Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692039

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692039

Asia-Pacific Edible Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 243 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

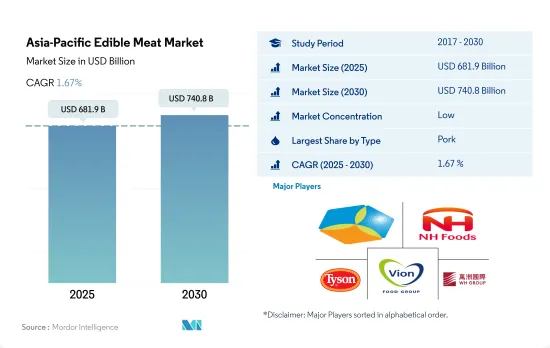

The Asia-Pacific Edible Meat Market size is estimated at 681.9 billion USD in 2025, and is expected to reach 740.8 billion USD by 2030, growing at a CAGR of 1.67% during the forecast period (2025-2030).

Increase in pork production and lower poultry prices fueling the demand

- The Asia-Pacific red meat segment was majorly led by pork meat throughout the study period, with 13% more market value share than poultry meat, which was the second most consumed type of meat in 2022. Pork meat is also anticipated to be the fastest-growing meat type during the forecast period, registering a CAGR value of 2.12%. This can be mainly supported by its growing production rate. It was the most produced meat type in the region, with a hike of 24.3% in domestic production from 2021 to 2022, as the governments are investing in the advancement of the production technologies of pork meat and pig farming.

- However, China generates the largest sales within the region due to high demand and is the largest producer of pork, producing around 53.9 million metric tons in 2022. The overall revenue per person for the APAC region was calculated at USD 117.50 in 2023, which is increasing the sales value.

- Mutton is likely to witness a high-growing CAGR value of 1.35% during the forecast period. Due to consumer preference for grass-fed meat, which reduces carbon footprint while being sustainable, the demand for mutton is rising. The food service industry is where most people get their mutton due to the work-from-home trend, which is becoming a new normal and driving the demand for processed and frozen forms majorly. For instance, in Asia-Pacific, around 50-60% of the population is working in a hybrid model.

- Poultry meat also accounted for a significant share in the market, which is projected to register a CAGR value of 1.37% during the forecast period because of the high availability of chicken in the region and the affordable prices, which are around 30-40% lower than red meat prices, driving the market positively.

China is the largest consumer of edible meat in the region

- The edible meat market in Asia-Pacific was anticipated to register a positive CAGR of 2.50% during 2017-2022. The influence of highly pathogenic avian influenza (HPAI) in the major countries in the region, such as China, Vietnam, and South Korea, slightly impacted the segmental growth. In December 2022, the recurrence of HPAI subtype H5N1 started in Hong Kong (Yuen Long). Since October 2022, more than 14.6 million Japanese poultry have been directly impacted by HPAI outbreaks linked to the H5N1 virus serotype. In Taiwan, 20 outbreaks directly impacted more than 325,700 commercial birds in 2022.

- China is a major meat-consuming country and is expected to hold a larger market share during the forecast period. The sales of edible meat in the country increased by 2.25% in 2022 compared to the previous year. China consumes 28% of the world's meat, and it also consumes around half of all pork in the world. The high availability and growing population are the major factors driving the demand for meat products in China. Pork was the most widely consumed meat type in China and accounted for 50.07% of the total edible meat in China in 2022.

- India is anticipated to be the fastest-growing country in the forecast period, registering a CAGR of 2.24% on a value basis. In India, poultry meat was the most consumed meat as of 2022. Around 70% of the Indian population is non-vegetarian. The total meat production in the country was around 9.29 million tons during 2021-2022, with an annual growth rate of 5.62% by volume. India has an abundant supply of meat, and the meat processing industry in the country is anticipated to grow during the forecast period.

