major land for vegetable cultivation in Africa, with a share of 42.7% (21.9 million ha). This is because the country has the largest geographical area in Africa and has fertile soils, which are highly suitable for vegetable cultivation.

- Therefore, the diverse agro-climatic zones, favorable conditions for vegetable cultivation, and consistent demand for vegetables are estimated to expand the cultivation area in Africa during the forecast period.

Disease resistance is a highly preferred trait in cabbage and peas cultivation because it can combat prevalent diseases such as black rot in cabbages and floral diseases in peas

- Cabbage is one of Africa's most widely cultivated exotic leafy vegetables. The demand from restaurants for fresh salads, soups, sautees, and typical summer vegetables drives the demand for cabbage. Farmers cultivate cabbage using high-quality seeds with multiple desirable traits due to the growing demand for high-quality foods.

- Seed varieties with traits such as uniformity in head size, foliage color, adaptability to different growing conditions, early maturity, and disease tolerance are boosting the market's growth due to higher preference by the growers in the region. In cabbage, black rot is the major disease in the region caused by Xanthomonas campestris PV. Campestris (XCC) results in 10-50% yield losses. Major players in the market, such as Bayer AG, BASF SE, Sakata Seeds Corporation, and Syngenta Group, offer cultivars that resist diseases, including black rot, mildews, and other leaf diseases, along with higher productivity. These seed varieties are witnessing high demand to prevent crop losses.

- Peas are an important crop in many parts of the African region. Farmers cultivate pea seeds that resist fungal, viral, and nematode infections. These seeds are also known for their wider adaptability to different growing conditions, especially stressful conditions. They possess high peas per pod and desirable pod shape and size.

- Therefore, introducing new seed varieties with traits such as disease resistance, wider adaptability, etc., along with high yield, is projected to boost the growth of the seed market during the forecast period.

Africa Vegetable Seed Industry Overview

The Africa Vegetable Seed Market is fragmented, with the top five companies occupying 26.38%. The major players in this market are Bayer AG, Bejo Zaden BV, Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel B.V. and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92540

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cabbage & Peas

- 4.2.2 Tomato & Chilli

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Okra

- 5.3.5.4 Peas

- 5.3.5.5 Spinach

- 5.3.5.6 Other Unclassified Vegetables

- 5.3.1 Brassicas

- 5.4 Country

- 5.4.1 Egypt

- 5.4.2 Ethiopia

- 5.4.3 Ghana

- 5.4.4 Kenya

- 5.4.5 Nigeria

- 5.4.6 South Africa

- 5.4.7 Tanzania

- 5.4.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Bejo Zaden BV

- 6.4.4 Enza Zaden

- 6.4.5 Groupe Limagrain

- 6.4.6 Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- 6.4.7 Sakata Seeds Corporation

- 6.4.8 Syngenta Group

- 6.4.9 Takii and Co.,Ltd.

- 6.4.10 Zambia Seed Company Limited (Zamseed)

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.