Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636521

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636521

Middle East And Africa Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

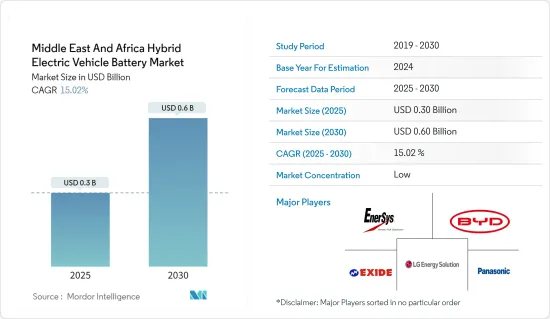

The Middle East And Africa Hybrid Electric Vehicle Battery Market size is estimated at USD 0.30 billion in 2025, and is expected to reach USD 0.60 billion by 2030, at a CAGR of 15.02% during the forecast period (2025-2030).

Key Highlights

- In the coming years, as electric vehicle (EV) adoption surges and fuel prices climb, the demand for hybrid vehicles is set to rise, subsequently boosting the need for hybrid electric vehicle batteries. Further, declining lithium-ion battery price is likely to support the market growth.

- Conversely, a shortage of raw material reserves poses a significant challenge to the growth of the hybrid electric vehicle battery market.

- However, advancements in battery technology-such as enhanced energy density, quicker charging times, heightened safety, and extended lifespan-present lucrative opportunities for players in the hybrid electric vehicle battery market.

- Driven by increasing electric vehicle adoption, South Africa is emerging as the fastest-growing region in the global hybrid electric vehicle battery market.

Middle East And Africa Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The lithium-ion electric vehicle battery market in the Middle East and Africa is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other battery technologies in popularity, thanks to their favorable capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, low maintenance, superior shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been ramping up investments. By achieving economies of scale and intensifying R&D efforts, they've not only enhanced battery performance but also intensified competition, driving prices down.

- In 2023, lithium-ion battery prices dipped to USD 139/kWh, marking a decline of over 13%. With ongoing technological innovations and manufacturing refinements, projections suggest prices will further drop to USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- Governments in the Middle East and Africa are championing electric vehicles, driven by mounting environmental concerns and a commitment to net-zero carbon emission targets. Lithium, a cornerstone element in these batteries, is pivotal for EV storage capacity.

- As a case in point, the UAE government unveiled plans in 2023 to invest a staggering USD 164 billion by 2050, aiming to meet surging energy demands and foster sustainable growth. Dubai's Energy Strategy 2050, having already achieved its 2020 milestone of 7% energy production from renewables, is ambitiously targeting 25% by 2030 and a bold 75% by 2050. Such ambitious targets bolster the outlook for lithium-ion batteries as a clean energy solution, signaling a surge in demand for these batteries in hybrids and EVs.

- Leading companies in the region are ramping up battery production to meet the burgeoning demand for lithium-ion batteries in hybrids and EVs. Over the past few years, battery production initiatives have seen a consistent upward trajectory.

- Highlighting this trend, in December 2023, an agreement was inked between the Federal Ministry of Power, the China Ministry of Ecology and Environment, and Nigeria's Federal Ministry of Power. This pact, valued at USD 150 million, paves the way for a lithium-ion battery manufacturing plant in Nigeria, spearheaded by a Chinese firm. Such endeavors are set to bolster battery production in the region.

- Given these initiatives, a surge in lithium-ion battery production is on the horizon, coinciding with an anticipated uptick in hybrid vehicle demand during the forecast period.

South Africa to Witness Significant Growth

- Government policies, industry trends, and market forces shape the landscape of hybrid electric vehicle (HEV) batteries in South Africa. Regulations at both federal and state levels, targeting a reduction in greenhouse gas emissions, are promoting HEVs as a solution to lower emissions from the transportation sector.

- Demand for HEVs is surging in South Africa, a prominent producer of these vehicles in the Middle East and Africa. Data from Naamsa (the Automotive Business Council) reveals that in 2023, sales of HEVs reached 6,484 units, marking a 60.09% increase from 2022. While sales have shown a consistent upward trend in previous years, the establishment of multiple EV production plants in the region signals a continued rise in demand for HEV batteries.

- Changing consumer preferences are fueling the growing demand for hybrid cars in South Africa. Factors like high inflation and limited EV charging infrastructure are nudging buyers towards hybrids. This shift occurs amidst significant discounts on EVs from manufacturers and the introduction of advanced hybrid models in recent years.

- In March 2024, Toyota introduced a new mild-hybrid variant of its renowned SUV, the Fortuner, to the South African market. The revamped Fortuner boasts an advanced powertrain, enhancing both performance and fuel efficiency, featuring a 2.8-litre diesel engine paired with 48V hybrid technology. Such innovations are poised to boost the demand for advanced hybrids in the nation.

- With technological strides, supportive government initiatives, and a growing consumer shift towards sustainable transport, the outlook for HEV batteries in South Africa is bright. The government is actively promoting hybrid vehicles, aiming to curb greenhouse emissions.

- In 2023, the nation unveiled the South African Automotive Masterplan (SAAM) 2021-2035. This ambitious plan targets producing 1% of the global vehicle output, equating to 1.4 million vehicles annually, by 2035. Such moves are set to bolster South Africa's global vehicle production standing and, in turn, amplify the demand for HEV batteries in the years ahead.

- These developments underscore the significance of HEV battery solutions in energy storage for EVs, suggesting a robust demand trajectory for HEV batteries in the near future.

Middle East And Africa Hybrid Electric Vehicle Battery Industry Overview

The Middle East and Africa hybrid electric vehicle battery market is semi-fragmented. Some key players (not in particular order) are BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003890

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Nigeria

- 5.3.4 Egypt

- 5.3.5 Qatar

- 5.3.6 South Africa

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 LG Energy Solution

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 Samsung SDI

- 6.3.9 SK Innovation

- 6.3.10 Contemporary Amperex Technology Co. Limited (CATL)

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.