Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636530

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636530

ASEAN Countries Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

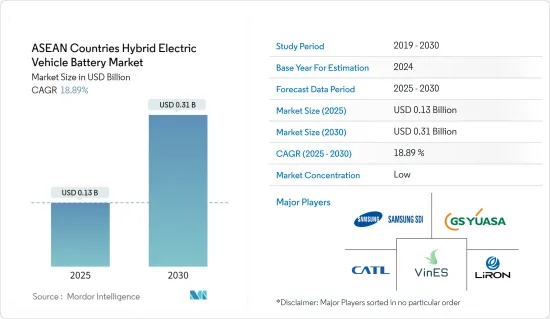

The ASEAN Countries Hybrid Electric Vehicle Battery Market size is estimated at USD 0.13 billion in 2025, and is expected to reach USD 0.31 billion by 2030, at a CAGR of 18.89% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, declining lithium-ion battery prices, and growing adoption of electric vehicles are expected to drive the demand for the ASEAN countries hybrid electric vehicle battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the technological advancements in battery technologies and the automaker-battery manufacturer collaborations are expected to create vast opportunities for ASEAN countries hybrid electric vehicle battery market in the future.

- Particularly, Thailand stands out, anticipating notable growth, driven by its commitment to amplifying the electric vehicle's presence in its automotive sector.

ASEAN Countries Hybrid Electric Vehicle Battery Market Trends

Passenger Vehicle Segment to Witness Significant Growth

- The ASEAN (Association of Southeast Asian Nations) countries are poised for significant growth in the market for hybrid electric vehicle (HEV) batteries, especially for passenger vehicles. This surge is driven by the increasing adoption of electric vehicles (EVs), government initiatives championing clean energy, and heightened consumer awareness of environmental concerns. In recent years, nations like Indonesia, Malaysia, Thailand, Vietnam, and the Philippines have emerged as pivotal players in the EV landscape.

- Data from the ASEAN Automotive Federation (AAF) reveals that the ASEAN region produced 2.748 million passenger vehicles in 2023, marking a 3.11% rise from 2.665 million in 2022. In 2022, production was approximately 2.212 million units, and the 2023 figure of 2.283 million units represents a 3.21% uptick. Notably, Indonesia, Malaysia, and Thailand collectively accounted for over 83% of the region's passenger vehicle output.

- Looking ahead, the region's growth in passenger vehicles is anticipated to be bolstered by government initiatives promoting electric vehicle adoption, subsequently driving demand for HEV batteries. Countries like Thailand, Indonesia, Singapore, Malaysia, and the Philippines are set to experience swift EV adoption, thanks to supportive government measures. For instance, the Philippines aims for EVs to constitute 21% of its total vehicles by 2030 and 50% by 2040. Additionally, the Electric Vehicle Association of the Philippines (EVAP) has upped its e-vehicle adoption target from 300,000 units in 2030 to a bold 1.0 million, banking on sector incentives, clearer regulations, and rising EV benefits awareness.

- Indonesia's ambitions are equally pronounced, targeting 20% EV representation in car sales by 2025 and a goal of 600,000 domestically produced EVs by 2030. These targets encompass various milestones in the EV supply chain, including sales, production, and charging infrastructure, all of which are set to spur HEV battery growth.

- In early 2024, Thailand's EV Board greenlit the EV 3.5 package, a four-year initiative (2024-2027) aimed at propelling the EV industry's momentum and attracting investments in local manufacturing. This comprehensive package not only seeks to invigorate the entire EV ecosystem but also includes government subsidies for EV purchases, tailored to vehicle types and battery capacities, fostering a conducive environment for the HEV battery market.

- In 2023, the Philippines' Department of Energy (DOE) unveiled plans to have 6.3 million electric vehicles (EVs) by 2040, targeting 50% of the road traffic. This ambitious goal is complemented by the installation of approximately 147,000 EV charging stations. The DOE's immediate objective includes deploying 2.45 million electric cars, motorcycles, and buses by 2028. Such expansive plans underscore the burgeoning battery market within the passenger vehicle segment, further propelling the HEV battery market's growth.

- Given these dynamics, the passenger vehicle segment is set for substantial growth in the coming years.

Thailand to Witness a Significant Growth

- Thailand stands out as a prime destination for investments in the automobile sector. Over the past five decades, Thailand has evolved from merely assembling auto components to becoming Southeast Asia's foremost automotive production and export hub. With rising investments from automakers, Thailand's battery industry is poised for steady growth, especially with the surge in electric vehicle (EV) production, including hybrids.

- As reported by the Electric Vehicle Association of Thailand (EVAT), Thailand registered approximately 85,069 new hybrid electric vehicles (HEVs) in 2023, marking a significant 32% increase from the previous year. Furthermore, by the end of February 2024, new HEV registrations reached around 26,134 units, underscoring the rapid growth and heightened demand for batteries in the nation.

- The surge in EV adoption, particularly HEVs, can be attributed to government incentives for buyers and supportive measures for manufacturers. For instance, Thailand's introduction of a purchase subsidy scheme for domestically produced EVs underscores its ambition to be Southeast Asia's EV production hub. The EV3.5 scheme, active from 2024 to 2027, offers subsidies between THB 50,000 (USD 1,397.02) and THB 100,000 (USD 2,794.04) per vehicle, highlighting the government's dedication to nurturing the EV sector and drawing in foreign investments.

- Thailand aims to have EVs make up 30% of all vehicle sales by 2030. This ambition, coupled with current initiatives, positions Thailand as a future hub for HEV batteries, especially lithium-ion types, presenting vast opportunities for battery manufacturers.

- In line with this vision, numerous battery manufacturers are ramping up their production capabilities in Thailand. For instance, in March 2024, BMW Group broke ground on its 'Gen-5' high-voltage battery manufacturing facility in Thailand. Situated in Rayong, on the eastern coast, the 4,000 square meter battery assembly is integrated into BMW's existing car plant. As BMW gears up to launch EVs from this Rayong facility in the latter half of 2025, the new battery assembly line will play a pivotal role, converting imported battery cells into modules for high-voltage batteries. BMW has reportedly invested over USD 45 million in this venture.

- Given these developments, Thailand is poised to lead the HEV battery market in the ASEAN region during the forecast period.

ASEAN Countries Hybrid Electric Vehicle Battery Industry Overview

The ASEAN Countries Hybrid Electric Vehicle Battery is semi-fragmented. Some of the key players in the market (not in any particular order) include Samsung SDI Co. Ltd., VinES Energy Solutions Joint Stock Company, Contemporary Amperex Technology Co. Ltd (CATL), LiRON LIB Power Pte Ltd and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003899

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Lithium-Ion Battery Prices

- 4.5.1.2 Increasing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Thailand

- 5.3.2 Indonesia

- 5.3.3 Philippines

- 5.3.4 Malaysia

- 5.3.5 Vietnam

- 5.3.6 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Samsung SDI Co., Ltd.

- 6.3.3 Contemporary Amperex Technology Co. Ltd (CATL)

- 6.3.4 LG Energy Solution Ltd.

- 6.3.5 LiRON LIB Power Pte Ltd

- 6.3.6 GS Yuasa Corporation

- 6.3.7 VinES Energy Solutions Joint Stock Company

- 6.3.8 SVOLT Energy Technology Co., Ltd.

- 6.3.9 Energy Absolute Public Company Limited.

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Technologies

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.