Asia-Pacific Edible Meat Market Trends

Major producing countries are observing growth owing to the increasing export demand

- In Asia-Pacific, the leading producers of beef were China, India, and Australia, with a volume share of 38.71%, 21.49% and 9.28% respectively, in 2022. In China, production grew by 2.74% in 2022 compared to 2021. The production is anticipated to grow in the future, driven by rising cattle herds, particularly on large farms, and strong domestic demand owing to the ongoing pork shortage. High feed costs and lower-cost imports of beef products would have an impact on China's cattle production. Consumer demand for beef products has grown beyond the normal hotel and restaurant trade to include ready-cooked meals.

- The Indian market saw a growth of around 3.69% in 2022 compared to 2021, owing to the growing export demand and marginally higher domestic consumption. In 2023, India was expected to consume 779 million kg of beef, an increase of 1.84% from 2022, driven largely by its affordable pricing. For the supply and promotion of quality meat, the regulatory bodies in the nation are encouraging farmers' cooperatives to play an important role, including the promotion of backward integration and contract farming.

- In March 2023, the number of cattle slaughtered in Australia increased 13.5% to 1.7 million compared to the previous year. Beef production in the March 2023 quarter increased 11.3% to 524,335 tons compared to the same period in 2022. In 2022, Australia produced approximately 1.9 million tons of carcass weight (cwt) of beef and veal, and in the same year, Australia exported 67% of its total beef and veal production. The plentiful grazing pasture in the country supported the production of grass-fed cattle. In 2022, 2.7 million grain-fed cattle were marketed, accounting for 47% of all adult cattle slaughtered.

Beef prices are growing at a steady pace in the region owing to the large production base

- In 2022, beef prices in the region were up by 0.96% compared to 2021. This rise in prices was owing to the heated geopolitical conditions, supply imbalance and demand for global commodities, increasing energy prices, and logistic barriers. The beef price index saw a decrease in 2023, reaching 118.48 in June and falling from 135.83 during the same period in 2022, which is anticipated to stabilize the beef prices in the region.

- The price of beef in China highly impacts the Asia-Pacific market, owing to China being the largest producer of beef in the region. The price of beef in China increased at an average of 2.02% throughout the review period compared to a regional average growth rate of 1.40%. The country also imports a good amount of beef from Brazil, which is mainly used in preparing industrialized products and other popular dishes. In 2023, the country saw a decrease in imports owing to the increase in local production, thus stabilizing the prices. The beef prices in the region experience a spike during the festive season. In countries like Indonesia, in 2022, beef prices ranged from USD 9.75 to USD 6.96/kg, whereas it was around USD 11.84/kg during Eid and Ramadan.

- Australia is among the top three producers of beef in the region and a major source of premium beef in the region. More than 60% of the beef produced annually in Australia is exported to the global market. The price of young Australian cattle in the market jumped by 132% in about two years, reaching USD 7.99 in October 2021. Importers from countries such as Indonesia and Vietnam struggled with a combination of a strong Australian currency and rising cattle prices. However, despite the rise in CIF (cost, insurance, and freight), retail beef prices were steady in both Indonesia and Vietnam.

Asia-Pacific Edible Meat Industry Overview

The Asia-Pacific Edible Meat Market is fragmented, with the top five companies occupying 4.22%. The major players in this market are COFCO Corporation, NH Foods Ltd, Tyson Foods Inc., Vion Group and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90331

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.1.4 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.2.4 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Australia

- 3.3.2 China

- 3.3.3 India

- 3.3.4 Japan

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Poultry

- 4.1.5 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

- 4.4 Country

- 4.4.1 Australia

- 4.4.2 China

- 4.4.3 India

- 4.4.4 Indonesia

- 4.4.5 Japan

- 4.4.6 Malaysia

- 4.4.7 South Korea

- 4.4.8 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Bid Corporation Limited

- 5.4.2 China Yurun Food Group Ltd

- 5.4.3 COFCO Corporation

- 5.4.4 Danish Crown AmbA

- 5.4.5 Linyi Xincheng Jinluo Meat Products Co. Ltd

- 5.4.6 NH Foods Ltd

- 5.4.7 Tyson Foods Inc.

- 5.4.8 Tonnies Holding ApS & Co. KG

- 5.4.9 Vion Group

- 5.4.10 Westfleisch SCE mbH

- 5.4.11 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.