Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636468

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636468

Middle East And Africa Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

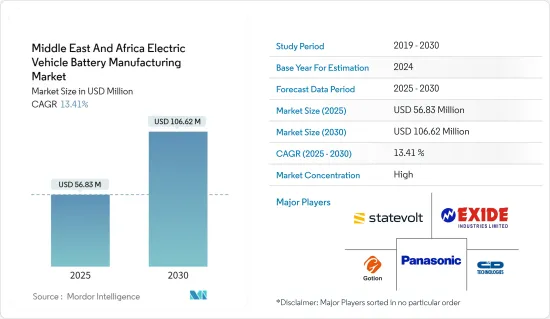

The Middle East And Africa Electric Vehicle Battery Manufacturing Market size is estimated at USD 56.83 million in 2025, and is expected to reach USD 106.62 million by 2030, at a CAGR of 13.41% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing adoption of electric vehicles (EV) and supportive government initiatives and investments to enhance the battery production are expected to drive the demand for the Middle East And Africa electric vehicle battery manufacturing market during the forecast period.

- On the other hand, the demand-supply gap of raw materials and the high cost of EV with a lack of EV charging infrastructure in the region are expected to restrain the market's growth during the forecast period.

- Nevertheless, the technological advancements in battery technologies and the automaker-battery manufacturer collaborations are likely to create vast opportunities for Middle East And Africa electric vehicle battery manufacturing market in the future.

Middle East And Africa Electric Vehicle Battery Manufacturing Market Trends

Lithium-ion Battery Segment to be the Fastest Growing

- The electric vehicle (EV) battery manufacturing market in the Middle East and Africa is on the brink of substantial growth, with lithium-ion batteries (LIBs) taking the lead. LIBs are gaining traction, primarily due to their superior capacity-to-weight ratio, enhanced performance, extended shelf life, and a notable decline in prices.

- In contrast to lead-acid batteries, lithium-ion (Li-ion) batteries present numerous technical advantages. With an impressive lifespan averaging over 5,000 cycles, Li-ion batteries far outstrip the 400-500 cycles typical of lead-acid batteries. Furthermore, Li-ion batteries require less frequent maintenance and replacements, and they sustain a consistent voltage throughout their discharge cycle, boosting the efficiency of electrical components.

- Key industry players are ramping up R&D investments and operational scales to enhance performance. This surge in competition, combined with technological strides and declining raw material costs, has significantly reduced the volume-weighted average price of lithium-ion batteries. From USD 780/kWh in 2013, prices tumbled to USD 139/kWh in 2023. Forecasts indicate a dip to approximately USD 113/kWh by 2025 and a striking USD 80/kWh by 2030. Such price reductions are making lithium-ion batteries an increasingly appealing option in the EV battery arena.

- Traditionally linked to consumer electronics, lithium-ion batteries have seen a marked expansion into the electric vehicle domain. While the Middle East and Africa trail behind global frontrunners like China, the US, and Europe in lithium-ion battery manufacturing, nations like the UAE and Saudi Arabia are making concerted investments. These moves aim not only to diversify their economies but also to cater to the surging demand for electric vehicles.

- In a significant development, Titan Lithium has teamed up with the Khalifa Economic Zones Abu Dhabi (KEZAD) Group to set up a state-of-the-art lithium processing facility in Abu Dhabi. This AED 5 billion venture will see a sprawling 290,000 square meter plant in KEZAD Al Mamourah, dedicated to producing vital battery-grade lithium carbonate and hydroxide for the EV sector.

- Saudi Arabia is also carving a niche in the global rechargeable battery landscape. In June 2023, Obeikan Investment Group joined forces with Australian startup European Lithium to establish a lithium hydroxide refinery. Furthermore, Ma'aden, the state mining giant, has collaborated with US's Ivanhoe Electric to scout the Arabian Shield for lithium and other rare metals.

- Reinforcing its commitment, Saudi Arabia's Energy Capital Group partnered with US tech firm Pure Lithium in September 2023. This venture, backed by an initial USD 50 million, focuses on developing batteries from lithium sourced from oilfield brines, aiming to satisfy the rising demand for lithium-ion battery metals. Additionally, ERG's founding membership in the Global Battery Alliance underscores the region's commitment to a sustainable lithium-ion battery supply chain.

- In a bid to strengthen Africa's lithium-ion battery supply chains, ReElement Technologies, a METALS refining and recycling firm, signed an MoU with Afrivolt in February 2024. Their collaboration seeks to create a closed-loop lithium battery and EV manufacturing ecosystem in Africa, emphasizing the use of locally sourced critical minerals, refined by ReElement Technologies Africa and its subsidiaries.

