Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692042

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692042

India Edible Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 207 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

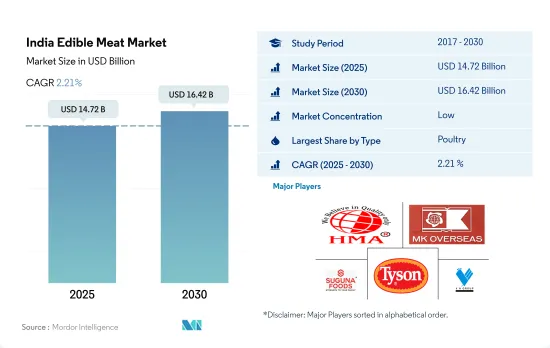

The India Edible Meat Market size is estimated at 14.72 billion USD in 2025, and is expected to reach 16.42 billion USD by 2030, growing at a CAGR of 2.21% during the forecast period (2025-2030).

Growing production, supported by government initiatives, is boosting the market

- The Indian edible meat market grew by 19.70%, by value, during 2017-2022, primarily driven by strong income and economic growth, rising urban population, rapidly growing middle class, changing lifestyles, improvement in logistics facilities, and the rise of modern retail in rural towns. The country has a very large vegetarian consumer base, accounting for around 20% of the total population in 2022. However, with the rising awareness of protein intake, the market is expected to grow during the forecast period.

- Poultry meat is the major and fastest-growing meat type consumed in India, which grew by 26.77%, by value, during 2017-2022. Consumption of poultry meat is increasing due to its versatility, relatively lower cost than other meat, the acceptance of chicken meat by all religions, and higher protein/lower fat composition. Poultry can respond more quickly to market signals due to shorter production cycles than ruminants. A major portion of meat from sheep, goats, pigs, and poultry produced in India is primarily used for domestic consumption in the form of fresh meat.

- Beef is the second fastest-growing meat type in the market after poultry, and it is expected to register a CAGR of 1.89%, by value, during the forecast period. The consumption of beef in India is impacted by the clash of values surrounding beef, which can be attributed to the sacredness of cows in Hinduism and the ethical concerns raised by animal rights organizations. The Government of India has taken steps to modernize municipal slaughterhouses to provide safe and hygienic meat to consumers. With the growing demand for safe and hygienic products, the market has seen increasing investments in farm automation, slaughterhouses, logistics, and point-of-sale cold storage infrastructures.

India Edible Meat Market Trends

Production is propelling due to domestic consumption and export demand

- In 2022, beef production in India grew by 3.69% from 2021. The increase in production is attributed to the rising demand for carabeef from India's export markets. The carabeef export is expected to grow to 1.48 MMT in 2023, driven by increased demand in Malaysia and the Middle East. India's carabeef and beef consumption projections for 2023 are expected to increase as water-bovine beef remains the country's most cost-effective animal protein source after poultry. However, religious taboos related to the consumption of cattle meat are a restraint to the growth.

- India has the highest number of live bovine animals worldwide, followed by Brazil and China in absolute terms. The national bovine herd is made up of bovine dairies and Asian domestic water buffaloes. The total bovine population is expected to reach 307.5 million in 2023, compared with 306.7 million bovine heads in 2022. With the improvement in the reproductive health of animals, calf crop numbers will gradually march upward.

- In 2022, India experienced an outbreak of lumpy skin disease (LSD) in cattle in various parts of the country. The overall observed impact of the outbreak was not severe, and the disease has now been largely contained. A new homologous vaccine, developed indigenously by the Indian Council for Agricultural Research-Indian Veterinary Research Institute (ICAR-IVRI), is expected to help control the spread of the virus in the coming years. The government is supporting the local livestock by providing a substantial allocation in the Fiscal Year Budget 2023/24 for the Ministry Of Agriculture and Farmers' Welfare's Department of Animal Husbandry and Dairying (DAHD).

Modest demand growth, coupled with government initiatives, is stabilizing the prices of beef

- In 2022, beef prices in India reached USD 3.06/kg. The prices gradually increased by 8.52% between 2017 and 2022. India's 2022 carabeef and beef consumption was 2.9 MMT, representing a nearly 5% increase from 2021's estimate of roughly 2.8 million metric tons. Carabeef has strong consumer demand, primarily driven by its affordable pricing.

- The wholesale price index (WPI) for buffalo meat (carabeef) and beef in 2022 (January-June) rose 6%, a modest increase compared to other meats, which makes these red meats relatively more affordable and accessible to consumers. During the first quarter of 2023, the approximate wholesale price range for Indian beef was between USD 1.07 and USD 2.63/ kilogram. Over the last five years, the import price per kilogram of beef into India has been relatively stable. In 2017, the price was USD 2.99/kg, which decreased to USD 2.86/kg in 2022. Based on this trend, the import price per kilogram of beef into India in 2023 was predicted to be around USD 2.84/kg.

- About 50% of total meat production is generated in unregistered, makeshift abattoirs. Marketing and transaction costs of livestock products are high, taking 15% to 20% from the sale price. The government's USD 1.80 billion Atma Nirbha Bharat Abhiyan stimulus package announced the creation of an Animal Husbandry Infrastructure Development Fund (AHIDF), the primary objective of which is to increase milk and meat processing capacity and product variety, increasing farmers' price realization. Prices in 2022 were also increasing due to a rise in food prices, feed prices, commodity prices, fuel prices, and supply chain disruptions due to the Russia-Ukraine war, which increased India's food inflation level by 7.7% Y-o-Y in March 2022.

India Edible Meat Industry Overview

The India Edible Meat Market is fragmented, with the top five companies occupying 5.97%. The major players in this market are HMA Agro Industries Limited, M. K. Overseas Private Limited, Suguna Foods Private Limited, Tyson Foods Inc. and VH Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90334

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.1.4 Poultry

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.2.4 Poultry

- 3.3 Regulatory Framework

- 3.3.1 India

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Poultry

- 4.1.5 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Al Aali Exports Pvt. Ltd

- 5.4.2 Al-Hamd Agro Food Products Pvt. Ltd

- 5.4.3 Allanasons Private Limited

- 5.4.4 Farm Suzanne Pvt. Ltd

- 5.4.5 HMA Agro Industries Limited

- 5.4.6 M. K. Overseas Private Limited

- 5.4.7 Mark International Food Stuff Pvt. Ltd

- 5.4.8 Mirha Exports Pvt. Ltd

- 5.4.9 Suguna Foods Private Limited

- 5.4.10 Tyson Foods Inc.

- 5.4.11 VH Group

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.