Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636522

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636522

India Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

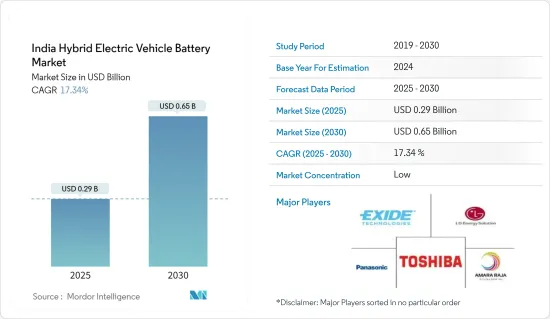

The India Hybrid Electric Vehicle Battery Market size is estimated at USD 0.29 billion in 2025, and is expected to reach USD 0.65 billion by 2030, at a CAGR of 17.34% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for hybrid electric vehicle batteries during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the hybrid electric vehicle battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for hybrid electric vehicle battery market players in the near future.

India Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion electric vehicle battery market across India presents a fascinating landscape of opportunities and challenges. Due to their favorable capacity-to-weight ratio, lithium-ion rechargeable batteries are gaining more popularity than other battery technologies. Other factors boosting their adoption include better performance (long life and low maintenance), better shelf life, and decreasing price.

- The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and R&D activities to enhance their performance, increasing the competition and, in turn, resulting in declining prices of lithium-ion batteries.

- In 2023, battery prices saw a notable dip, settling at USD 139/kWh-a reduction exceeding 13%. With ongoing technological innovations and manufacturing refinements, projections suggest a continued decline, eyeing USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- In response to escalating environmental concerns, the Indian government is fervently championing electric vehicles. With a keen eye on achieving net-zero carbon emissions, the government recognizes lithium's pivotal role in bolstering EV storage capacities. Recent discoveries of lithium-ion fields across the nation further bolster the optimism, hinting at potential price reductions in the region.

- Highlighting these discoveries, February 2023 saw the Geological Survey of India (GSI) unveil lithium reserves, estimated at 5.9 million tonnes, in the Salal-Haimana region of Jammu and Kashmir. Given lithium's non-ferrous nature and its criticality in battery energy storage and EV applications, this find is poised to amplify lithium-ion battery production, catering to the surging demand for hybrid vehicle batteries in the foreseeable future.

- Moreover, Indian government policies are pivotal in shaping the trajectory of lithium-ion and hybrid electric vehicle (HEV) battery adoption. Through a slew of initiatives, the government has not only bolstered the demand for lithium-ion batteries but has also fervently promoted EVs nationwide.

- As a testament to these efforts, the Indian government, in 2023, set ambitious targets: aiming for EVs to constitute 30% of private car sales, 70% of commercial vehicles, and a staggering 80% of two and three-wheelers by 2030. To further incentivize this shift, subsidies ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180) have been introduced. Such proactive measures are poised to not only accelerate EV production but also amplify the demand for lithium-ion batteries in the coming years.

- Given these concerted efforts and investments, a surge in EV production and a corresponding rise in lithium-ion battery demand seem inevitable in the forecast period.

Passengers Cars Segment to Witness Significant Growth

- India's automotive industry is undergoing a transformation, with a pronounced emphasis on electric and hybrid vehicles (EVs and HEVs). The nation is advancing in the development and production of batteries for these vehicles, spurred by the quest for sustainable transportation and the government's endorsement of electric mobility.

- Sales of passenger cars, hybrids included, have surged in the region over recent years. For instance, data from the Society of Indian Automobile Manufacturers (SIAM) reveals that in 2023, India sold 42.18 million passenger vehicles, marking a 10.7% uptick from 2022. This figure prominently features hybrid passenger cars, whose sales have seen a notable rise and are poised to continue this trajectory, given the escalating demand in the region.

- Moreover, a heightened consumer appetite for sustainable and advanced mobility is prompting automakers to channel investments into Battery Electric Vehicle (BEV) production. This demand is further bolstered by a burgeoning market for shared and autonomous electric mobility solutions.

- For instance, in July 2024, Ola Electric unveiled a USD 100 million investment as the first phase in establishing its gigafactory in Tamil Nadu, India. This facility is set to manufacture indigenous lithium-ion batteries. Ola Electric plans to utilize these in-house battery cells for its vehicles by early next year, moving away from its current suppliers in Korea and China. Such a move is poised to expedite lithium-ion battery production for EVs and hybrid passenger vehicles, amplifying the demand for hybrid batteries in the region.

- Furthermore, the Indian government is actively championing electric and hybrid vehicles through various initiatives, targeting pollution reduction and diminished fossil fuel reliance. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, for instance, offers subsidies and incentives to both manufacturers and consumers, cultivating a conducive atmosphere for EV uptake.

- In a related move, the Uttar Pradesh government in July 2024, waived road tax on hybrid cars. This initiative is designed to spur clean vehicle adoption and mitigate the environmental repercussions of conventional gasoline and diesel cars. Such measures are anticipated to bolster the popularity of hybrid passenger cars and subsequently, the demand for hybrid batteries.

- These developments underscore the viability and significance of HEV battery solutions for passenger vehicles, suggesting a robust demand for HEV batteries in the nation in the near future.

India Hybrid Electric Vehicle Battery Industry Overview

The Indian Hybrid Electric Vehicle battery market is semi-fragmented. Some of the key players (not in particular order) are LG Energy Solution Ltd, Toshiba Corporation, Panasonic Holdings Corporation, Exide Industries Ltd, Amara Raja Batteries Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003891

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution Ltd

- 6.3.2 Amara Raja Batteries Ltd

- 6.3.3 Toshiba Corporation

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Exide Industries Ltd

- 6.3.6 Bharat Electronics Limited (BEL)

- 6.3.7 Exicom Tele-Systems Limited

- 6.3.8 iPower Batteries Pvt. Ltd

- 6.3.9 Okaya Power Group

- 6.3.10 Contemporary Amperex Technology Co. Limited

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.