Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636533

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636533

Europe Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

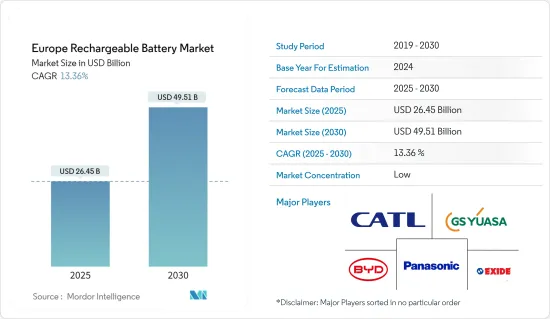

The Europe Rechargeable Battery Market size is estimated at USD 26.45 billion in 2025, and is expected to reach USD 49.51 billion by 2030, at a CAGR of 13.36% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for electric vehicles and growing adoption of renewable energy are expected to be among the most significant drivers for the Europe rechargeable battery market during the forecast period.

- Conversely, high supply chain constraints in battery procurement threaten the European rechargeable battery market during the forecast period.

- However, ongoing advancements in battery chemistry development have resulted in more efficient rechargeable batteries, presenting numerous future opportunities for the market.

- Germany is poised to lead the market and is projected to achieve the highest growth during the forecast period, driven by a burgeoning consumer electronics segment and swift renewable energy installations.

Europe Rechargeable Battery Market Trends

Automobile to Witness Significant Growth

- In recent years, the European Union has implemented stringent measures aimed at curbing greenhouse gas emissions and promoting cleaner energy technologies across the region. These initiatives also emphasize a heightened electrification push within the transportation sector. Individual countries within the EU have mirrored these efforts, rolling out policies that offer tax incentives and subsidies to bolster the adoption of electric vehicle (EV). Consequently, this has led to an anticipated surge in demand for rechargeable batteries, a pivotal component of electric vehicles.

- Additionally, heightened awareness surrounding environmental sustainability and a collective move away from fossil fuel reliance has shifted consumer preferences towards eco-friendly transportation. Electric vehicles, with their zero direct emissions, are increasingly viewed as a sustainable alternative to traditional internal combustion engine vehicles. This rising consumer inclination towards EVs is poised to propel the rechargeable battery market's growth in Europe.

- Data from the International Energy Agency highlights a consistent uptick in electric vehicle sales across Europe. In 2023, sales reached approximately 2.2 million units, a notable increase from 1.6 million units in 2021, marking a growth rate exceeding 37.5%. Such momentum underscores the burgeoning traction of electric vehicles, further fueling the rechargeable battery market.

- Moreover, ongoing technological advancements in battery technology have ushered in enhancements like improved energy density, extended ranges, and expedited charging times for electric vehicles. These advancements have catalyzed increased investments across Europe, particularly in establishing new battery manufacturing facilities.

- For example, in July 2023, Tata Motors, a prominent Indian automobile manufacturer, unveiled plans for a 40 GW annual cell production capacity electric vehicle battery plant in Britain. This facility is poised to fortify the domestic car industry by localizing battery production, ensuring long-term sustainability. Both Tata Motors and government officials disclosed a hefty investment of GBP 4 Billion for the factory.

- Given these developments, the electric vehicle segment of the automobile industry is set for substantial growth in the coming years.

Germany to Dominate the Market

- Germany is poised to lead the European rechargeable battery market, bolstered by its status as an industrial and manufacturing hub and a strong automobile industry. This industry is pivoting towards innovative electric vehicles, aligning with the global energy transition. As Europe's appetite for electric vehicles grows, German automakers are set to significantly boost the demand for rechargeable batteries, solidifying Germany's leadership in this segment.

- Furthermore, Germany's dedication to incorporating renewable energy into its power generation amplifies its need for rechargeable batteries. Given the intermittent nature of renewable sources, energy storage becomes crucial to harness their full potential. With the rising adoption of battery energy storage systems, Germany's renewable energy sector is poised to further fuel the demand for rechargeable batteries.

- Data from the International Renewable Energy Agency highlights Germany's swift embrace of renewables: the nation's installed renewable energy capacity surged by about 12% from 2022 to 2023, outpacing a consistent five-year average growth rate of over 5.6%.

- Moreover, Germany is a leader in battery R&D, due to substantial investments from both government and private entities. Domestic research institutions and companies are pushing the envelope in battery technologies, emphasizing enhancements in energy density, charging speed, and overall efficiency.

- As an illustration, in May 2024, Varta, a prominent German battery supplier, launched a project aimed at pioneering industrial-scale rechargeable sodium-ion battery technology. With a three-year investment of EUR 7.5 million (USD 8.08 million), the initiative seeks to elevate cell chemistry to an industrial scale. The goal is to produce a limited batch of round cells, tailored for electric vehicles and stationary storage. Set to wrap up by mid-2027, the project will undergo a thorough technical, economic, and ecological evaluation.

- Given these developments, Germany's dominance in the European rechargeable battery market appears assured during the forecast period.

Europe Rechargeable Battery Industry Overview

The Europe Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003928

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles

- 4.5.1.2 Growing Renewable Energy Penetration

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automobiles

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 GS Yuasa Corporation

- 6.3.10 Tesla, Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in New Battery Chemistry

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.