Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636545

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636545

Asia-Pacific Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

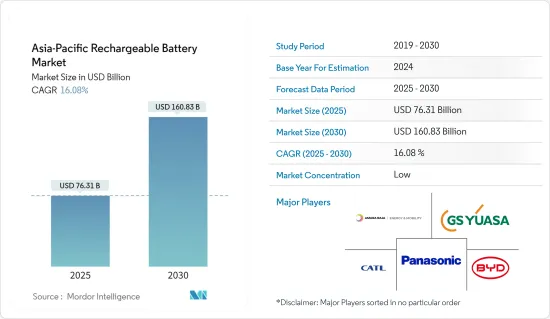

The Asia-Pacific Rechargeable Battery Market size is estimated at USD 76.31 billion in 2025, and is expected to reach USD 160.83 billion by 2030, at a CAGR of 16.08% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector are expected to drive the Asia-Pacific rechargeable battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the growing progress in developing new battery technologies and advanced battery chemistries will likely create vast opportunities for the Asia-Pacific rechargeable battery market.

- Among the countries in the region, India is expected to have significant growth due to the rise in the adoption of electric vehicles, consumer electronics, and energy storage systems in renewable projects.

Asia-Pacific Rechargeable Battery Market Trends

Lithium-ion Battery to be the Fastest Growing

- Among various battery technologies, lithium-ion batteries (LIBs) are poised to dominate the rechargeable battery market, showcasing rapid growth during the forecast period. Their rising popularity over other battery types can be attributed to their superior capacity-to-weight ratio, extended shelf life, reduced maintenance needs, and plummeting prices.

- Li-ion batteries boast several technical advantages over traditional lead-acid batteries. While lead-acid batteries typically offer 400-500 cycles, rechargeable Li-ion batteries can exceed 5,000 cycles. Moreover, Li-ion batteries demand less frequent maintenance and replacements. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for connected electrical components.

- Major players in the Asia-Pacific region are heavily investing in lithium-ion batteries, focusing on R&D and economies of scale. This surge in competition has driven down lithium-ion battery prices. Thanks to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further drop to around USD 113/kWh by 2025 and USD 80/kWh by 2030. Regionally, China recorded the lowest average battery pack prices at USD 126/kWh in 2023. Intense local competition in China saw manufacturers ramping up production to capture the burgeoning battery demand. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries.

- Historically, lithium-ion batteries powered consumer electronics like mobile phones and laptops. Recently, they've been adapted for hybrids, the full range of battery electric vehicles (BEVs), and battery energy storage systems (BESS) in renewable energy, largely due to their reduced environmental impact.

- Grid-scale BESS, for instance, is pivotal in achieving Net Zero Emissions. They provide essential services, from short-term balancing and grid stability to long-term energy storage and post-blackout restoration. The International Energy Agency (IEA) forecasts that grid-scale battery energy storage will spearhead energy storage growth. In 2022, China contributed over 42% of the 11.21 GW annual grid-scale battery storage additions, totaling over 4.81 GW. With plans to install over 30 GW of BESS by 2025, predominantly using lithium-ion batteries, China's ambitions signal a booming future for BESS and, consequently, a surging demand for rechargeable batteries in the Asia-Pacific.

- In December 2023, South Korea's Ministry of Finance unveiled a plan to inject KRW 38 trillion into the lithium battery industry over the next five years, with formal implementation set for 2024. Alongside establishing a KRW 1 trillion promotion fund, South Korea is channeling KRW 73.6 billion into R&D and bolstering reserves of critical minerals for domestic lithium battery production. These moves, coupled with efforts to foster a battery reuse and recycling ecosystem, are set to invigorate the lithium-ion battery sector and bolster the rechargeable battery market.

- March 2024 saw Panasonic Group announce a joint venture with Indian Oil Corporation Ltd (IOCL) for cylindrical lithium-ion battery production. This venture, driven by anticipated demand for two and three-wheel vehicles and BESS in India, underscores the region's growing lithium-ion battery manufacturing trend.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, declining costs, and industry advancements, lithium-ion batteries are set to emerge as the fastest-growing battery technology in the Asia-Pacific rechargeable battery market during the forecast period.

India to Witness Significant Growth

- Driven by the rising adoption of electric vehicles (EVs), surging demand for consumer electronics, and government initiatives championing energy storage solutions, the Indian rechargeable battery market is on the brink of significant growth. The surge in demand for rechargeable batteries, pivotal for the expansion of the market, is largely attributed to the widespread adoption of smartphones, laptops, and other portable devices in the consumer electronics sector.

