Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636510

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636510

North America Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

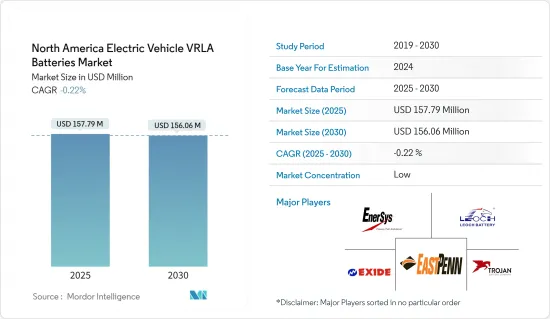

The North America Electric Vehicle VRLA Batteries Market size is estimated at USD 157.79 million in 2025, and is expected to decline to USD 156.06 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition to advanced lithium-ion batteries is diminishing the relevance of VRLA batteries for high-performance EVs, posing a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backup systems in electric vehicles, particularly where reliability trumps energy density. This niche presents substantial growth opportunities for the electric vehicle VRLA batteries market in the near future.

- In North America, the United States is set to emerge as the fastest-growing nation in the electric vehicle VRLA batteries market, driven by the increasing adoption in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

North America Electric Vehicle VRLA Batteries Market Trends

Low Speed EV battery Type to Witness Significant Growth

- In North America, low-speed electric vehicles (LSEVs) such as golf carts, electric utility vehicles, neighborhood electric vehicles (NEVs), and electric scooters predominantly rely on Valve-Regulated Lead-Acid (VRLA) batteries. Commonly known as sealed lead-acid batteries, VRLA batteries are favored for LSEVs due to their cost-effectiveness, minimal maintenance needs, and robust supply chains.

- Moreover, VRLA batteries offer a more economical alternative to lithium-ion batteries, a significant advantage for LSEVs. Since LSEVs, encompassing golf carts, e-bikes, and NEVs, are designed for short commutes and lower speeds, the affordability of VRLA batteries aligns perfectly with the financial goals of these vehicles.

- Recently, the demand for LSEVs, including electric trucks, has surged in North America. Data from Cox Automotive highlights that Rivian, a prominent medium-duty electric truck manufacturer in the United States, experienced a sales uptick of approximately 17.9% in 2024 (up to November 10, 2024) compared to 2023. The company's sales jumped from about 36,150 units in 2023 to 42,610 in 2024. With trade in the region expected to grow significantly and trucks playing a pivotal role in the transportation industry, sales are projected to continue their upward trajectory.

- While the use of VRLA batteries in LSEVs raises environmental concerns in North America due to their lead content, it's worth noting that lead-acid batteries boast a high recycling rate, supported by established programs across the continent. Furthermore, regional governments have been actively promoting battery recycling initiatives.

- For example, in January 2024, as President Biden introduced economic packages to bolster American competitiveness and reinforce United States leadership in energy storage, he emphasized the importance of harnessing the potential of lead batteries. By focusing on R&D and domestic battery manufacturing, these initiatives aim to boost lead battery production and address environmental concerns linked to their disposal.

- The North American market for LSEVs, spanning electric scooters, bikes, and compact urban vehicles, has been on a steady upward trajectory. As the demand for LSEVs, particularly electric scooters, continues to rise, leading companies are responding by launching a series of advanced vehicles.

- For instance, in January 2024, Flash Motors introduced the Infinity X Hyper Scooter, marking a significant leap in personal transportation. The Infinity X stands out not just as a scooter; it boasts proprietary AI technology that customizes the riding experience by adjusting the engine, battery, brakes, and other components. Such innovations are poised to bolster the demand for advanced electric scooters in the coming years, subsequently driving up the demand for VRLA batteries.

- In summary, these advancements and projects are set to boost the production of LSEVs in the region, alongside a heightened demand for EV VRLA batteries in the forecast period.

Canada is Expected to Witness Significant Growth

- Across Canada, Valve-Regulated Lead-Acid (VRLA) batteries are integral to the electric vehicle (EV) landscape, especially in niche markets such as low-speed electric vehicles (LSEVs) and certain industrial applications. Their robustness and cost-effectiveness make VRLA batteries a preferred choice for electric utility vehicles in agricultural, warehousing, and commercial sectors throughout Canada.

- Moreover, VRLA batteries are significantly more affordable than their lithium-ion counterparts, making them appealing for budget-friendly EVs and industrial vehicles. Sales of EVs, including those powered by VRLA batteries, have surged in the region. For example, the International Energy Agency (IEA) reported in 2023 that Canada sold 0.171 million electric vehicles, marking a 48.69% increase from 2022 and a 2.4-fold rise since 2019. Given this momentum and recent Canadian government initiatives, EV sales are poised to climb in the coming years, driving a heightened demand for EV battery production.

- Canada has a robust infrastructure for recycling lead-acid batteries, including VRLA types. This capability is crucial for the continued adoption of VRLA batteries in Canadian EV applications. By addressing environmental concerns and managing lead content responsibly, these recycling programs highlight their importance. Initiatives like Call2Recycle, along with regional efforts, enhance Canada's capacity to manage end-of-life VRLA batteries effectively.

- VRLA batteries also power LSEVs for short-range urban transport, are popular in recreational vehicles at resorts, and are utilized in industrial applications like forklifts. Notably, the demand for electric forklifts in material handling has surged recently.

- For instance, in June 2024, Toyota Material Handling (TMH) began constructing a nearly USD 100 million facility for electric forklift production, in collaboration with state and local officials. Set to be completed by the end of 2026, this factory enters a market where electric forklifts already represent 65% of North American sales, including Canada. Such initiatives are expected to boost the demand for VRLA batteries in the EV sector during the forecast period.

- Consequently, these developments are anticipated to elevate electric vehicle production in the region and drive the demand for VRLA batteries in the coming years.

North America Electric Vehicle VRLA Batteries Industry Overview

The North America Electric Vehicle VRLA Batteries market is semi-fragmented. Some of the key players (not in particular order) are East Penn Manufacturing, EnerSys, Exide Technologies, Trojan Battery Company, Leoch International Technology, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003840

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 East Penn Manufacturing

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Trojan Battery Company

- 6.3.5 Leoch International Technology

- 6.3.6 Johnson Controls

- 6.3.7 Crown Battery Manufacturing

- 6.3.8 NorthStar Battery

- 6.3.9 U.S. Battery Manufacturing

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.