Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692084

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692084

North America Edible Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 260 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

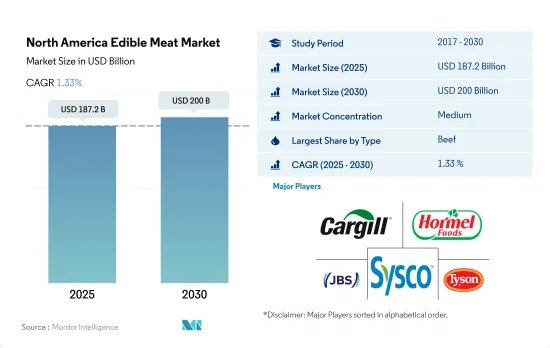

The North America Edible Meat Market size is estimated at 187.2 billion USD in 2025, and is expected to reach 200 billion USD by 2030, growing at a CAGR of 1.33% during the forecast period (2025-2030).

Cost-effectiveness of poultry meat is attracting customers

- The North American edible meat market is driven by beef, which had the highest growth rate by value in 2022, and it is expected to register a CAGR of 1.37% over the forecast period. In the country, demand for beef is extremely high, and in 2022, around USD 20.1 billion worth of beef was sold at retail markets, up 4.6% Y-o-Y. Luncheon meat, sausages, hot dogs, hams and bacon, and beef jerky are the most popular processed beef products consumed in the United States.

- The decrease in sheep and lamb production has been accompanied by higher prices, which have been responsible for the greater production costs. Production is priced 15-20% higher than any other meat in the region in 2022. Shortages in supply and high prices diminished the consumption of sheep and lamb and prevented their growth.

- Poultry meat held the second major share in the North American region in 2022 and is anticipated to register a CAGR of 1.15% by value during the forecast period. The United States has an extensive poultry industry, with more than 513 million poultry and over 216 million turkeys as of 2022.

- In total, 9.17 billion broilers were produced in 2022, up slightly from 2021. Overall, the production of live-weight broilers in 2022 amounted to 58.9 billion pounds, up from 2021, a slight increase. Turkeys produced in 2022 were valued at USD 7.10 billion, up 21% from the previous year's figure of USD 5.89 billion. The affordability of chicken compared to other meat types makes it an attractive option for consumers, especially those who are looking for cost-effective protein sources. Cargill, Incorporated, Hormel Foods Corporation, Sysco Corporation, Tyson Foods Inc., and WH Group Limited are among the major players operating in the poultry market in the United States.

Advanced technologies are driving the sales of beef

- The United States held the major market share of edible meat during the review period, as the sales value increased by about 14.81% from 2019 to 2022. This increase was majorly due to the increased beef consumption in the United States. Beef accounted for about 68.86% of the market share in 2022 compared to other meat types. In 2022, beef consumption was estimated at 59.1 pounds, the highest since the last decade. Moreover, the beef industry is also increasingly utilizing data analytics and blockchain technology, using sensors to enhance traceability, transparency, and food safety.

- Mexico held the second major share in the edible meat market in 2022. It is projected to record a CAGR of 1.57% during the forecast period due to the steadily growing US exports to Mexico over the past few years. This increase in exports is boosted by the North American Free Trade Agreement (NAFTA) and Mexico's growing meat consumption. Mexico has the largest market, by volume, for US pork and poultry and the second-largest market for US beef exports. As pork imports and production increased in Mexico, people began preferring less expensive pork over beef.

- Canada is experiencing a comparatively slower growth rate, registering a CAGR of 1.04% by value during the forecast period owing to the slow population growth. The production of pork accounts for about 70% of Canadian meat products, e.g., sausages and various types of chilled meat. Canada's meat processing facilities are involved in a large variety of meat products, which include fresh and frozen meat, beef preparations, smoked, cured, or prepared meats, sausages, and any cold meat.