- As part of this initiative, Afrivolt, previously known as Aqora, is leading the charge in setting up a lithium-ion cell gigafactory. Their MoU with ReElement Technologies is transitioning into a detailed offtake agreement, ensuring robust support for African gigafactories. Both partners are dedicated to fostering local talent, working with institutions to develop essential skills for Africa's evolving industry and manufacturing landscape.

- Given these strides, it's clear that the lithium-ion battery segment is set to dominate the EV battery manufacturing landscape in the Middle East and Africa in the foreseeable future.

United Arab Emirates To Witness Significant Growth

- The electric vehicle (EV) battery manufacturing market in the United Arab Emirates (UAE) is on the brink of substantial growth. Factors such as rapid industrialization, a surge in EV adoption, technological advancements, and the UAE's strategic economic positioning are driving this momentum, setting the stage for robust battery adoption and innovation.

- EV adoption in the UAE has seen a sharp uptick in recent years. In 2023, the country recorded approximately 28,900 electric vehicle sales, a significant rise from around 18,900 in 2022, according to the International Energy Agency (IEA). This upward trend, combined with the UAE's ambitious target of having electric and hybrid vehicles make up 50% of its total vehicles by 2050, is poised to bolster the EV battery manufacturing industry.

- As part of its sustainability drive, the UAE is heavily investing in EV infrastructure and promoting EV adoption to combat climate change and reduce reliance on fossil fuels. This has led to a surging demand for high-capacity, durable EV batteries.

- Moreover, advancements in battery technology, especially the rise of solid-state batteries, are boosting the efficiency, safety, and performance of EV batteries. For example, in April 2024, US-based Statevolt unveiled plans for a USD 3.2 billion gigafactory in Ras Al Khaimah, targeting an annual production capacity of up to 40 gigawatt-hours. This initiative is designed to serve the expanding battery storage and electric mobility markets across the Middle East, Africa, and India.

- In a testament to the UAE's commitment to EV manufacturing, Dubai's M Glory Holding Group revealed plans in early 2022 for a sprawling EV manufacturing plant in Dubai Industrial City. With a hefty investment of AED 1.5 billion, the 93,000 square meter facility aims for an annual output of 55,000 EVs, further amplifying the demand for EV batteries.

- Understanding the significance of battery recycling, the UAE is making notable strides in this domain. In December 2023, LOHUM Cleantech, hailing from India, made its foray into the UAE, setting up the nation's first-ever EV Battery Recycling plant. This venture, in collaboration with the UAE's Ministry of Energy & Infrastructure and sustainability leader BEEAH, is in line with the UAE's Net Zero by 2050 Strategic Initiative and Circular Economy Policy.

- As part of this collaboration, an 80,000 sq ft facility is being established to refurbish and recycle Lithium batteries. The plant has set ambitious targets: recycling 3,000 tons of Lithium-ion batteries annually and repurposing 15MWh into Energy Storage Systems (ESS) each year, which would satisfy over 80% of the projected EV battery management needs.

- With these strategic moves, the UAE is set to emerge as a dominant player in the EV battery manufacturing landscape of the Middle East and Africa.

Middle East And Africa Electric Vehicle Battery Manufacturing Industry Overview

The Middle East And Africa electric vehicle battery Manufacturing market is semi-consolidated. Some of the key players in the market (not in any particular order) include Exide Industries Ltd., Panasonic Holdings Corporation., C&D Technologies Inc., Statevolt, and Gotion High Tech Co Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003735

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives and Investments to Enhance the Battery Production

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Gap of Raw Materials

- 4.5.2.2 High Cost of EV With a Lack of EV Charging Infrastructure in the Region

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Other Battery Type

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.2.3 Other Vehicle Type

- 5.3 Propulsion

- 5.3.1 Battery Electric Vehicle

- 5.3.2 Hybrid Electric Vehicle

- 5.3.3 Plug-in Hybrid Electric Vehicle

- 5.4 Geography

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Egypt

- 5.4.5 Nigeria

- 5.4.6 Qatar

- 5.4.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Holdings Corporation

- 6.3.2 Middle East Battery Company (MEBCO)

- 6.3.3 C&D Technologies Inc.

- 6.3.4 Exide Industries Ltd

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Statevolt

- 6.3.7 Amara Raja Energy & Mobility Limited.

- 6.3.8 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Automaker-Battery Manufacturer Collaborations

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.