Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692041

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692041

United States Edible Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 224 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

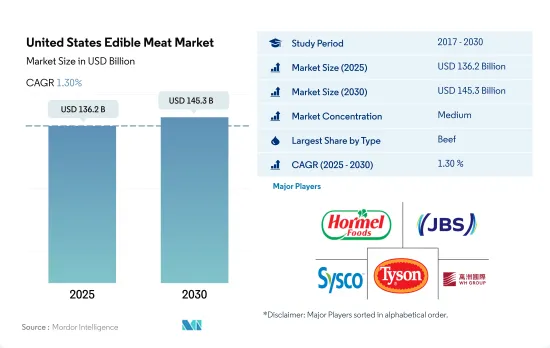

The United States Edible Meat Market size is estimated at 136.2 billion USD in 2025, and is expected to reach 145.3 billion USD by 2030, growing at a CAGR of 1.30% during the forecast period (2025-2030).

High production and environmental consciousness are boosting demand for poultry meat

- Poultry is the most consumed meat variant in the country, owing to consumers' inclination toward a leaner animal protein source over red meat variants. The huge consumption rate is due to the versatile usage of poultry meat in various flavors, cooking methods, and recipes, increasing its usage in various food service stations. As of 2021, 8 billion chickens were consumed by Americans. Also, environment-conscious consumers are switching from red meat to poultry options, as intensive chicken farming causes lesser GHG emissions than cattle meat.

- Beef is the country's second most consumed edible meat variety in the United States. As of 2022, annual beef consumption per person was highest in the Midwest (73 pounds), followed by the South and West (65 pounds each) and the Northeast (63 pounds). Rural consumers ate more beef (75 pounds) than did urban and suburban consumers (66 and 63 pounds). Fast food options like beef burgers and hotdogs in the states of the country are also very popular, making beef one of the most consumed and favored meat options. As of 2022, 20 billion burgers with an average of 60 patties per person annually were consumed in the United States, opening opportunities to expand the application of beef.

- Pork is the third-largest type of red market in the country primarily due to the increased consumption of processed pork, such as luncheon meat sausage, hot dogs, ham, and bacon. Thus, processed pork is projected to record the fastest CAGR, amounting to 2.48%, over the forecast period. The growing influence of Asian cuisines, particularly Korean and Vietnamese, has also made some cuts of pork newly popular. Americans are increasingly turning to fast-food restaurants for breakfast, where bacon and pork sausage are both popular.

United States Edible Meat Market Trends

Increased domestic production and rising exports from asian countries is driving the market growth

- Meat producers in the United States are technology-driven, which helps in strategically supplementing forage-based diets to fulfill animal requirements for protein, vitamins, or minerals. The US is one of the largest beef producers in the entire world, with a share of nearly 30% in 2022. The country produced 12.89 million metric tons of beef in 2022, up 0.15 million metric tons from 2021. The top beef-producing states in the US are Ohio, Texas, Oklahoma, and Missouri. Ohio is ranked among the top beef-producing states throughout the nation and had around 2.9 million cattle slaughtered in 2022. Ohio's beef production also increased by 2% in 2022 compared to 2021.

- The US primarily produces high-quality, grain-fed beef. Beef farms and ranches represent over 30% of US farms. The US beef industry is divided into two sectors, namely cow-calf operations and cattle feeding. The focus of the cow-calf operation is to maintain a herd of beef cattle to raise calves. The cattle feeding sector focuses on preparing cattle for various means of production. Beef cattle are raised in all the states of the United States. As of January 2023, there were around 28.9 million beef cattle in the United States, down 4% from last year.

- Beef production in the US is anticipated to grow in the coming years due to the growing demand for American beef from Asia. In 2021, for the first time in the last five years, the United States sent more edible meat to China than Australia, and it currently leads in important export markets like Japan and South Korea. The US frozen beef exports to Asia grew, registering a CAGR of 9.90% by value from 2017 to 2022. The US struggled with ongoing supply chain issues, transportation problems, and ample supplies of domestic products, especially on its West Coast.

Rise in feed cost and lower production of cattle lead to a rise in prices

- The price of beef witnessed a 40% growth from 2017 to 2022. Rising retail demand boosted the need for the wholesale demand for beef. The supply fell as slaughterhouses were shut, and overall slaughter declined, leading to higher beef prices. Therefore, there was a higher focus on fresh/chilled and frozen beef. However, livestock producers earned low prices for their animals despite the high price of meat. The number of cattle and calves at the end of 2022 was around 89.3 million, which was a decline of 3% from the previous year. Cattle prices are expected to receive support from packer demand due to the relatively stable demand for beef and limited supplies of steers and heifers in feedlots.

- In the United States, beef prices were predicted to rise by 15% from 2022 to 2023 and stay high until 2025. This projection is influenced by a severe drought that affected most of the cattle trade this summer and prompted many producers to sell their herds early for slaughter, which will impact the herd size for 2023. In November 2022, 59.3% of the lower 48 states and 49.59% of the US were in a drought, impacting feed production by raising the cost of feed. Feed expenses are the largest operating cost for cow-calf producers, comprising 75% of the operational costs.

- Intervention from authorities may be required in the future to stabilize beef prices and create a supply balance. Companies must increase their production in meat plants to higher volumes, provided the USDA relaxes certain regulatory requirements as it has done in the past. For instance, in April 2020, the USDA's Food Safety Inspection Service temporarily permitted beef processing plants to accelerate processing speeds to supplement the US meat supply as demand increased.

United States Edible Meat Industry Overview

The United States Edible Meat Market is moderately consolidated, with the top five companies occupying 52.95%. The major players in this market are Hormel Foods Corporation, JBS SA, Sysco Corporation, Tyson Foods Inc. and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90333

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.1.4 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.2.4 Poultry

- 3.3 Regulatory Framework

- 3.3.1 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Poultry

- 4.1.5 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 BRF S.A.

- 5.4.2 Cargill Inc.

- 5.4.3 Conagra Brands Inc.

- 5.4.4 Continental Grain Company

- 5.4.5 Hormel Foods Corporation

- 5.4.6 JBS SA

- 5.4.7 OSI Group

- 5.4.8 Perdue Farms Inc.

- 5.4.9 Sysco Corporation

- 5.4.10 Tyson Foods Inc.

- 5.4.11 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.