Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692043

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692043

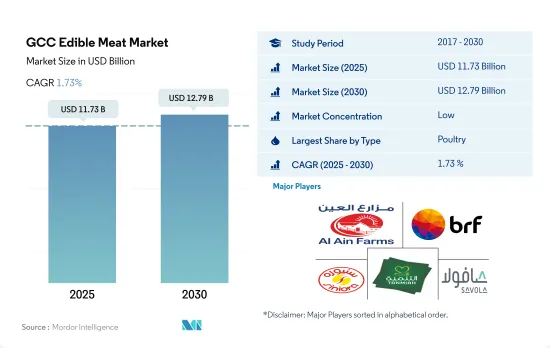

GCC Edible Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 234 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The GCC Edible Meat Market size is estimated at 11.73 billion USD in 2025, and is expected to reach 12.79 billion USD by 2030, growing at a CAGR of 1.73% during the forecast period (2025-2030).

High ex-pat population in the region drives the demand for various meat products

- Poultry is the most consumed meat type in the GCC region. The sales of poultry meat in the region rose by 15.95% in value from 2019 to 2022. Among all poultry birds, chicken meat dominated in the region compared to turkey, duck, and goose. Several countries are investing in improving poultry meat production. Pork is banned in most GCC countries under Islamic dietary law. However, consuming pork is not illegal for non-Muslims in the UAE and Bahrain. These two countries import pork sold in authorized food service establishments and retail outlets.

- Beef is anticipated to grow during the forecast period, registering a CAGR of 1.93% by value. Bahrain has the highest per capita beef consumption of 15.80 kg in 2023. The country relies on beef imports from New Zealand, Pakistan, and the United Arab Emirates. Most fresh meat cuts available through online channels are New Zealand's beef sirloin, topside steak, and silverside steak. The country has also seen an increase in the ex-pat population from Western and Asian nations over the last two decades, leading to a more diverse range of gastronomic preferences, including food items like hamburgers. Similarly, among red meat, consumption is primarily dominated by beef due to the religious affiliations of Bahrain's population.

- By country, Saudi Arabia has the highest consumption of edible meat, with a share of 20.42% by value of the GCC edible meat market. The country is increasing its meat production facilities to gain self-sufficiency in meat production. For instance, Saudi Arabia plans to invest USD 5 billion to boost poultry production as the Kingdom aims to achieve a poultry meat self-sufficiency rate of 80% by 2025.

- Bahrain is the fastest-growing edible meat market in the GCC, and it is expected to register a CAGR of 4.14%, by value, during the forecast period. In 2020, Bahrain witnessed an influx of around 48.9% of ex-pats from Asia and Western countries, resulting in foods like hamburgers and fried chicken becoming more popular with Bahraini consumers. The edible meat segment is largely dominated by poultry, mainly due to the religious affiliation of Bahraini consumers.

- In the United Arab Emirates, the poultry demand is rising. From 2018 to 2021, poultry meat registered a growth of 32.08% by value. Amid increasing global food prices, poultry remains a comparatively cheap source of animal protein in the United Arab Emirates. As of July 2021, poultry prices were 0.5% lower than last year's and declined every month in 2021 since record high prices in 2020. As a result of lower poultry prices and a recovery in tourism, travel, and business from the impact of the COVID-19 pandemic, the demand for poultry meat increased. The consumption was registered at 441,000 metric ton in 2021, and it is expected to increase in 2022.

- Oman is the second-fastest-growing edible meat market in the GCC, and it is expected to register a CAGR of 3.24%, by value, during the forecast period. The Oman Investment Authority supported various edible meat projects in the country to increase its self-sufficiency and expand the market. These projects reached meat self-sufficiency of 46% in 2022 from 37% in 2021. The major project launched its commercial operations and distribution of products in the local markets of the region in order to proliferate the edible meat market.

