Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636516

China Electric Vehicle Vrla Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 90 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

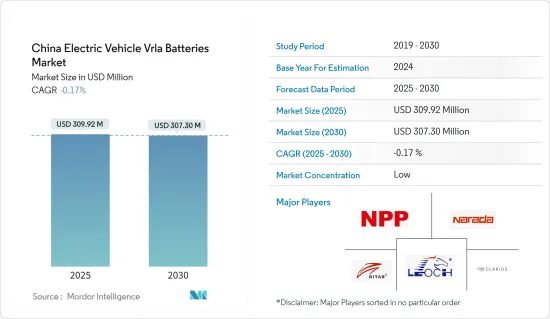

The China Electric Vehicle Vrla Batteries Market size is estimated at USD 309.92 million in 2025, and is expected to decline to USD 307.30 million by 2030.

Key Highlights

- In the coming years, the demand for electric vehicle VRLA batteries is projected to rise, driven by their cost-effectiveness compared to lithium-ion batteries and the surging popularity of electric scooters and bikes nationwide.

- Conversely, the swift transition to advanced lithium-ion batteries, which are becoming the standard for high-performance EVs, poses a challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries still hold value as auxiliary power sources or backups in electric vehicles, especially in scenarios prioritizing reliability over energy density. This niche presents substantial growth potential for the electric vehicle VRLA batteries market in the near future.

China Electric Vehicle Vrla Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- Due to their cost-effectiveness, reliability, and maintenance-free nature, VRLA batteries, particularly Absorbed Glass Mat (AGM) types, are frequently utilized in China's EV industry. AGM batteries, being more affordable than lithium-ion counterparts, present an attractive option for electric vehicles.

- AGM (Absorbed Glass Mat) batteries, a subset of VRLA batteries, have garnered attention for outperforming traditional lead-acid variants. By utilizing a glass mat separator to absorb the electrolyte, AGM batteries offer distinct advantages, making them particularly suited for certain EV applications, especially in budget-friendly electric mobility.

- As two and three-wheeler electric vehicles gain traction in China, the demand for AGM batteries in this segment has surged. Yet, with a recent downturn in two and three-wheeler sales, the AGM battery sector is feeling the pinch. Data from the International Energy Agency (IEA) reveals a drop in electric two-wheeler sales in China, plummeting from 10.2 million in 2021 to 5.9 million. Looking ahead, the rise of alternative battery technologies, notably lithium-ion, poses a challenge to the AGM market.

- China's electric vehicle battery market is primarily propelled by the uptake of new energy vehicles (NEVs), a momentum further fueled by government mandates. For example, in June 2023, The Ministry of Finance announced a sales tax exemption of CNY 30,000 (USD 4,170) per vehicle for NEVs purchased in 2024 and 2025. This exemption will taper to CNY 15,000 for purchases made between 2026 and 2027. Additionally, China's national New Energy Vehicle Subsidy Program, initiated in April 2020 to further stimulate EV sales, was originally set to conclude at the end of 2020 but received an extension until 2022 due to the COVID-19 pandemic.

- The growing prominence of AGM batteries in the EV domain, especially in cost-sensitive regions, underscores the sustained significance of VRLA technology. Furthermore, government agreements and initiatives underscore a commitment to bolster EV adoption and enhance the region's EV infrastructure.

- Consequently, these initiatives are poised to not only boost EV production in the region but also elevate the demand for EV VRLA batteries in the coming years.

Chinese Policies Targeting Charging Infrastructure for New Energy Vehicles

- As of August 2023, China boasted 7,208,000 charging infrastructure units (both public and private), according to the China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA). Out of these, 2,272,000 were public charging stands, while 4,936,000 were designated for private use.

- Projections for the end of 2024 suggest that the number of EV chargers in China will surge to 9.58 million units, representing a substantial growth rate of approximately 84 percent. This upward trajectory underscores the immense potential and opportunities within the EV charging market.

- China has introduced a series of targeted policies to strengthen its EV charging market, with the following key dates:

- June 2023 (Policy Document: Guiding Opinions on Further Constructing a High-Quality Charging Infrastructure System): The policy aims to establish a unified charging network across urban, highway, and rural areas. It emphasizes the need for standardization, regulation, and market oversight, with a vision to dominate global charging technologies by 2030.

- May 2023 (Policy Document: Accelerating the Development of Charging Infrastructure to Better Support the Deployment of New Energy Vehicles in Rural Areas and Rural Revitalization): This initiative supports local governments in setting up public charging networks at the county level and facilitates the installation of charging points in commercial buildings, traffic hubs, and highway parking areas.

- January 2023 (Policy Document: Guiding Opinions on Promoting the Development of Energy Electronics Industry): Focuses on boosting the application of energy electronic products in emerging facilities, including 5G base stations and new energy vehicle charging stations.

- December 2022 (Policy Document: Implementation Plan for Expanding Domestic Demand in the 14th Five-Year Plan): Emphasizes the enhancement of supporting facilities like parking lots, charging stations, battery swapping stations, and hydrogen refueling stations.

- For example, the Beijing Urban Management Development Plan, aligned with the 14th Five-Year Plan, targets a cumulative total of 700,000 electric vehicle chargers by 2025.

- These governmental efforts are not just about numbers; they focus on elevating the safety, intelligence, and connectivity of charging facilities. Such advancements are poised to propel the EV industry forward, potentially bolstering the battery market in the coming years.

China Electric Vehicle Vrla Batteries Industry Overview

The China Electric Vehicle VRLA Batteries market is moderately fragmented. Some of the key players (not in particular order) are NPP Power Group., Vision Battery Group, Zhejiang Narada Power Source Co., Ltd., and LEOCH Battery Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003869

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LEOCH Battery Corporation

- 6.3.2 Zhejiang Narada Power Source Co., Ltd.

- 6.3.3 NPP Power Group

- 6.3.4 C&D Technologies

- 6.3.5 Shenzhen Ritar Power Co Ltd

- 6.3.6 Clarious LLC

- 6.3.7 Ritar Power

- 6.3.8 GS Yuasa Battery Ltd.

- 6.3.9 JYC Battery Manufacturer Co. Ltd.

- 6.3.10 Chilwee Battery

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.