Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636501

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636501

Europe Electric Vehicle VRLA Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

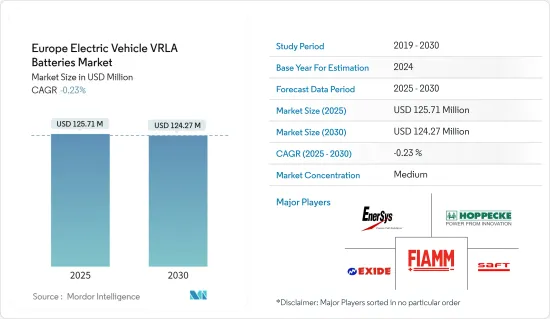

The Europe Electric Vehicle VRLA Batteries Market size is estimated at USD 125.71 million in 2025, and is expected to decline to USD 124.27 million by 2030.

Key Highlights

- Over the medium term, the cost-effectiveness of VRLA batteries, especially when compared to lithium-ion counterparts, coupled with the surging popularity of electric scooters and bikes in the region, is poised to bolster the demand for electric vehicle VRLA batteries during the forecast period.

- Conversely, the swift transition towards advanced lithium-ion batteries, rendering VRLA batteries less pertinent for high-performance EVs, poses a significant challenge to the growth of the electric vehicle VRLA batteries market.

- However, VRLA batteries find utility as auxiliary power sources or backups in electric vehicles, especially where reliability trumps energy density, unveiling substantial growth prospects for the electric vehicle VRLA batteries market in the near future.

- Germany is set to emerge as the frontrunner in the European electric vehicle VRLA batteries market, driven by the increasing adoption in electric two-wheelers, thanks to their cost-efficiency and minimal maintenance needs.

Europe Electric Vehicle VRLA Batteries Market Trends

Absorbed Glass Mat Battery Witness Significant Growth

- In the European EV industry, VRLA batteries, particularly the Absorbed Glass Mat (AGM) variants, are preferred for their cost-effectiveness, reliability, and maintenance-free characteristics. AGM batteries, being more economical than their lithium-ion counterparts, emerge as a compelling choice for electric vehicles.

- AGM (Absorbed Glass Mat) batteries, a type of VRLA battery, outperform traditional lead-acid batteries. By employing a glass mat separator to absorb the electrolyte, AGM batteries gain unique advantages, making them especially suitable for specific EV applications, notably in budget-conscious electric mobility.

- As hybrid and battery-electric vehicles gain traction in the region, the demand for AGM batteries is witnessing a notable surge. Sales of EVs in key European nations have shown a consistent upward trajectory. Data from the International Energy Agency highlights that in 2023, Germany led with 0.7 million EV sales, trailed by France at 0.47 million and the UK at 0.45 million. With government policies actively promoting EV adoption, sales are poised for further growth.

- The European Union's commitment to emission reductions and sustainable transportation bolsters the entire EV market, including segments dependent on VRLA and AGM battery technologies. These initiatives not only advocate for electric industrial vehicles but also champion smaller, cost-effective EVs, amplifying the demand for AGM solutions in the region.

- In a notable move, the UK government, in November 2023, pledged an investment of 50 million GBP (USD 63 million) to fortify its battery supply chain, aligning with its ambitious EV production goals. The Battery Strategy, spanning until 2030, promises focused support for zero-emission vehicles, encompassing fresh capital and R&D funding. Such endeavors are set to bolster the adoption of AGM batteries as a clean energy alternative, subsequently driving up the demand for VRLA batteries in EVs.

- AGM batteries are increasingly being integrated into hybrid electric vehicles (HEVs), especially for auxiliary functions. These batteries play a pivotal role as secondary power sources, aiding start-stop features, vehicle electronics, and energy recovery systems, thereby complementing the main lithium-ion battery packs.