GCC Edible Meat Market Trends

The underdeveloped local supply chain in the region is restraining production

- Beef production in the region declined by 7.92% in 2022 from 2021. Saudi Arabia accounted for the region's major share of beef production. However, beef production is declining in Saudi Arabia. In 2022, beef production in the country dropped by 21.63%, registering a decline from 40 thousand tons in 2021 to 31 thousand tons in 2022. Imports account for the major beef source in Saudi Arabia. The country's beef imports grew at a rate of 1.54% in 2022 compared to 2021. India, Brazil, and Australia were the major exporters of beef to Saudi Arabia in 2021, with India exporting around 27 thousand tons. With the change in the maximum shelf life of imported frozen products, manufacturers from the United States are hoping that will result in increased sales growth in the Kingdom.

- Qatar has an exponential decline in beef production, and it had a decline of 43.74% in 2022 compared to the previous year. Qatar's beef production reached 925 tons in 2022 from 1644 tons in 2021. However, the local value chain of the bovine category is underdeveloped, and live bovine animals are imported for local slaughtering. Large amounts of water and animal feed are required for fattening large animals such as cattle.

- Bahrain accounted for the lowest production in the region. However, the country saw growth in the production of beef by 3.40% in 2022. The beef market in Bahrain sees a huge demand during the Ramadan season. According to the Ministry of Municipalities Affairs and Agriculture Undersecretary for Animal Wealth Resources, the country imported 11,611 heads of livestock, including 10,500 heads of sheep, 1,077 heads of cattle, and 40 heads of camels, to ensure sufficient stock, bringing the total availability to 27,000 heads of livestock during the Ramadan season of 2023.

The market is observing a growing demand for premium beef

- Kuwait and Bahrain recorded the highest prices for essential goods in the Gulf region. In 2022, 1 kg of beef was priced at USD 4.91 in Bahrain and USD 4.93 in Kuwait, whereas in the United Arab Emirates and Saudi Arabia, it was priced below USD 4. The reliance of Gulf countries on imports for necessities, including beef and beef products, is one of the leading causes of price increases.

- Spending on premium meat is high in Middle Eastern countries owing to their large affluent populations. For the past eight years, the United Arab Emirates (UAE) and Saudi Arabia have consistently ranked among Australia's top 20 most valuable beef export markets. In October 2022, the price of beef in Australia reached USD 2.82/1 kg, up by 5.3% week-on-week and 5.1% Y-o-Y, owing to rising exports. Western-style foodservices have grown rapidly in the last decade due to accelerated economic growth driven by rapid urbanization, rising disposable incomes, and increased tourism. This has increased demand for higher-quality beef grades and cuts.

- The Saudi Food and Drug Authority (SFDA) has expanded the shelf life for chilled beef from the United States from 70 to 120 days. This measure is expected to help US exporters save at least USD 4 per kg due to lower transportation costs while allowing Saudi Arabian importers to purchase larger quantities of US beef. Instead of just a few weeks per the prior regulation, Saudi Arabian importers now have at least 70 days to sell US beef. The extra time is expected to increase profitability since a longer shelf life minimizes the need for last-minute panic sales at steep discounts.

GCC Edible Meat Industry Overview

The GCC Edible Meat Market is fragmented, with the top five companies occupying 11.40%. The major players in this market are Al Ain Farms, BRF S.A., Siniora Food Industries Company, Tanmiah Food Company and The Savola Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90338

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Saudi Arabia

- 3.3.2 United Arab Emirates

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Poultry

- 4.1.4 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

- 4.4 Country

- 4.4.1 Bahrain

- 4.4.2 Kuwait

- 4.4.3 Oman

- 4.4.4 Qatar

- 4.4.5 Saudi Arabia

- 4.4.6 United Arab Emirates

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Al Ain Farms

- 5.4.2 Al Islami Foods

- 5.4.3 Americana Group

- 5.4.4 BRF S.A.

- 5.4.5 Golden Gate Meat Company

- 5.4.6 JBS SA

- 5.4.7 Najmat Taiba Foodstuff LLC

- 5.4.8 Qatar Meat Production Company

- 5.4.9 Siniora Food Industries Company

- 5.4.10 Sunbulah Group

- 5.4.11 Tanmiah Food Company

- 5.4.12 The Savola Group

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.