Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693485

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693485

China Vegetable Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 314 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

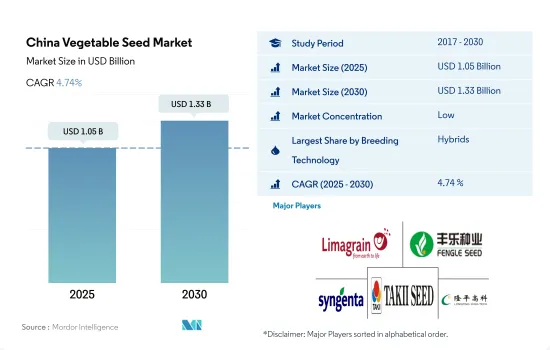

The China Vegetable Seed Market size is estimated at 1.05 billion USD in 2025, and is expected to reach 1.33 billion USD by 2030, growing at a CAGR of 4.74% during the forecast period (2025-2030).

Hybrids dominated the market with the implementation of new laws and policies by the government and increased demand for high yielding varieties

- China had a market share of 36.5% in the Asia-Pacific vegetable seed market in 2022. With increased productivity, the production difference between China and India, the second-largest vegetable producer, was more than 450 million metric ton in 2021. Globally, China was the leading vegetable producer, with more than 51% in 2022, which is associated with the increase in hybrid vegetable seed production and breeding and research and development after the Seed Project.

- In China, hybrid vegetable seeds held a share of 71.6% of the vegetable seed market in 2022, with the remaining being occupied by open-pollinated varieties and hybrid derivatives because of the increased demand for high-yielding varieties.

- Among all the vegetable crop families, Solanaceae vegetables occupied a major portion of the hybrid and OPV seed market in 2022, accounting for 67.6% and 32.4% of the respective seed markets in the country.

- The hybrid vegetable seed market is estimated to grow at a faster rate compared to the OPVs in the country at a CAGR of 4.8% during the forecast period, which is because of their higher yield, which has increased Chinese Seed industry because of the breeding programs and government policies, specifically during the 12th Five-year project.

- The new Seed Law of the country excludes all vegetables from variety registration, and the National Vegetable Industry Development Plan to increase the greenhouse and protected cultivation area is estimated to increase the vegetable seed industry of the country on a large scale.

- Increased demand for vegetables and increased protected cultivation are driving the market growth during the forecast period.

China Vegetable Seed Market Trends

Potatoes and peas are the major vegetables cultivated in the country, with other vegetables also witnessing growth owing to favorable market prices

- China is one of the major vegetable-producing countries in the world, leading in the area under cultivation of the majority of vegetables. In 2022, the area under cultivation of vegetables in the country was 22.7 million hectares, which was an increase of 3.9% between 2017 and 2022. The area under vegetable cultivation in the country declined by 2.7% in 2019 compared to 2018. The dip in the acreage was attributed to the decline in the acreage of major crops such as potatoes, peas, onions, and chilies.

- In China, unclassified vegetables and roots and bulbs accounted for a major share of the vegetable acreage, with 44.7% and 30.8% in 2022, respectively. The higher share of these vegetable segments in the country was because of the presence of major vegetables such as potatoes, asparagus, peas, and onions, which occupied 17.2%, 4.3%, 4.2%, and 3.4% of the vegetable acreage in 2022, respectively. Globally, China is the largest producer of potatoes, and its acreage is estimated to increase further owing to its demand in export markets and agronomic advantages for potato cultivation, such as cold resistance, geographic adaptability, and drought tolerance. Additionally, Cucurbits and Solanaceae are also the major crops cultivated in the country, wherein cucumber and gherkin and tomatoes are the major vegetables. These vegetables accounted for 1.3 million hectares and 1.16 million hectares in 2022, respectively. Shandong, Xinjiang, Hebei, and Henan provinces were the main tomato-producing provinces in China, accounting for more than 50% of the production in China in 2022.

- Therefore, the demand from fresh food and processing markets, favorable climatic conditions, and international demand are estimated to drive vegetable acreage in the country.

Growing preference for disease-resistant tomato varieties and the quality attributes of specific lettuce traits are helping in the growth of the market

- Tomato is an important vegetable crop widely cultivated in China. Tomatoes are grown mainly in plastic tunnels or open fields. Varieties with large fruit, red or pink, are mostly favored by farmers and consumers in China. Disease resistance, pest resistance, quality and quantitative traits, heat tolerance, and longer maturity for production are the most popular traits cultivated in China. Moreover, there is significant demand for varieties resistant to diseases, such as tomato mosaic virus and yellow leaf curl mosaic virus, and resistant to whiteflies and thrips, where infection of these pathogens causes yield losses of more than 90% in the field.

- Globally, China is the largest producer of lettuce, producing more than 50% of the crop in 2022. The popular traits cultivated in the country are the varieties with resistance to disease, tolerance to bolting and heat, quality traits such as the color and type of leaves, quantitative traits, and wider adaptability. The quality attributes are significant in selling the final crop to the customers and have been popular in producing different types of lettuce. Moreover, it is expected that disease-resistant varieties for diseases such as leaf blight and downy mildew will witness growth in the future.

- Major companies breeding the tomato and lettuce traits in the country are Enza Zaden, Syngenta, Bayer Crop Science (Seminis), and Rijk Zwaan Zaadhandel BV.

- Factors such as low water due to climatic conditions and diseases such as tomato mosaic virus, leaf blight, and downy mildew are affecting the growth of crops, and these factors are expected to help in the introduction of new seed varieties during the forecast period.

China Vegetable Seed Industry Overview

The China Vegetable Seed Market is fragmented, with the top five companies occupying 22.24%. The major players in this market are Groupe Limagrain, Hefei Fengle Seed Industry Co. Ltd, Syngenta Group, Takii and Co. Ltd and Yuan Longping High-Tech Agriculture Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92548

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Vegetables

- 4.2 Most Popular Traits

- 4.2.1 Tomato & Lettuce

- 4.3 Breeding Techniques

- 4.3.1 Vegetables

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.2 Cultivation Mechanism

- 5.2.1 Open Field

- 5.2.2 Protected Cultivation

- 5.3 Crop Family

- 5.3.1 Brassicas

- 5.3.1.1 Cabbage

- 5.3.1.2 Carrot

- 5.3.1.3 Cauliflower & Broccoli

- 5.3.1.4 Other Brassicas

- 5.3.2 Cucurbits

- 5.3.2.1 Cucumber & Gherkin

- 5.3.2.2 Pumpkin & Squash

- 5.3.2.3 Other Cucurbits

- 5.3.3 Roots & Bulbs

- 5.3.3.1 Garlic

- 5.3.3.2 Onion

- 5.3.3.3 Potato

- 5.3.3.4 Other Roots & Bulbs

- 5.3.4 Solanaceae

- 5.3.4.1 Chilli

- 5.3.4.2 Eggplant

- 5.3.4.3 Tomato

- 5.3.4.4 Other Solanaceae

- 5.3.5 Unclassified Vegetables

- 5.3.5.1 Asparagus

- 5.3.5.2 Lettuce

- 5.3.5.3 Peas

- 5.3.5.4 Spinach

- 5.3.5.5 Other Unclassified Vegetables

- 5.3.1 Brassicas

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Bejo Zaden BV

- 6.4.3 East-West Seed

- 6.4.4 Groupe Limagrain

- 6.4.5 Hefei Fengle Seed Industry Co. Ltd

- 6.4.6 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.4.7 Sakata Seeds Corporation

- 6.4.8 Syngenta Group

- 6.4.9 Takii and Co. Ltd

- 6.4.10 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.