Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636500

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636500

Asia Pacific Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

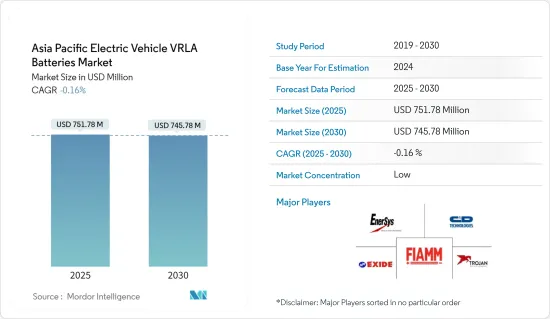

The Asia Pacific Electric Vehicle VRLA Batteries Market size is estimated at USD 751.78 million in 2025, and is expected to decline to USD 745.78 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries compared to lithium-ion and rising growth in electric scooters and bikes across the region are expected to drive the demand for electric vehicle VRLA batteries in the market during the forecast period.

- On the other hand, the rapid shift toward advanced lithium-ion batteries is making VRLA batteries less relevant for high-performance EVs can significantly restrain the growth of the electric vehicle VRLA batteries market.

- Nevertheless, the VRLA batteries can be used as auxiliary power sources or for backup in electric vehicles, where reliability is more important than energy density creating significant growth opportunities in the electric vehicle VRLA batteries market in the near future.

- India is anticipated to be the fastest-growing country in the Asia Pacific electric vehicle VRLA batteries market during the forecast period due to the rising used of electric two-wheelers due to their cost-efficiency and low maintenance.

Asia Pacific Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- The Asia-Pacific EV VRLA batteries market has witnessed substantial growth, largely driven by the adoption of Absorbed Glass Mat (AGM) battery technology. AGM, a variant of Valve Regulated Lead-Acid (VRLA) batteries, boasts several advantages. Its sealed construction minimizes leakage risks and reduces maintenance needs, especially when compared to traditional flooded lead-acid batteries. This characteristic makes AGM batteries particularly suitable for the region's electric vehicles (EVs).

- AGM batteries also offer a higher power density than their conventional counterparts. This attribute is crucial for EVs, which demand swift energy bursts for acceleration. Such capabilities not only enhance vehicle performance and range but also position AGM batteries as a competitive alternative to lithium-ion batteries in specific EV segments, notably electric bikes and scooters.

- As hybrid and battery-electric vehicles gain traction in the region, the demand for AGM batteries is witnessing a notable surge. Sales of two-wheeler EVs in key Asia-Pacific nations have seen growth in recent years. Data from the International Energy Agency highlights that in 2023, 6 million two-wheeler EVs were sold in China, compared to 880000 in India and 380000 in ASEAN countries. With several regional policies promoting EV adoption, sales are poised to rise further.

- Urban areas in Asia-Pacific are experiencing a notable uptick in demand for electric bikes, scooters, and compact electric vehicles, driving the adoption of AGM batteries. Leading companies are launching new two- and three-wheeled EVs across various Asia-Pacific nations, further fueling the AGM battery market. AGM batteries are preferred in this domain due to their durability, compactness, and adequate energy output.

- In a notable development in August 2024, companies from Pakistan and China collaborated to introduce an electric motorcycle featuring swappable batteries. This initiative not only aims to drive innovations in the EV sector for both countries but also seeks to bring swappable battery technology to the commercial three-wheeler market. Such initiatives are anticipated to bolster the demand for AGM batteries in the region.

- Furthermore, the growing reliance on AGM batteries is bolstering the Asia-Pacific EV market, especially in areas where economical energy storage is paramount. Regional companies are innovating advanced battery materials for the electric vehicle sector, aiming to boost the performance and efficiency of VRLA batteries, including AGMs.

- In April 2024, GS Yuasa Battery Ltd., a subsidiary of GS Yuasa Corporation, announced a sales launch for its ECO.R HV auxiliary VRLA battery series, tailored for Toyota hybrid vehicles, with a scheduled release in June 2024. Hybrid vehicles employ two battery types: one for traction and another for auxiliary tasks. The newly enhanced VRLA auxiliary batteries come in two sizes, B20 and B24. Such initiatives are set to amplify EV production in the region and, subsequently, the demand for AGM batteries.

- Given these developments, the trajectory suggests a continued rise in both EV production and AGM battery demand in the Asia-Pacific region.

India Expected to Dominate the Market

- India's market for EV VRLA batteries is on a steady upward trajectory, driven by the surging demand for electric vehicles, especially in the two-wheeler and three-wheeler segments. As one of Asia's largest markets for electric cars, India plays a crucial role in propelling the demand for VRLA batteries. These valve-regulated lead-acid (VRLA) batteries, especially the Absorbed Glass Mat (AGM) variant, are preferred for their reliability and cost-effectiveness.

- In recent years, India's EV sales have seen a notable uptick, spurred by heightened consumer demand, growing environmental consciousness, and government incentives like tax credits and rebates. This surge in EV adoption has, in turn, amplified the demand for EV batteries, and by extension, VRLA batteries.

- For instance, the International Energy Agency (IEA) reported that in 2023, three-wheeler electric vehicle sales hit 580,000 units, marking a 65% increase from 2022. With the government rolling out several supportive policies and incentives, EV sales are poised for further growth in the coming years.

- Moreover, India's market for electric two-wheelers and rickshaws (three-wheelers) is expanding rapidly. AGM batteries, a type of VRLA battery, are preferred in these vehicles for their cost-effectiveness, durability, and capacity to endure frequent charging cycles. In response to the burgeoning demand in the electric two-wheeler and three-wheeler sectors, numerous companies have launched VRLA battery projects across the nation.

- For instance, in July 2024, Daewoo India, a global entity present in 110 countries, introduced its SUPER POWER AGM VRLA Silver+ battery, specifically designed for two-wheelers. These maintenance-free batteries, infused with 'Korean Technology', cater to Indian motorcycles and scooters and come with a 48-month warranty. Such product launches are anticipated to meet the escalating demand for VRLA batteries in the near future.

- Moreover, the government's initiatives, like the FAME II (Faster Adoption and Manufacturing of Electric Vehicles) policy, are propelling the electrification of both public and private transport. These measures not only boost the adoption of VRLA batteries in electric vehicles but also in low-power EV segments, especially in urban areas prioritizing enhanced public transportation and clean energy solutions.

- For instance, the Indian government, as of 2023, set ambitious targets for 2030: 30% of private cars, 70% of commercial vehicles, and 80% of two and three-wheelers to be electric. Additionally, the government is offering subsidy incentives ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). Such proactive measures are set to bolster the demand for EV batteries, particularly those utilizing VRLA technology, during the forecast period.

- Consequently, these initiatives and projects are poised to boost EV production in the region, leading to create a favourable environment for the market.

Asia Pacific Electric Vehicle VRLA Batteries Industry Overview

The Asia Pacific Electric Vehicle VRLA Batteries market is semi-fragmented. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Trojan Battery Company, C&D Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003790

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Malaysia

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 C&D Technologies

- 6.3.5 Trojan Battery Compan

- 6.3.6 Shenzhen Center Power Tech Co.

- 6.3.7 Amara Raja Batteries Ltd

- 6.3.8 GS Yuasa Corporation

- 6.3.9 Leoch International Technology Limited

- 6.3.10 HBL Power Systems Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.