Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636513

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636513

ASEAN Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

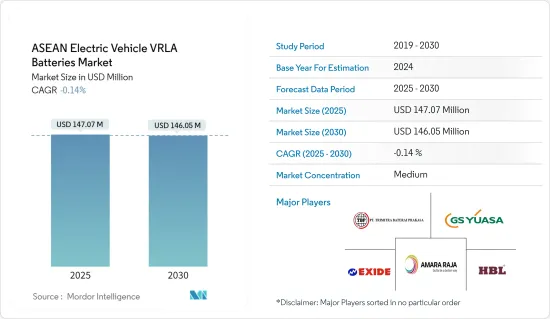

The ASEAN Electric Vehicle VRLA Batteries Market size is estimated at USD 147.07 million in 2025, and is expected to decline to USD 146.05 million by 2030.

Key Highlights

- In the coming years, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries is diminishing the relevance of VRLA batteries for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backup solutions in electric vehicles, especially where reliability trumps energy density. This niche presents substantial growth opportunities for the electric vehicle VRLA batteries market in the near future.

- Thailand is set to emerge as the frontrunner in the ASEAN electric vehicle VRLA batteries market, driven by the increasing adoption of cost-efficient and low-maintenance electric two-wheelers.

ASEAN Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery to Witness Significant Growth

- The ASEAN market for EV VRLA batteries has seen significant growth, largely fueled by the rising adoption of Absorbed Glass Mat (AGM) battery technology. AGM batteries, a type of Valve-Regulated Lead-Acid (VRLA) battery, come with distinct advantages. Their sealed design not only minimizes leakage risks but also cuts down on maintenance, especially when compared to traditional flooded lead-acid batteries. This feature makes AGM batteries especially beneficial for the region's electric vehicles (EVs).

- AGM batteries also deliver a higher power density than standard lead-acid batteries. This is a vital trait for EVs, which require quick energy bursts for acceleration. Such superior performance not only enhances vehicle range but also positions AGM batteries as a viable alternative to lithium-ion batteries in certain EV segments, particularly in electric bikes and scooters.

- As the adoption of AGM batteries surges in the region's two-wheeler and three-wheeler EV industries, demand continues to rise. Data from the ASEAN Automotive Federation highlights this trend: in 2023, Southeast Asia saw sales of 12.72 million motorcycles and scooters, marking a 3.67% increase from 2022 and a 2.2-fold surge since 2019. With a notable portion of these sales being EV motorcycles and scooters, and given the government's regional policies promoting EV adoption, this share is set to grow.

- Governments throughout the ASEAN region are championing electrification, aiming to lessen reliance on fossil fuels and tackle environmental challenges. Their policies emphasize boosting local production of EV components, batteries included, to cater to both domestic and export markets.

- Take, for example, the Indonesian government's 2023 Low Carbon Emission Vehicle (LCEV) program, which promotes hybrid and electric vehicles, thereby nurturing the growth of VRLA technologies like AGM. In Singapore, the government's Green Plan 2030 is set to phase out internal combustion engine vehicles by 2040, bolstering the push for EV technologies, including AGM batteries for compact vehicles. Such endeavors are poised to elevate both EV production and demand in the near future.

- Moreover, countries in the ASEAN, including Thailand, Malaysia, Indonesia, and Vietnam, are ramping up their EV infrastructure, further driving the demand for economical energy storage solutions like AGM batteries. Numerous companies are launching initiatives to boost electric vehicle production, aiming to meet the surging demand.

- For instance, in August 2024, TVS Motor is set to bolster its presence in ASEAN, kicking off in Indonesia. The automaker plans to export electric vehicles to ASEAN markets from its Indonesian manufacturing base. TVS Motor has rolled out five electric scooter variants from its iQube lineup. Furthermore, the company is gearing up to launch a budget-friendly electric scooter and a novel electric three-wheeler by year-end. Such initiatives are anticipated to not only meet the growing EV demand but also amplify the need for AGM batteries during the forecast period.

- Given these developments, the projected increase in EV production across the region creates a conducive environment for market analysis.

Thailand to Witness Significant Growth

- Thailand's push towards electric vehicles (EVs) is driving up the demand for valve-regulated lead-acid (VRLA) batteries. This surge is largely due to the government's strong commitment to electrification, local production initiatives, and a growing appetite for cost-effective EV solutions.

- Cost plays a pivotal role in the shift to electric mobility. While higher-end EVs predominantly use lithium-ion batteries, VRLA batteries, especially Absorbed Glass Mat (AGM) variants, offer a more economical alternative. These are frequently found in smaller EVs, like electric scooters and three-wheelers, which enjoy popularity in Thailand.

- Sales of electric vehicles (EVs) have seen a significant uptick in the ASEAN region. For instance, the Thailand Automotive Institute reported that in 2023, registered battery electric vehicles (BEVs) reached 76.36 thousand units. This marks a 6.89-fold increase from 2022 and a staggering 47.6-fold rise since 2019. With EV sales projected to continue their upward trajectory, the region's demand for VRLA batteries is expected to increase. However, the availability of alternate battery technology like lithium-ion, with the added advantages of VRLA batteries, is likely to impact the market growth in the EV industry in the upcoming years.

- Thailand boasts a substantial market for electric motorcycles, scooters, and tuk-tuks, all of which commonly utilize VRLA batteries. These vehicles, vital for short-distance travel, are affordable and accessible to a broad demographic. In response to the surging demand for EVs, numerous regional companies have introduced EV two-wheelers.

- For example, at the 2024 Motor Show in April 2024, STROM made headlines by launching three innovative models in Thailand's electric motorcycle sector. The STROM APE AP-400L is designed for sporty riders eyeing speed on long journeys. In contrast, the All-New Panther V2, branded as 'Igniting the Future of Electric Mobility,' promises agility and flexibility. Such launches are anticipated to meet the growing EV demand and subsequently boost VRLA battery production.

- Moreover, Thailand is positioning itself as Southeast Asia's EV battery manufacturing hub. With government incentives driving the initiative, both domestic and international firms are ramping up VRLA battery production to cater to the surging EV demand.

- In a notable move, BMW announced in February 2024 its plans for a dedicated EV battery factory in Rayong, Thailand. This strategic decision aims to strengthen the nation's battery supply chains. BMW has set its sights on making Thailand a central export hub for its EV batteries, with ambitions targeting the expansive Asia Pacific market. Such endeavors are not only set to elevate battery production in Thailand but also heighten the demand for VRLA batteries in the coming years.

- Consequently, these initiatives are poised to boost EV production in the region and are likely to support the market study.

ASEAN Electric Vehicle VRLA Batteries Industry Overview

The ASEAN Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are GS Yuasa Corporation, Exide Industries, HBL Power Systems Ltd., PT Trimitra Baterai Prakasa, and Amara Raja Batteries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003856

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Technological Obsolescence

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Laos

- 5.3.4 Thailand

- 5.3.5 Myanmar

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Amara Raja Batteries Ltd

- 6.3.3 Exide Technologies

- 6.3.4 HBL Power Systems Ltd

- 6.3.5 PT. Trimitra Baterai Prakasa

- 6.3.6 Global Power Source Co., Ltd

- 6.3.7 Panasonic Corporation

- 6.3.8 CSB Battery

- 6.3.9 Leoch International Technology Limited

- 6.3.10 Narada Power Source Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.