Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636275

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636275

Asia Pacific Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

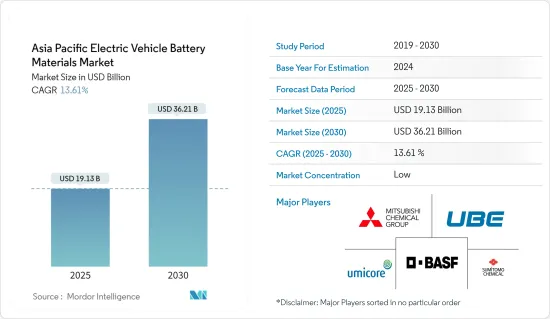

The Asia Pacific Electric Vehicle Battery Materials Market size is estimated at USD 19.13 billion in 2025, and is expected to reach USD 36.21 billion by 2030, at a CAGR of 13.61% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- Conversely, the widespread preference for conventional vehicles, attributed to their reliability and cost-effectiveness, poses a challenge to the sales of electric vehicles and their batteries.

- However, breakthroughs in battery technology-boasting features like enhanced energy density, quicker charging, heightened safety, and extended lifespans-are set to unlock substantial opportunities for players in the electric vehicle battery materials market.

- Driven by surging electric vehicle adoption, India is poised to lead as the fastest-growing region in Asia Pacific's electric vehicle battery materials market during the forecast period.

Asia Pacific Electric Vehicle Battery Materials Market Trends

Lithium-Ion Battery Type Dominate the Market

- The growing production of lithium-ion batteries for electric vehicles (EVs) has notably influenced the battery materials market. This surge in battery production has driven a marked increase in lithium demand. Discoveries of lithium in the region have a pronounced effect on raw material costs.

- Key market players are channeling investments into lithium reserves and R&D, aiming to boost lithium-ion battery production and meet the escalating demand for battery raw materials. Ongoing discoveries of these reserves have been instrumental in driving down lithium-ion battery prices over time.

- For instance, battery prices saw a dip in 2023, settling at USD 139/kWh, marking a decline of over 13%. With the current trajectory of technological advancements and manufacturing improvements, projections suggest battery pack prices could further drop to USD 113/kWh by 2025 and USD 80/kWh by 2030.

- Moreover, in response to escalating environmental concerns, governments in the Asia Pacific are actively championing lithium-ion battery production for EVs. With a keen focus on achieving net-zero carbon emissions, these governments have launched multiple initiatives to boost lithium-ion battery production, catering to the surging EV demand.

- For instance, in December 2023, South Korea unveiled a USD 29 billion investment plan over the next five years to bolster its battery industry, with a spotlight on EV batteries. The strategy includes diversifying battery supply chains and providing tax incentives to major South Korean firms. These firms are being supported in their overseas ventures to secure mining rights for essential battery materials. Such initiatives are poised to not only amplify lithium-ion battery production as a clean energy alternative but also escalate the demand for battery materials in the foreseeable future.

- Additionally, the declining prices of lithium-ion batteries, coupled with a surging demand and the establishment of new production plants, are bolstering the demand for battery raw materials in the region. In recent years, top global firms have embarked on projects aimed at boosting lithium-ion battery production for EVs in the region.

- For instance, in February 2024, BMW unveiled plans for a new battery factory in Rayong, Thailand. This move is anticipated to bolster the nation's battery supply chains. BMW envisions Thailand as a pivotal export hub for its EV batteries, catering to the broader Asia Pacific market. Such undertakings are set to expedite battery production in Thailand and heighten the demand for lithium-ion battery materials in the years to come.

- Given these developments, it's clear that advancements in lithium-ion battery production and the surging demand for EV battery materials will continue to grow in the coming years.

India to Witness Significant Growth

- India is positioning itself as a key player in the electric vehicle (EV) battery materials arena. The nation is strategically bolstering its battery manufacturing capabilities while ensuring a steady supply of essential materials.

- In recent years, India has emerged as a dominant force in the regional EV production landscape. For instance, the International Energy Agency (IEA) reported that in 2023, India sold 82,000 electric vehicles, marking a 70.8% surge from 2022 and an astonishing 119-fold increase since 2019. With the government launching several initiatives and projects, the momentum in EV sales is set to continue its upward trajectory.

- India is placing a strong emphasis on ensuring a consistent and ethical supply of vital materials such as lithium, cobalt, and nickel. This endeavor, however, poses significant challenges. To tackle the raw material conundrum, India is delving into its domestic reserves and forging international partnerships. The nation's focus remains on harnessing its mineral wealth to cater to the surging demand for EV battery materials.

- In a notable development, the Geological Survey of India (GSI) unearthed lithium reserves estimated at 5.9 million tonnes in the Salal-Haimana region of Jammu and Kashmir in February 2023. Lithium, a non-ferrous metal, plays a pivotal role in battery energy storage systems and EV applications. This discovery is poised to satiate the burgeoning lithium demand for EVs and bolster EV battery material production in the foreseeable future.

- Leading Indian EV manufacturers are ramping up their battery production capabilities to align with the surging EV demand, necessitating substantial investments in both infrastructure and technology.

- In a significant move, Ola Electric, in July 2024, unveiled a USD 100 million investment for the initial phase of its gigafactory in Tamil Nadu. This facility is set to produce indigenous lithium-ion batteries. Ola Electric's strategic goal is to transition to its battery cells by early next year, moving away from its current suppliers in Korea and China. Such a bold investment is poised to not only expedite lithium-ion battery production for EVs but also amplify the demand for EV battery materials in the region.

- Given these developments, the trajectory of battery production for EVs is set for a significant boost, leading to a pronounced surge in demand for EV battery materials in the coming years.

Asia Pacific Electric Vehicle Battery Materials Industry Overview

Asia Pacific's electric vehicle battery materials market is fragmented. Some key players (not in particular order) are BASF SE, Mitsubishi Chemical Group Corporation, UBE Corporation, Umicore SA, Sumitomo Chemical Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003562

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Conventional Vehicle

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Japan

- 5.3.5 South Korea

- 5.3.6 Malaysia

- 5.3.7 Thailand

- 5.3.8 Indonesia

- 5.3.9 Vietnam

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 UBE Corporation

- 6.3.5 Umicore SA

- 6.3.6 Contemporary Amperex Technology Co. Limited

- 6.3.7 Nichia Corporation

- 6.3.8 ENTEK International LLC

- 6.3.9 LG Chem

- 6.3.10 Kureha Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.