North America Edible Meat Market Trends

Growing demand and reduced imports are boosting production

- The beef market was highly impacted by increased production costs during the historical period. The rise in production cost was primarily because of the dry conditions. However, beef production in the region was up by 1.25% in 2022 compared to 2021. Drought in locations throughout western North America during the past few years negatively impacted the region's production. Due to difficulty in locating enough food for their animals, farmers who rear cattle are losing money in regions ranging from western Canada to the states of northern Mexico. Some farmers buy feed for their livestock from other parts of North America.

- Canada is the second-largest beef producer in North America after the United States. The production share of Canada and the United States in 2022 was 5.46% and 50.15%, respectively. Despite a dwindling cow herd, live cattle imports positively affect Canadian meat production. In 2022, moisture levels were likely to be a crucial aspect in monitoring the trading of cattle. More cattle may be moved north if the drought subsides in Canada but continues in the United States.

- The declining cow herd and a smaller calf yield in Canada and the United States are resulting in long-term and tighter beef supplies in North America. On January 1, 2022, in Canada, beef cow inventories were down by 1% for the fifth consecutive year to 3.5 million heads. In Canada, 61% of farms have less than 47 cows, with 596,419 beef cows, 16% of the herd. All cattle and calves in the United States as of January 1, 2023, totaled 89.3 million heads, 3% below the 92.1 million heads on January 1, 2022. In addition to having the world's largest-fed cattle industry, the United States is also the world's largest consumer of beef, primarily high-value, grain-fed beef.

Rising retail demand boosted the need for wholesale beef and drove market growth

- The rising retail demand has boosted the need for wholesale beef in recent years, which led to higher beef prices. Since 2021, retail beef prices have been largely stable, and the 12-month moving average of monthly prices has exceeded USD 7.25 USD per pound since April 2022. Given the record beef production in 2022 and the greatest per-capita beef consumption since 2010, at 58.9 pounds, this suggests a strong beef demand. Retail prices for all fresh beef averaged USD 7.30 per pound in 2022, which was a record-high price and an increase of 5.1% above prices in 2021. Tenderloins and ribeyes are up 12% to 15% Y-o-Y, and middle meat prices continue to dominate wholesale prices.

- Like retail prices, wholesale boxed beef prices have fluctuated within a small range for most of 2022. Since March, Choice boxed beef has had an average price of USD 261.77/cwt, with a weekly high and minimum of 272.48/cwt and USD 246.31/cwt, respectively, for a range of USD 26.17/cwt. Following very strong wholesale demand, Choice boxed beef prices averaged USD 279.81/cwt in 2021, with weekly maximums of USD 347.02/cwt, weekly minimums of USD 206.73/cwt, and annual ranges of USD 140.29/cwt.

- However, processing plants struggled with labor shortages that continued during the pandemic and in 2021, limiting their ability to process meat at the same rate as before the outbreak. This decline in production was due to the increasing demand for beef from consumers and restaurants, thus boosting the prices. The regional labor shortage continued in 2021, with a labor force participation rate of 61.6% in September 2021, down from 63.4% in January 2020.

North America Edible Meat Industry Overview

The North America Edible Meat Market is moderately consolidated, with the top five companies occupying 47.08%. The major players in this market are Cargill Inc., Hormel Foods Corporation, JBS SA, Sysco Corporation and Tyson Foods Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90392

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.1.4 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.2.4 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Canada

- 3.3.2 Mexico

- 3.3.3 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Poultry

- 4.1.5 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

- 4.4 Country

- 4.4.1 Canada

- 4.4.2 Mexico

- 4.4.3 United States

- 4.4.4 Rest of North America

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Cargill Inc.

- 5.4.2 Continental Grain Company

- 5.4.3 Foster Farms Inc.

- 5.4.4 Hormel Foods Corporation

- 5.4.5 JBS SA

- 5.4.6 Marfrig Global Foods S.A.

- 5.4.7 NH Foods Ltd

- 5.4.8 OSI Group

- 5.4.9 Perdue Farms Inc.

- 5.4.10 Sysco Corporation

- 5.4.11 The Clemens Family Corporation

- 5.4.12 The Kraft Heinz Company

- 5.4.13 Tyson Foods Inc.

- 5.4.14 Vion Group

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.