- In a strategic move, Stellantis, in July 2024, announced its ambition to expand its lineup of budget-friendly hybrid vehicles to 36 models across Europe by 2026. The company is set to roll out 30 hybrid models this year, representing nine of its 14 brands, including notable names like Fiat, Peugeot, Jeep, and Alfa Romeo. Additionally, Stellantis plans to introduce six more models in the next two years. Such initiatives are poised to boost hybrid EV production and, in turn, elevate the demand for AGM batteries during the forecast period.

- Consequently, these developments are anticipated to not only amplify EV production in the region but also heighten the demand for VRLA batteries in the coming years.

Germany to Witness Significant Growth

- Germany's VRLA (Valve-Regulated Lead-Acid) battery market, while smaller, plays a pivotal role in the nation's expansive electric vehicle (EV) ecosystem. Predominantly, Absorbed Glass Mat (AGM) batteries, a type of VRLA battery, are integral to various EV applications, including industrial electric vehicles, electric scooters, utility vehicles, and as backup power systems.

- Driven by consumer demand, heightened environmental consciousness, and government incentives like tax credits and rebates, Germany has seen a notable uptick in EV sales over recent years. This surge in EV adoption has, in turn, spurred a heightened demand for EV batteries, including VRLA variants.

- According to the International Energy Agency (IEA), Germany recorded sales of 0.7 million electric vehicles, mirroring 2022's figures but showcasing a 5.5-fold leap since 2019. With the government rolling out several pro-EV policies, sales are poised to climb in the coming years.

- In electric vehicles, VRLA batteries serve as secondary power sources, energizing non-propulsion features like lighting and infotainment. In hybrid electric vehicles (HEVs), AGM batteries bolster auxiliary systems, complementing the main lithium-ion battery.

- For instance, XPENG Motors, a Chinese smart electric vehicle (EV) firm, declared its foray into the German market in March 2024. Set to launch its flagship G9 SUV and P7 sports sedan in May, with more models to follow, XPENG's entry is anticipated to boost the demand for VRLA batteries in Germany.

- Moreover, with Germany's emphasis on curbing urban congestion and pollution, there's been a surge in demand for compact electric mobility solutions like e-scooters and e-bikes. Given their cost-effectiveness, VRLA batteries are a preferred choice for these short-range, low-speed vehicles.

- In July 2024, Acer unveiled its ebii Elite and Fat Tire Acer and Predator e-bikes, featuring cutting-edge tracking technology, in Frankfurt, Germany. Highlighting Acer's dedication to diverse e-mobility solutions, the eNomad series, with its aluminum alloy frames and 20x4" fat tires, promises versatility across various terrains. Such innovations in e-bikes are set to bolster demand in Germany, subsequently driving up the need for VRLA batteries.

- Thus, with these developments, the production of EVs in Germany is set to rise, further amplifying the demand for VRLA batteries in the coming years.

Europe Electric Vehicle VRLA Batteries Industry Overview

The Europe Electric Vehicle VRLA Batteries market is moderate. Some of the key players (not in particular order) are FIAMM Energy Technology S.p.A., EnerSys, Exide Technologies, Saft Groupe S.A., HOPPECKE Batterien GmbH & Co. KG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003791

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Cost-Effectiveness of VRLA batteries

- 4.5.1.2 Growth in Electric Scooters and Bikes

- 4.5.2 Restraints

- 4.5.2.1 Availability of Alternate Battery Technology

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Absorbed Glass Mat Battery

- 5.1.2 Gel Battery

- 5.2 By Vehicle Type

- 5.2.1 Two-Wheelers

- 5.2.2 Low-Speed EVs

- 5.2.3 Industrial Evs

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 France

- 5.3.3 United Kingdom

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 NORDIC

- 5.3.7 Russia

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 FIAMM Energy Technology S.p.A.

- 6.3.2 EnerSys

- 6.3.3 Exide Technologies

- 6.3.4 Saft Groupe S.A.

- 6.3.5 HOPPECKE Batterien GmbH & Co. KG

- 6.3.6 Banner Batteries

- 6.3.7 MIDAC SpA

- 6.3.8 TAB Batteries

- 6.3.9 NorthStar Battery

- 6.3.10 YUASA Battery Europe Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Backup and Auxiliary Applications

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.