Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636452

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636452

Italy Electric Vehicle Battery Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

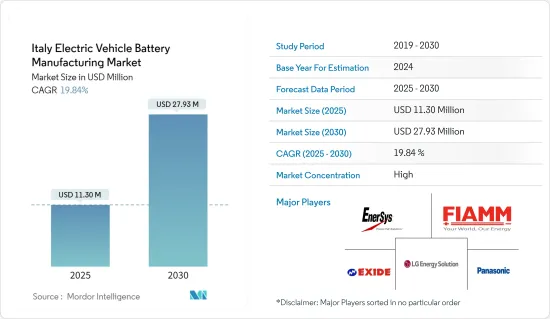

The Italy Electric Vehicle Battery Manufacturing Market size is estimated at USD 11.30 million in 2025, and is expected to reach USD 27.93 million by 2030, at a CAGR of 19.84% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments to enhance the battery production capacity and the decline in the cost of raw battery materials are expected to drive the demand for electric vehicle battery manufacturing during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery manufacturing market.

- Nevertheless, the long-term ambitious targets for electric vehicles like scaling up production capacity, enhancing technological advancements, and reducing costs are expected to create significant opportunities for the electric vehicle battery manufacturing market in the near future.

Italy Electric Vehicle Battery Manufacturing Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion (Li-ion) batteries have revolutionized the electric vehicle (EV) market, driving innovations in battery production. Their key attributes-high energy density, long cycle life, and swift charging-make them the preferred choice for today's EVs.

- Moreover, lithium-ion rechargeable batteries surpass other technologies due to their excellent capacity-to-weight ratio. Although they tend to be more expensive than alternatives, leading players in the market are boosting R&D investments and ramping up production, heightening competition, and pushing prices down.

- Despite rising average battery pack prices for EVs and battery energy storage systems (BESS), 2023 witnessed a significant dip, with prices falling to USD 139/kWh-a 13% decrease. Projections suggest this downward trajectory will persist, with prices anticipated to reach USD 113/kWh by 2025 and further decline to USD 80/kWh by 2030, driven by relentless technological and manufacturing progress.

- Globally, governments are rolling out policies and incentives to accelerate the adoption of electric vehicles (EVs) and expand Lithium-ion battery production. In a strategic move, major international firms are channeling significant investments into local companies to boost lithium-ion battery production, particularly for electric vehicles (EVs).

- For example, in February 2024, the Automotive Cells Company clinched a USD 4.7 billion funding to set up three lithium-ion battery gigafactories in France, Germany, and Italy. This venture, backed by industry giants like Stellantis, Mercedes-Benz, and Saft (a TotalEnergies subsidiary), is poised to elevate the demand for advanced lithium-ion batteries in the near future, subsequently bolstering EV battery manufacturing in the region.

- Additionally, governments nationwide are pushing policies and incentives to accelerate electric vehicle (EV) adoption and advance the Lithium-ion battery industry. With a focus on R&D, these governments aim to discover cost-effective substitutes for materials like cobalt, known for their high cost and limited availability. This strategic pivot not only reduces production expenses but also strengthens a sustainable supply chain.

- As an illustration, in July 2024, the POSCO N.EX.T Hub introduced a groundbreaking anode protection layer, equipped with a functional binder (PVA-g-PAA), tailored for all-solid-state batteries. This innovative feature guarantees even lithium deposition, significantly curtailing lithium usage, while enhancing battery lifespan and energy density. Such breakthroughs are set to expedite battery production in the country in the forthcoming years.

- Consequently, these initiatives and projects are poised to boost lithium-ion battery production and markedly elevate EV battery manufacturing capacity during the forecast period.

Passengers Cars Segment to Witness Significant Growth

- Italy's automotive sector is making a decisive shift towards electric vehicles (EVs), driven by a global push for sustainability and a commitment to reducing carbon emissions. A key element of this transformation is the intensified focus on the production and refinement of electric vehicle batteries. This shift is not only altering the dynamics of Italy's passenger car market but also influencing various facets of the industry.

- Moreover, as Italy embraces clean energy, the transition to electric vehicles has become a central theme for numerous companies. EV sales in Italy have surged dramatically. For instance, in 2023, the International Energy Agency (IEA) reported 136,000 electric vehicles sold, marking a 19.3% increase from 2022 and a staggering 6.8-fold rise since 2019. With this momentum and buoyed by recent Canadian government initiatives, EV sales are poised to climb further, signaling a booming demand for EV battery production.

- In a bid to tackle air pollution and reduce reliance on fossil fuels, Italy is vigorously promoting the adoption of electric vehicles (EVs), extending this push to encompass a broader range of passenger cars. The government's multifaceted strategy includes financial incentives, infrastructure enhancements, and public awareness campaigns, all designed to facilitate this transition.

- As a testament to its commitment, in February 2024, Italy allocated a significant 950 million euros (about USD 1 billion) in subsidies. This funding aims to accelerate the shift to cleaner vehicles, especially electric cars (EVs), and rejuvenate the automotive sector. Specifically, Rome's strategy includes generous subsidies of up to 13,750 euros (USD 15,042), predominantly benefiting low-income individuals. This financial boost is intended for purchasing new, fully electric vehicles, capped at a price of 35,000 euros (USD 38,290). Such measures are poised to amplify the demand for passenger cars in the region and subsequently heighten the need for battery manufacturing during the forecast period.

- In addition, leading automotive manufacturers are introducing state-of-the-art plug-in hybrid electric vehicles (PHEVs) in Italy. This trend reflects a wider industry movement towards PHEVs, as manufacturers seek to merge the benefits of electric and conventional engines, catering to both consumer desires and regional regulations.

- For example, in May 2024, Stellantis announced its plan to launch a hybrid version of its 500e compact electric car, with production slated at its Mirafiori facility in Italy. The 500e is already in production in Turin, Italy. Such strategic maneuvers are set to boost the uptake of hybrid passenger vehicles in the region and drive the demand for battery manufacturing in the foreseeable future.

- Consequently, these initiatives and projects are anticipated to bolster EV demand and substantially elevate the need for EV battery manufacturing in the coming years.

Italy Electric Vehicle Battery Manufacturing Industry Overview

Italy's electric vehicle battery manufacturing market is semi-consolidated. Some of the key players (not in particular order) are Panasonic Holdings Corporation, Exide Industries Ltd, EnerSys, FIAMM Energy Technology SpA, and LG Chem Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003719

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Investments to Enhance the battery production capacity

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Nickel Metal Hydride Battery

- 5.1.4 Others

- 5.2 Battery Form

- 5.2.1 Prismatic

- 5.2.2 Pouch

- 5.2.3 Cylindrical

- 5.3 Vehicle

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.3.3 Others

- 5.4 Propulsion

- 5.4.1 Battery Electric Vehicle

- 5.4.2 Hybrid Electric Vehicle

- 5.4.3 Plug-in Hybrid Electric Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology SpA

- 6.3.2 Panasonic Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 EnerSys

- 6.3.5 Saft Groupe SA

- 6.3.6 FAAM (Fabbrica Accumulatori Motocarri Montenero)

- 6.3.7 Exide Industries Ltd

- 6.3.8 STMicroelectronics N.V

- 6.3.9 MIDAC SpA

- 6.3.10 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.