Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636546

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636546

India Rechargeable Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

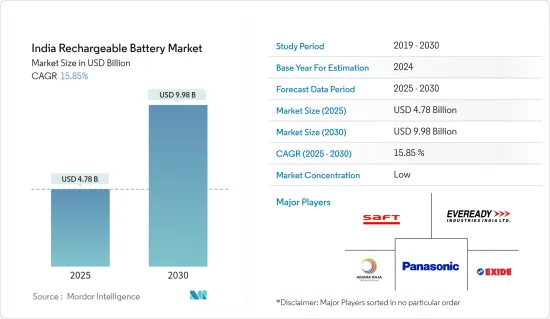

The India Rechargeable Battery Market size is estimated at USD 4.78 billion in 2025, and is expected to reach USD 9.98 billion by 2030, at a CAGR of 15.85% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for consumer electronics coupled with rising penetration of renewable energies are expected to be among the most significant drivers for the India Rechargeable Battery Market during the forecast period.

- On the other hand, the supply chain constraints for the battery procuring is high. This poses a threat to the India Rechargeable Battery Market during the forecast period.

- Nevertheless, continued advancements in energy density, charging cycles, and energy hold-up led to more efficient rechargeable batteries. This factor is expected to create several opportunities for the market in the future.

India Rechargeable Battery Market Trends

Lithium-ion Battery Expected to Witness Growth

- Lithium-ion batteries are poised for substantial growth in the market under consideration. Their rising popularity, especially when compared to other battery types, can be attributed to their favorable capacity-to-weight ratio. Additional factors fueling their adoption encompass superior performance (notably, longevity and low maintenance), an extended shelf life, and a trend of declining prices. While lithium-ion batteries typically command a higher price point than their counterparts, their advantages are driving demand.

- Consumer electronics are increasingly turning to lithium-ion batteries, further propelling their popularity. This sector encompasses smartphones, laptops, tablets, and wearables. Given the industry's demand for lightweight components, efficient charging cycles, and prolonged battery life, lithium-ion batteries emerge as the prime choice. As the appetite for advanced electronics grows among consumers, so too will the demand for lithium-ion batteries, bolstering market expansion.

- Moreover, the global pivot towards renewable energy sources, like solar and wind, is amplifying the demand for energy storage solutions. Lithium-ion batteries excel in this domain, adeptly storing surplus energy from renewables and releasing it as needed. This capability not only aids in grid stability but also diminishes dependence on fossil fuels.

- In recent years, a notable decline in the prices of lithium-ion batteries and cell packs has rendered them increasingly appealing to end-user industries. Following minor price surges in 2022, a downward trend resumed in 2023. Specifically, the cost of lithium-ion battery packs plummeted by 14%, achieving a historic low of USD 139/kWh. This price drop is largely due to reductions in raw material and component costs, alongside an expansion in production capacity throughout the battery value chain.

- Additionally, India, a nation reliant on lithium imports, has been actively scouting for domestic lithium reserves to mitigate vulnerabilities in the global value chain. Responding to this need, the Indian government has mandated regulatory bodies to pinpoint any domestic lithium reserves.

- For instance, in May 2023, the Geological Survey of India (GSI) unveiled a fresh deposit of this vital mineral in Degana, situated in Rajasthan's Nagaur district. These newly discovered reserves are projected to dwarf previous finds, potentially satisfying 80% of the nation's lithium demand. Notably, the lithium deposits are located in Renvat Hill and its neighboring regions in Degana, an area with a history of supplying tungsten to the country.

- Given these insights, it's evident that lithium-ion batteries are set for significant growth in the coming years.

Increasing Penetration of Renewable Energy To Drive The Market

- India's rechargeable battery market is set for substantial growth, driven by the rising integration of renewable energy sources, especially solar and wind power, into the nation's energy framework. Given the intermittent nature of renewable energy, energy storage systems, predominantly rechargeable batteries, are essential to manage this variability and maintain a consistent electricity supply.

- Additionally, the Indian government's ambitious renewable energy targets, bolstered by supportive policies and incentives, are propelling the rechargeable battery market's expansion. With a goal of achieving a renewable energy capacity of 500 GW by 2030, and a substantial portion from solar and wind, the government's plans underscore the need for extensive energy storage solutions, amplifying the demand for rechargeable batteries.

- As of April 2024, India's installed renewable energy capacity stands at 144.75 GW, with solar and wind contributing 57.08% and 31.89%, respectively, according to the Ministry of New and Renewable Energy. The ministry confidently asserts its trajectory towards the 2030 renewable energy goals.

- With India's ongoing expansion in renewable energy capacity, the appetite for battery energy storage technology is set to surge. This uptick will bolster the demand for rechargeable batteries, which are pivotal in storing surplus energy during peak production and dispensing it during lulls.

- In a notable development, the Delhi Electricity Regulatory Commission (DERC) granted regulatory approval in May 2024 for India's first commercial standalone Battery Energy Storage System (BESS) project. The 20 MW/40 MWh BESS, located at BRPL's 33/11 kV Kilokari substation, aims to achieve operational status swiftly, targeting an 18-20 month timeline from project inception.

- Moreover, the rise of microgrids and off-grid renewable systems in India's remote and rural locales, often devoid of grid connectivity, is amplifying the demand for rechargeable batteries. These energy storage solutions are vital for ensuring a steady electricity supply, thereby uplifting communities and fostering sustainable growth.

- Given these dynamics, the surge of renewable energy adoption is poised to significantly bolster India's rechargeable battery market in the coming years.

India Rechargeable Battery Industry Overview

The India Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are Saft Groupe SA, Eveready Industries India Ltd., Exide Industries, Panasonic Corporation, and Amara Raja Energy & Mobility Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50004022

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Penetration of Renewable Energy

- 4.5.1.2 Growing Demand for Consumer Electronics

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Others (NiMh, NiCd, etc.)

- 5.2 Applications

- 5.2.1 Automotive Batteries

- 5.2.2 Industrial Batteries

- 5.2.3 Portable Batteries

- 5.2.4 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Eveready Industries India Ltd.

- 6.3.2 LG Chem Ltd.

- 6.3.3 Contemporary Amperex Technology Co Ltd

- 6.3.4 Exide Industries

- 6.3.5 Saft Groupe SA

- 6.3.6 Samsung SDI Co., Ltd.

- 6.3.7 Murata Manufacturing Co., Ltd.

- 6.3.8 Panasonic Corporation

- 6.3.9 Duracell Inc.

- 6.3.10 Amara Raja Energy & Mobility Ltd

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.