Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636557

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636557

Japan Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

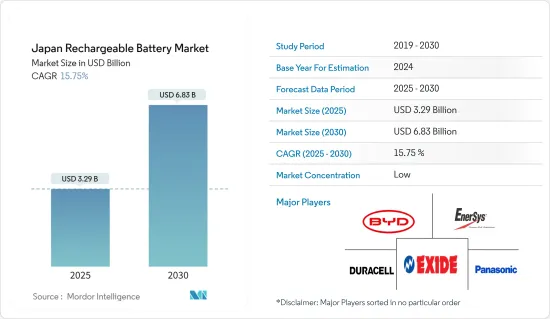

The Japan Rechargeable Battery Market size is estimated at USD 3.29 billion in 2025, and is expected to reach USD 6.83 billion by 2030, at a CAGR of 15.75% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising electric vehicle (EV) production and declining lithium-ion battery prices are expected to drive the demand for rechargeable batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the Japan rechargeable battery market.

- Nevertheless, the growing adoption of wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for rechargeable battery market players in the near future.

Japan Rechargeable Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- Lithium-ion rechargeable batteries, known for their numerous advantages, find extensive applications across various sectors. These batteries have emerged as a trusted and efficient solution for electrical energy storage. One of their standout features is their high energy density, allowing them to pack substantial power into a compact and lightweight form.

- Japan's lithium-ion rechargeable battery market is a dynamic arena, brimming with both opportunities and challenges. Thanks to their favorable capacity-to-weight ratio, lithium-ion batteries are outpacing other technologies in popularity. While lithium-ion batteries typically come with a premium price tag compared to their counterparts, leading market players are heavily investing in R&D and scaling up operations. This intensified competition has not only enhanced battery performance but also contributed to a downward trend in lithium-ion battery prices.

- In 2023, driven by rising average battery pack prices in electric vehicles (EVs) and battery energy storage systems (BESS), battery prices saw a notable dip, settling at USD 139/kWh-a drop of over 13%. With the ramp-up of extraction and refining capacities, lithium prices are projected to stabilize, aiming for USD 100/kWh by 2026.

- Central to many Battery Energy Storage Systems (BESS), lithium-ion batteries are prized for their high energy density, rapid charging, and extended cycle life. These attributes make them exceptionally suited for efficient energy storage and release in BESS applications. Companies in Japan are actively pursuing projects to bolster BESS in the upcoming years.

- As a case in point, in August 2023, Power X, a prominent Japanese battery manufacturer, teamed up with West Holdings, a local renewable energy developer. Their joint venture aims to roll out battery storage systems and solar power facilities nationwide. Targeting a spring 2025 completion, the duo plans to achieve a storage capacity of 200MWh and a solar output of 30MW. This initiative not only promises to bolster regional storage systems but also addresses the surging energy demand, subsequently driving up the need for lithium-ion rechargeable batteries.

- Japan's commitment to renewable energy, particularly solar and wind, underscores the pivotal role of lithium-ion batteries. These batteries are essential for harnessing and storing surplus energy from renewables, ensuring consistent power supply despite weather variations.

- Solar energy, among all sources, is set to take center stage. Japan's ambition to boost its solar capacity to nearly 108 GW by 2030, as part of its strategy to reduce nuclear energy reliance, signals a burgeoning demand for lithium-ion batteries in the near future.

- Given these projects and initiatives, the demand for lithium-ion rechargeable batteries is poised for an upswing in the coming years.

Automobile Segment to Witness Significant Growth

- For a long time, vehicles with internal combustion engines (ICE) dominated the roads. However, as environmental concerns grow, there's a noticeable shift towards electric vehicles (EVs). Predominantly, EVs utilize lithium-ion rechargeable batteries, celebrated for their high energy density, lightweight nature, minimal self-discharge, and low maintenance needs.

- Plug-in hybrids and electric vehicles are powered by lithium-ion battery systems. Thanks to their rapid recharge capability and high energy density, lithium-ion batteries stand out as the sole technology meeting OEM demands for driving range and charging time. In contrast, lead-based traction batteries fall short for full hybrids or EVs, given their heftier weight and lower specific energy.

- Japan has seen a remarkable surge in electric vehicle adoption recently. In 2023, the International Energy Agency (IEA) reported sales of 140,000 electric vehicles, marking a 44.3% increase from 2022. Projections indicate a significant uptick in EV sales across the region in the coming years.

- To champion electric vehicles and renewable energy, the Japanese government has rolled out a suite of policies and incentives. These initiatives have bolstered the demand for lithium-ion batteries. In 2023, the government unveiled ambitious plans to ramp up EV production and expedite the journey to zero carbon emissions.

- Japan's government introduced the Electrified Vehicle Strategy 2050, targeting a complete transition to EVs for all vehicles produced by Japanese automakers by 2050. Additionally, under Japan's EV Charging Infrastructure Landscape, Tokyo Electric Power Company Holdings is set to increase rapid highway chargers to 1,000 units by 2025.

- Moreover, as the global community pivots towards sustainability, Japan is wholeheartedly embracing this electric revolution. The Tokyo government aims to amplify public charging points from 30,000 to 150,000 by 2030. With these concerted efforts, Japan is poised to boost EV production and, consequently, the demand for lithium-ion batteries.

- Given these proactive measures, it's anticipated that EV sales and charging infrastructure will flourish in the region, subsequently driving up the demand for rechargeable batteries in the forecast period.

Japan Rechargeable Battery Industry Overview

The Japan rechargeable Battery is semi-fragmented. Some of the key players (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004063

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Saft Groupe SA

- 6.3.7 Exide Industries Ltd

- 6.3.8 Gotion High tech Co Ltd

- 6.3.9 Murrata Manufacturing Co. Ltd.

- 6.3.10 GS Yuasa International Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Wearable Devices

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.