Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636548

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636548

Spain Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

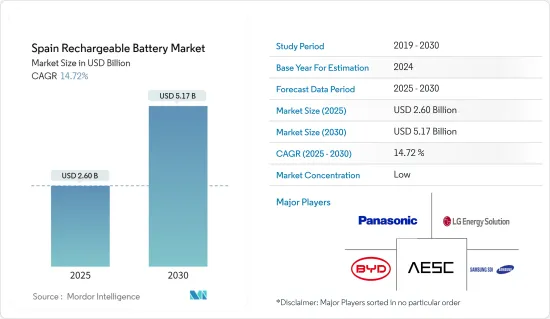

The Spain Rechargeable Battery Market size is estimated at USD 2.60 billion in 2025, and is expected to reach USD 5.17 billion by 2030, at a CAGR of 14.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector aided by government initiatives are expected to drive the Spain rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials, and the safety issues related to battery technologies are expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create opportunities for the Spain rechargeable battery market.

Spain Rechargeable Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among various battery technologies, lithium-ion batteries (LIBs) are poised to dominate the rechargeable battery market, experiencing rapid growth during the forecast period. Their rising popularity over other battery types can be attributed to their superior capacity-to-weight ratio, extended shelf life, reduced maintenance needs, and declining prices.

- Li-ion batteries boast distinct technical advantages over traditional lead-acid batteries. For instance, while lead-acid batteries offer a lifespan of approximately 400-500 cycles, rechargeable Li-ion batteries can exceed 5,000 cycles. Moreover, Li-ion batteries require less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- In recent years, major industry players have ramped up investments in R&D and production to enhance lithium-ion battery performance, intensifying competition and driving down prices. Due to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further decline to around USD 113/kWh by 2025 and USD 80/kWh by 2030, making lithium-ion batteries an increasingly attractive option.

- Historically, lithium-ion batteries powered consumer electronics like mobile phones and laptops. However, their application has expanded to include hybrids, fully electric vehicles (BEVs), and battery energy storage systems (BESS) in the renewable energy sector.

- In early 2022, the Volkswagen Group, in collaboration with partners, announced plans for a lithium-ion battery gigafactory in Sagunto, near Valencia. This location was strategically selected to supply battery cells to nearby EV plants in Martorell and Pamplona. The project, with an estimated cost of USD 3.25 billion, aims for an annual production capacity of 40 GWh. Construction commenced in Q1 2023, with production slated to begin in 2026. This gigafactory will be Volkswagen's third, joining existing sites in Sweden and Germany. Furthermore, the group envisions establishing six additional 40 GWh gigafactories across Europe, targeting a cumulative capacity of 240 GWh by 2030.

- Recognizing the importance of sustainable practices, Spain has seen a surge in lithium-ion battery recycling initiatives. Safe recycling not only conserves essential minerals but also presents a sustainable alternative to disposal. In July 2023, South Korean battery recycling specialist SungEel HiTech partnered with Spain's BeePlanet Factory to form a consortium focused on reusing and recycling lithium-ion batteries from electric vehicles.

- This consortium, named BeeCycle, will kick off its operations by constructing a recycling plant in Caparroso (Navarre). Set to commence in 2025, the facility will handle batteries at the end of their life cycle and scrap from battery cell manufacturing. With a processing capacity of 10,000 tonnes annually, it aims to produce 'black mass' - a crushed metal composite from batteries - equivalent to the output of 25,000 cars per year.

- In April 2023, Glencore, FCC Ambito, and Iberdrola announced a collaborative effort to establish large-scale lithium-ion battery recycling solutions in Spain. Their goal is to address the pressing challenge of lithium-ion battery recycling by setting up a dedicated facility that offers both second-life repurposing and end-of-life recycling solutions.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, decreasing costs, and advancements in the industry, lithium-ion batteries are set to become the fastest-growing battery technology in Spain's rechargeable battery market during the forecast period.

Increasing Adoption of Electric Vehicles To Drive the Market

- Spain's rechargeable battery market, especially for lithium-ion batteries, is set to surge, driven by the country's accelerating adoption of electric vehicles (EVs). Recent data from the International Energy Agency (IEA) highlights this trend: BEV sales in Spain jumped to approximately 57,000 units in 2023, marking a 72% increase from 33,000 units in 2022. Additionally, PEV sales reached around 65,000 units in 2023. This uptick in EV adoption signals a corresponding rise in demand for rechargeable batteries in Spain.

- In 2023, BEV stocks in Spain hit about 160,000 units, a notable 66% increase from 96,000 in 2022. Meanwhile, PEV stocks grew by 50%, reaching around 200,000 units. Despite this growth, Spain's total vehicle stock falls short of the government's ambitious target of 5.5 million electric vehicles by 2030. This gap underscores a robust future demand for rechargeable batteries.

- Spain has become a focal point for EV players in recent years. Notably, in April 2024, Ebro-EV Motors and Chery Automobile forged a joint venture in Barcelona, marking Chery as the first Chinese automaker to produce in Europe, utilizing Ebro's former Nissan plant.

- In another significant move, EV supplier Mobis, in April 2024, unveiled plans for a USD 128 million investment in Navarre, Spain. This investment aims to establish Western Europe's inaugural electrification-dedicated plant. Navarre, strategically located at Spain's northern tip bordering France, offers a gateway into mainland Europe. Mobis, hailing from Seoul, boasts battery system production facilities across Korea, China, and the Czech Republic, with additional plants underway in the U.S. and Indonesia.

- Set to commence mass production in 2026, Mobis' Spanish facility aims for an ambitious output of 360,000 annual battery system assemblies (BSA). These assemblies, crucial for EV efficiency and safety, integrate electronic components and the Battery Management System (BMS). In a strategic move, Mobis clinched a significant BSA contract with Volkswagen in 2023. The BSAs from the new plant are destined for Volkswagen's next-gen EV platforms, set to be produced in Pamplona.

- Given these developments, Spain's rechargeable battery market is poised for growth, driven by the nation's evolving EV landscape.

Spain Rechargeable Battery Industry Overview

The Spain rechargeable battery market is semi-fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, BYD Company Ltd., AESC Group Ltd., Samsung SDI Co. Ltd., and LG Energy Solution Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004024

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 BYD Company Ltd.

- 6.3.3 AESC Group Ltd.

- 6.3.4 Contemporary Amperex Technology Co. Limited

- 6.3.5 Exide Technologies

- 6.3.6 Toshiba Corporation

- 6.3.7 Samsung SDI Co. Ltd

- 6.3.8 Duracell Inc.

- 6.3.9 Clarios, LLC.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.