Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636528

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636528

Italy Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

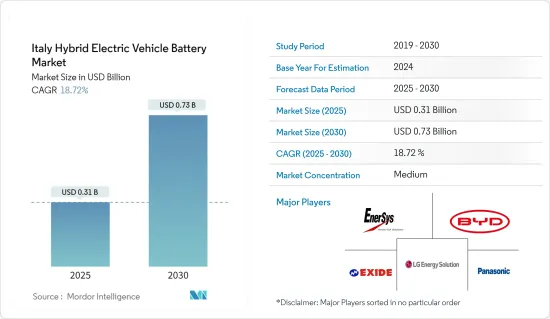

The Italy Hybrid Electric Vehicle Battery Market size is estimated at USD 0.31 billion in 2025, and is expected to reach USD 0.73 billion by 2030, at a CAGR of 18.72% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for hybrid electric vehicle batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the hybrid electric vehicle battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for hybrid electric vehicle battery market players in the near future.

Italy Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion hybrid electric vehicle battery market in Italy is dynamic, teeming with opportunities and challenges. Lithium-ion hybrid EV batteries are outpacing other battery technologies in popularity, primarily due to their advantageous capacity-to-weight ratio. Their adoption is further fueled by superior performance attributes, such as longevity, low maintenance, an extended shelf life, and a notable decrease in price.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been channeling investments into achieving economies of scale and enhancing R&D. These efforts have intensified competition, subsequently driving down lithium-ion battery prices.

- In 2023, battery prices dipped to USD 139/kWh, marking a 13% drop from the prior year. With ongoing technological innovations and manufacturing refinements, projections suggest a further decline, targeting USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- Italy is swiftly carving out a prominent position in the lithium-ion battery production arena, especially for hybrid and electric vehicles (EVs). This ascent is largely attributed to strategic investments and robust government backing, aimed at fortifying the nation's critical minerals supply chain and battery manufacturing capabilities.

- Global industry leaders are significantly backing local entities to amplify lithium-ion battery production for hybrid electric vehicles (HEVs) and electric vehicles in the region. A case in point: In February 2024, Automotive Cells Company secured a whopping USD 4.7 billion for establishing three lithium-ion battery gigafactories in France, Germany, and Italy. This ambitious venture, supported by stalwarts like Stellantis, Mercedes-Benz, and Saft (a TotalEnergies subsidiary), underscores the commitment to ramping up lithium production and meeting the surging demand for HEVs.

- Moreover, the Italian government is proactively enhancing lithium-ion battery production, especially for HEVs, as part of its broader commitment to sustainable energy and carbon emission reduction.

- Highlighting this momentum, Italvolt, in 2023, unveiled plans for one of Europe's largest gigafactories in Scarmagno, Piedmont. Set to churn out an impressive 45 GWh of battery cells annually, this facility is poised to be a cornerstone in Europe's battery production landscape. Such strides are set to bolster lithium-ion battery production and, by extension, the demand for hybrid EVs in the foreseeable future.

- Given these developments, it's evident that Italy is on the brink of a lithium-ion battery production surge, with hybrid EVs set to ride the wave of this growing demand.

Passengers Cars Segment to Witness Significant Growth

- Italy's automotive industry is undergoing a transformation, with a pronounced emphasis on electric and hybrid vehicles (EVs and HEVs). The nation is advancing in the development and production of batteries for these vehicles, spurred by a commitment to sustainable transportation and a governmental push toward electric mobility.

- In recent years, sales of passenger cars, hybrids included, have surged across the region. Data from the European Automobile Manufacturers' Association highlights this trend: June 2024 saw new car registrations hit 159,982 units, marking a 14.67% uptick from May and a 34.27% jump from July 2023. With this momentum, new car sales and registrations are poised to rise, especially with the growing demand for hybrids.

- To further bolster this trend, the Italian government has rolled out subsidy initiatives aimed at increasing the appeal of hybrid and electric vehicles, including passenger cars. These measures align with a larger goal: curbing air pollution and reducing reliance on fossil fuels.

- As a testament to this commitment, Italy has earmarked EUR 650 million (USD 709 million) annually for 2023 and 2024. This funding is directed at incentivizing the purchase of electrified and low-emission vehicles, encompassing subsidies for plug-in hybrids. Under certain conditions, these subsidies can reach up to EUR 4,000 (USD 4,368). Such financial backing is set to bolster the demand for hybrid passenger cars and, consequently, HEV batteries.

- On a global scale, companies are heavily investing in R&D for battery technology, electric drivetrains, and other pivotal components for hybrid and electric vehicles, unveiling multiple car projects slated for future launches.

- Highlighting this trend, Stellantis, in May 2024, revealed plans to introduce a hybrid variant of its 500e small electric car, set to be manufactured at its Mirafiori plant in Italy. The 500e assembly takes place in Turin. These moves not only underscore the growing prominence of hybrid passenger cars but also signal an uptick in demand for hybrid batteries.

- Such developments underscore the significance of HEV battery solutions for passenger vehicles, suggesting a robust demand for HEV batteries in the near future.

Italy Hybrid Electric Vehicle Battery Industry Overview

Italy's hybrid electric vehicle battery market is moderate. Some key players (not in particular order) are BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003897

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 LG Energy Solution

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Exide Industries Ltd

- 6.3.6 Fiamm Energy Technology

- 6.3.7 Flash Battery S.r.l.

- 6.3.8 AMTE Power

- 6.3.9 Italvolt

- 6.3.10 FIB S.p.A.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.