Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636439

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636439

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

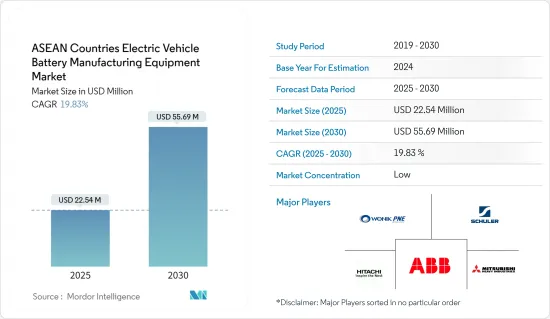

The ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 22.54 million in 2025, and is expected to reach USD 55.69 million by 2030, at a CAGR of 19.83% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, high initial investment costs are expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in these countries are expected to create a significant opportunity in the forecast period.

- Thailand is expected to grow significantly owing to the increasing investment in EV battery manufacturing in the country.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery Segment is Expected to Grow Significantly

- Lithium-ion battery manufacturing equipment includes specialized machines and tools tailored for producing lithium-ion batteries. In recent years, ASEAN countries have seen a surge in lithium-ion battery production for electric vehicles (EVs), spurred by rising EV demand, supportive government policies, and the region's pivotal role in global supply chains. With this uptick in manufacturing, the need for lithium-ion battery production equipment is set to rise.

- Moreover, advancements in domestic manufacturing equipment have played a crucial role in driving down lithium-ion battery prices across these nations. As EV demand escalates, achieving economies of scale has led to reduced production costs. Consequently, with falling lithium-ion battery prices, companies are ramping up investments in EV battery production, further fueling the demand for associated manufacturing equipment in the region.

- In 2023, lithium-ion battery pack prices plummeted by 14% from the prior year, settling at USD139/kWh. Beyond this price dip, countries like Thailand, Indonesia, Vietnam, and Malaysia are experiencing a surge in both personal and commercial EV adoption. This momentum has spurred local lithium-ion battery production, aiming to lessen import reliance and bolster domestic EV sectors, thereby amplifying the demand for battery manufacturing equipment.

- For example, in August 2023, EVE Energy Co. Ltd., a prominent global lithium battery manufacturer from China, broke ground on a new facility in Kulim, Kedah, Malaysia, with an initial investment of USD 422 million. Such strategic investments are poised to elevate lithium-ion battery production for EVs, subsequently driving up the demand for manufacturing equipment.

- Given the declining prices and surging investments in EV lithium-ion battery production, this segment is poised to command a substantial share in the coming years.

Thailand is Expected to Grow Significantly

- Thailand's electric vehicle (EV) battery manufacturing equipment market is poised for substantial growth, bolstered by a favorable environment for EV battery production. With government backing, Thailand has emerged as a regional hub for EV production. The government is luring EV manufacturers and battery producers with tax incentives and subsidies, setting an ambitious goal to have 30% of its automotive output as EVs by 2030.

- Furthermore, a growing number of battery manufacturers, especially from China, are keenly investing in new facilities for EV batteries in Thailand. This surge in investments is set to boost the demand for equipment essential for EV battery production in the country.

- For example, in March 2024, SVOLT Energy, a prominent Chinese battery manufacturer, kicked off mass production of EV battery packs at its state-of-the-art facility in Si Racha, located in Chonburi province, Thailand. This facility is equipped with an impressive annual production capacity of around 60,000 modules and packs.

- As the adoption of electric vehicles continues to surge in Thailand, companies are amplifying their investments in local manufacturing hubs, consequently spurring demand for manufacturing equipment. Data from the Thailand Automotive Institute highlights this trend: in 2023, registered electric vehicles in Thailand surged to 172,540 units, a notable increase from the previous year's 84,570. Such a significant uptick in EV adoption underscores the expanding need for EV manufacturing equipment.

- Looking ahead, the outlook for EV battery manufacturing equipment in Thailand remains optimistic, due to government initiatives like Thailand 4.0 and the Eastern Economic Corridor (EEC). These initiatives are designed to elevate Thailand's status as a regional frontrunner in high-tech sectors, including EVs and batteries, by providing attractive incentives such as tax breaks and simplified regulations.

- Given the government's unwavering support and the accelerating adoption of EVs, Thailand is set for notable growth in the coming years.

ASEAN Countries Electric Vehicle Battery Manufacturing Equipment Industry Overview

The ASEAN country's electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include WONIK PNE CO., LTD., Schuler AG, Hitachi Ltd, ABB Ltd., and Mitsubishi Heavy Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003706

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High initial investment costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 ASEAN Countries

- 5.3.1.1 Indonesia

- 5.3.1.2 Malaysia

- 5.3.1.3 Philippines

- 5.3.1.4 Singapore

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Rest of ASEAN Counties

- 5.3.1 ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 WONIK PNE CO., LTD.

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd

- 6.3.4 ABB Ltd.

- 6.3.5 Mitsubishi Heavy Industries, Ltd

- 6.3.6 Sovema Group

- 6.3.7 Daiichi Jitsugyo Thailand Co Ltd

- 6.3.8 Yokogawa India Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.