Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693489

India Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 362 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

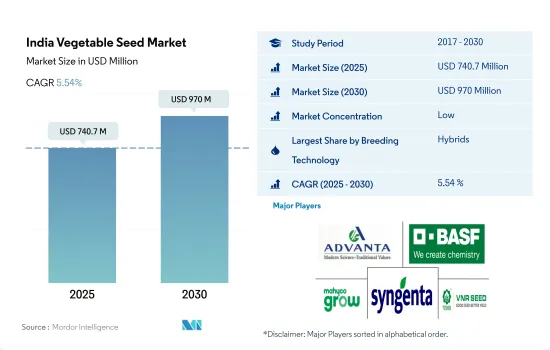

The India Vegetable Seed Market size is estimated at 740.7 million USD in 2025, and is expected to reach 970 million USD by 2030, growing at a CAGR of 5.54% during the forecast period (2025-2030).

Hybrids dominated the Indian vegetable seed market due to their high-yielding and disease-resistant traits

- India is the second-largest vegetable producer in the world after China. The production and average productivity of vegetables in India are far behind other countries due to the non-adaptability of modern agricultural practices and the use of low-yielding varieties.

- In 2022, hybrids and open-pollinated varieties & hybrid derivatives accounted for 79.4% and 20.6%, respectively, of the vegetable seed market due to an increase in the usage of hybrids in vegetable production.

- OPV seeds are more common in leafy vegetables, along with some roots and bulbs such as tapioca, yams, and sweet potato, as farmers are willing to produce them every year on some portion of the arable land for extra income. In this context, small-scale farmers use OPV seeds to save them for the next crop.

- Tomato, brinjal, okra, chili, and cucurbits are the major vegetables grown using hybrid seeds, and the varietal development in tomato and brinjal is high, with hybrid and OPVs being released from the public sector mostly in India. In India, hybrid and OPVs are estimated to register CAGRs of 5.5% and 5.7%, respectively, during the forecast period, as farmers prefer OPVs for their low price, taste, shape, and size.

- The increasing population and decreasing arable land in India are boosting the demand for high-yielding varieties of hybrids or OPVs, along with disease and pest resistance, to decrease the input costs, as 80% of Indian farmers are small and marginal farmers.

- However, with the ongoing research trials in genetically modified vegetables, GM brinjal is expected to be released in the near future. Government policies on safe and high-yielding varieties are also expected to boost the growth of the hybrid vegetable seed market in India.

India Vegetable Seed Market Trends

Roots and bulbs dominated the area under cultivation of vegetable crop with higher demand for these crops and high export potential

- The area under cultivation for vegetables in India is lower than that of row crops. In 2022, it was 6.0% of the area cultivated in the country. The area under vegetable cultivation increased by 6.6% between 2017 and 2022. This is mainly due to the increased cultivation of vegetables through protected cultivation structures and increased demand for a healthy and vegan diet.

- Roots and bulbs had the largest share in the area under cultivation of vegetables. The segment had a share of 46% in 2022 as the country is one of the major producers of onion and potato. Consumers in the country prefer onions for seasoning, and they have high export potential. Potatoes are used in Indian cuisines such as aloo tikki, paranthas, and others, which led to high areas under onion and potato cultivation. For instance, India's area under onion cultivation increased from 1.3 million hectares in 2017 to 1.6 million hectares in 2022.

- The area under Solanaceae crop cultivation was 2.37 million hectares in 2022, and tomatoes accounted for the major area under cultivation. The area under tomato cultivation in India increased from 797,000 ha in 2017 to 857,321.1 ha in 2022. The increased cultivation area is estimated to increase the demand for tomato seeds. Other unclassified vegetables such as lettuce, spinach, and other green leafy vegetables have witnessed a growth of 6.2% in the area cultivated from 2017 to 2022 (1.3 million hectares) due to an increase in the demand for these vegetables as they have high nutritional value and growth in the consumption of salads. The rising demand for ve getables, with the country being a major producer of vegetables, is estimated to increase the area under cultivation during the forecast period.

Susceptibility to various diseases and demands for high-quality crop produce are driving the usage of cabbage and onion varieties with resistance to diseases, wider adaptability, and quality attributes

- Cabbage is widely cultivated in the country. The demand for high-value products is growing both in domestic and international markets. Popular traits available in the country are head weight, foliage color, adaptability to wide seasons (as cabbage is cold-specific), early maturity, and disease tolerance to foliar diseases. The size of heads and head weight are the major traits that have a significant demand, as they help increase yield productivity per hectare. Companies such as Syngenta AG and Bayer AG provide seeds with these traits to grow with high quality in adverse weather conditions.

- Onion is one of the major vegetable crops cultivated in the country. Globally, Indian onions are famous for pungency. Major traits such as disease tolerance, long shelf-life (helps in avoiding decay losses during long storage and long-distance transports), uniform size, the color of the onions (red, yellow, and white), tolerance to pest attacks, especially thrips, and early maturing varieties are promoting onion cultivation in the country. The major seed companies, such as Bayer AG, BASF SE, and Bejo Zaden BV, are developing varieties focusing on high yields, attractive colors, and winter adaptability traits. Varieties with disease resistance to purple blotch and downy mildew are widely cultivated, as they cause yield loss of 20%-60%. For instance, in 2021, Bejo and De Groot en Slot launched the first Downy-resistant shallot from seed named Innovator.

- High-quality crops with high disease resistance, increased shelf life, and product innovations with quality attribute traits are helping to increase the demand for these seeds during the forecast period.

India Vegetable Seed Industry Overview

The India Vegetable Seed Market is fragmented, with the top five companies occupying 28.06%. The major players in this market are Advanta Seeds - UPL, BASF SE, Maharashtra Hybrid Seeds Co. (Mahyco), Syngenta Group and VNR Seeds (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92552

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Cabbage & Onion

- 4.2.2 Tomato & Chilli

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Okra

- 5.3.5.4 Peas

- 5.3.5.5 Spinach

- 5.3.5.6 Other Unclassified Vegetables

- 5.3.1 Brassicas

- 5.4 State

- 5.4.1 Bihar

- 5.4.2 Chhattisgarh

- 5.4.3 Gujarat

- 5.4.4 Haryana

- 5.4.5 Madhya Pradesh

- 5.4.6 Maharashtra

- 5.4.7 Odisha

- 5.4.8 Tamil Nadu

- 5.4.9 Uttar Pradesh

- 5.4.10 West Bengal

- 5.4.11 Other States

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 East-West Seed

- 6.4.5 Groupe Limagrain

- 6.4.6 Maharashtra Hybrid Seeds Co. (Mahyco)

- 6.4.7 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.8 Sakata Seeds Corporation

- 6.4.9 Syngenta Group

- 6.4.10 VNR Seeds

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.