Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636456

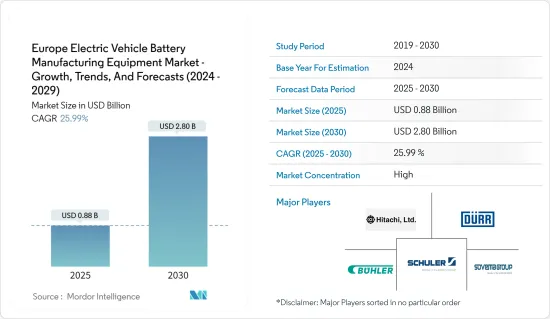

Europe Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Europe Electric Vehicle Battery Manufacturing Equipment Market - Growth, Trends, And Forecasts Industry is expected to grow from USD 0.88 billion in 2025 to USD 2.80 billion by 2030, at a CAGR of 25.99% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles (EV) and supportive government initiatives and investments towards EV battery manufacturing are expected to drive the demand for the Europe electric vehicle battery manufacturing equipment market during the forecast period.

- On the other hand, the requirement of high initial investments and setup costs are expected to hinder the market's growth during the forecast period.

- Nevertheless, the expansion of local EV battery production is expected to create vast opportunities for the Europe electric vehicle battery manufacturing equipment market in the future.

- Among all the countries in the region, Germany is expected to have significant growth due to rising investment in the electric vehicle sector.

Europe Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery to be the Fastest Growing Segment

- Lithium-ion (Li-ion) batteries are at the forefront of transforming the electric vehicle (EV) landscape, spurring advancements in battery manufacturing. Their standout features, including high energy density, extended cycle life, and rapid charging capabilities, solidify their status as the go-to choice for today's EVs.

- Moreover, lithium-ion batteries outshine competing technologies with their superior capacity-to-weight ratio. While they come with a heftier price tag, leading industry players are countering this by amplifying R&D investments and scaling up production, intensifying competition and driving prices down.

- In 2023, lithium-ion battery prices saw a notable dip, settling at USD 139/kWh, marking a 13% drop. Forecasts indicate this downward trend will continue, with prices projected to hit USD 113/kWh by 2025 and further dive to USD 80/kWh by 2030, all thanks to relentless technological and manufacturing advancements.

- In Europe, several governments are rolling out policies and incentives to not only champion electric vehicle (EV) adoption but also to supercharge the growth of lithium-ion battery manufacturing. Responding to the burgeoning demand for these batteries, governments are making hefty investments and actively endorsing the production of rechargeable lithium-ion batteries.

- For instance, in November 2023, the United Kingdom government unveiled a GBP 50 million (USD 63 million) investment strategy, targeting the establishment of a robust battery supply chain, with a spotlight on lithium-ion batteries. This move dovetails with the UK's ambitious goals for EV production. The Battery Strategy, running through 2030, guarantees tailored support for zero-emission vehicles, batteries, and their supply chains, encompassing fresh capital investments and R&D funding. Such initiatives are set to amplify battery production in the United Kingdom in the years ahead and strengthen the nation's battery manufacturing equipment sector.

- Additionally, the escalating appetite for Li-ion batteries has spurred the rise of expansive production hubs, known as Gigafactories. These state-of-the-art facilities are designed for mass battery cell production, catering to the surging demands of electric vehicles (EVs). Key regional players are rolling out initiatives to bolster their lithium-ion battery production, anticipating a surge in demand for EV battery production equipment.

- As a case in point, in May 2024, French company Blue Solutions unveiled its ambitious EUR 2 billion (USD 2.17 billion) gigafactory project in eastern France. This facility aims to produce a cutting-edge solid-state battery for electric vehicles, boasting a swift 20-minute charging capability, with production set to kick off by 2030. Such initiatives are expected to amplify the demand for battery production equipment in France in the coming years.

- Given these developments, the lithium-ion battery production landscape is set for significant growth, which in turn will substantially elevate the EV battery manufacturing equipment market during the forecast period.

Germany To Witness Significant Growth

- Germany leads the charge in the electric vehicle (EV) revolution, harnessing its robust automotive sector, advanced manufacturing prowess, and unwavering dedication to sustainability. With the surging demand for EVs, Germany is ramping up its focus on EV battery production, heralding a promising future for the market of EV battery manufacturing equipment.

- The nation is making a decisive shift towards clean energy, with electric vehicles taking center stage. EV sales in Germany have skyrocketed, with the International Energy Agency (IEA) reporting 0.7 million sales in 2023, matching 2022 but marking a 5.5-fold increase since 2019. Additionally, Germany's EV stock exceeded 2.5 million in 2023, up 34% from 1.86 million in 2022. With a government target of 15 million electric cars by 2030 and support from recent European initiatives, the momentum for EV adoption in Germany is unmistakable, fueling demand for EV batteries and their manufacturing equipment.

- As a pivotal member of the European Battery Alliance, Germany is spearheading efforts to cultivate a competitive and sustainable battery cell manufacturing ecosystem within Europe. This initiative seeks to diminish reliance on external battery suppliers and stimulate innovation across the European Union. Concurrently, the German government is making significant investments in research, infrastructure, and incentives to accelerate EV adoption.

- In a significant development, January 2024 witnessed Northvolt, a leading Swedish lithium-ion battery manufacturer, securing a hefty EUR 902 million (USD 986.43 million) state aid package from Germany, backed by the EU. This funding is earmarked for an EV and hybrid battery production facility in Heide, Germany, aligning with both national and EU goals for net-zero emissions. Such initiatives are set to boost battery production and escalate the demand for manufacturing equipment in Germany.

- German companies and research institutions are pioneering the development of solid-state batteries, which offer enhanced energy density, safety, and longevity over conventional lithium-ion batteries. Collaborations among leading regional entities are poised to elevate EV battery demand and create opportunities for equipment suppliers.

- In May 2024, a consortium of 15 companies and academic researchers, spearheaded by VARTA, unveiled groundbreaking sodium-ion battery technology. Their goal is to manufacture high-performance, cost-efficient, and eco-friendly batteries for EVs and other uses, targeting project completion by mid-2027. Such innovations are expected to boost the demand for advanced EV batteries and the requisite production equipment.

- Considering these trends, Germany is set to witness a significant surge in demand for EV battery manufacturing and its associated equipment in the foreseeable future.

Europe Electric Vehicle Battery Manufacturing Equipment Industry Overview

The Euope Electric Vehicle Battery Manufacturing Equipment market is semi-consolidated. Some of the key players in the market (not in any particular order) include Duerr AG, Hitachi Ltd., Schuler AG, Buhler Holding AG, and Sovema Group S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003723

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Eelectric Vehicles

- 4.5.1.2 Supportive Government Policies and Investments Towards EV Battery Manufacturing

- 4.5.2 Restraints

- 4.5.2.1 Requirement of High Initial Investments and Setup Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Poland

- 5.3.6 Nordic

- 5.3.7 Spain

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Hitachi Ltd.

- 6.3.3 Schuler AG

- 6.3.4 Buhler Holding AG

- 6.3.5 Manz AG

- 6.3.6 Sovema Group S.p.A.

- 6.3.7 Komatsu NTC Ltd.

- 6.3.8 Yokogawa Electric Corporation

- 6.3.9 KROENERT GmbH & Co KG.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Local EV Battery Production

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.