- Moreover, the Indian Government's aggressive push towards electric mobility is amplifying the demand for rechargeable batteries, especially in the EV segment. Data from the International Energy Agency (IEA) highlights this trend, noting that battery electric vehicle (BEV) sales in India soared to approximately 82,000 units in 2023, marking a remarkable 70% uptick from the previous year. With the Indian Government setting ambitious targets for 2030 - envisioning 30% of newly registered private cars, 40% of buses, 70% of commercial cars, and a staggering 80% of two-wheelers and three-wheelers to be electric - the demand for rechargeable batteries, particularly lithium-ion variants, is set to surge.

- In a bid to bolster local manufacturing and reduce reliance on imported Advance Chemistry Cell (ACC) batteries for electric vehicles, the Indian Government rolled out a Production Linked Incentive (PLI) Scheme in early 2021. With a substantial outlay of USD 2.12 billion spread over five years, the scheme aims to establish a competitive ACC battery manufacturing setup in the country, targeting a capacity of 50 GWh, with an additional focus on 5 GWh of niche ACC technologies. The PLI Scheme offers a production-linked subsidy, determined by the applicable subsidy per KWh and the achieved percentage of value addition based on actual sales. By 2022, four prominent companies - Reliance New Energy Solar Limited, Hyundai Global Motors Company Limited, Ola Electric Mobility Private Limited, and Rajesh Exports Limited - secured incentives under this scheme, underscoring the government's commitment to boosting local battery cell production.

- Capitalizing on India's growing energy storage demands and its shift towards sustainable solutions, both local and international players are making significant investments in the Indian rechargeable battery market. For instance, in April 2022, Exide Industries, a major player in the battery sector, unveiled plans for a lithium-ion cell manufacturing plant in Karnataka, with an investment of approximately USD 718 million. The facility, starting with a 6 GWh capacity, is set to become operational by 2024, with plans to expand to a 12 GWh integrated lithium-ion battery facility in subsequent years.

- In another notable move, battery technology startup Log9 Materials inaugurated India's inaugural lithium-ion cell manufacturing facility in Jakkur, Bengaluru, in April 2023. Starting with a capacity of 50 MWh, Log9 has ambitious plans to scale up to 1 GWh for cell manufacturing and 2 GWh for battery pack manufacturing by Q1 2025. March 2024 saw GoodEnough Energy announcing its plans to commence operations at India's first battery energy storage gigafactory in Jammu and Kashmir by October 2024. With an investment of INR 1.5 billion (USD 18.07 million) for the initial 7 GWh facility and a projected spend of INR 3 billion (USD 37 million) by 2027 to elevate capacity to 20 GWh, GoodEnough's facility aims to significantly impact the industry, potentially cutting over 5 million tons of carbon emissions annually. This gigafactory aligns with India's ambitious goal to ramp up its renewable energy capacity to 500 GW by 2030, a significant leap from around 176 GW in 2023. To further bolster these efforts, the Indian government is extending incentives worth USD 452 million to companies engaged in promoting battery storage projects.

- With a vast consumer base, supportive governmental policies, and strides in battery manufacturing, the Indian rechargeable battery market is set for robust growth in the foreseeable future.

Asia-Pacific Rechargeable Battery Industry Overview

The Asia-Pacific rechargeable battery market is fragmented. Some of the key players in the market (not in any particular order) include Panasonic Corporation, Contemporary Amperex Technology Co. Limited, BYD Company Ltd., GS Yuasa Corporation, and Amara Raja Energy & Mobility Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004021

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Declining Lithium-ion Battery Cost

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Technologies (NiMh, Nicd, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 BYD Co.Ltd.

- 6.3.4 GS Yuasa Corporation

- 6.3.5 Samsung SDI Co. Ltd

- 6.3.6 LG Chem Ltd.

- 6.3.7 Clarios, LLC.

- 6.3.8 Amara Raja Energy & Mobility Ltd

- 6.3.9 Exide Industries Ltd

- 6.3.10 Duracell Inc.

- 6.3.11 Saft Groupe SA

- 6.3.12 Tianjin Lishen Battery Joint-Stock Co. Ltd. Source: https://www.mordorintelligence.com/industry-reports/southeast-asia-battery-market

- 6.3.13 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Progress in Developing New Battery Technologies and Advanced Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.