Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636269

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636269

ASEAN Countries Plug-in Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

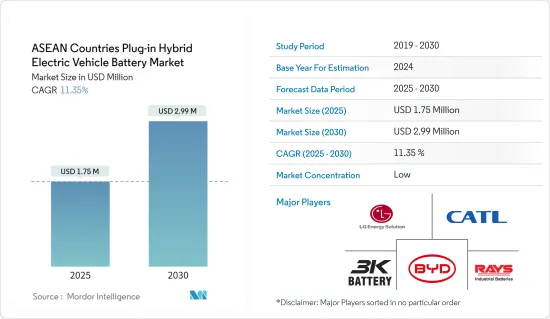

The ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market size is estimated at USD 1.75 million in 2025, and is expected to reach USD 2.99 million by 2030, at a CAGR of 11.35% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market is poised to be significantly influenced by surging electric vehicle sales and the plummeting costs of lithium-ion batteries.

- However, the market faces headwinds, notably from the steep replacement costs associated with plug-in hybrid electric vehicle batteries.

- Yet, ongoing advancements in battery chemistries, aimed at enhancing energy capacity and extending driving range, promise to unlock numerous opportunities for the market.

- Among all the countries, Indonesia is expected to dominate the market during the upcoming years.

ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Market Trends

Passenger Vehicles to Witness Growth

- Driven by a mix of government policies, environmental concerns, and technological advancements, the passenger vehicle segment of the plug-in hybrid electric vehicle (PHEV) battery market is experiencing notable growth in ASEAN (Association of Southeast Asian Nations) countries.

- With rapid urbanization and a burgeoning middle class, ASEAN nations are witnessing a surge in vehicle demand. As urban congestion and pollution escalate, governments are responding with stringent emission regulations and incentives to promote electric and hybrid vehicle adoption.

- Data from the ASEAN Automotive Federation highlights Indonesia's lead in 2023 with 779,326 units sold, trailed by Malaysia at 719,160 units. Thailand's market stands robust at 406,501 units, while Vietnam and the Philippines report 230,706 and 111,980 units, respectively. Singapore and Myanmar round out the figures with 32,511 and 2,832 units. Such sales figures underscore the growing appetite for passenger vehicles in the region.

- Government initiatives, including subsidies, tax rebates, and charging infrastructure development, are propelling the adoption of plug-in hybrid vehicles across ASEAN. Furthermore, regional collaborations and R&D investments are solidifying the plug-in hybrid vehicle battery market's significance in the ASEAN automotive arena.

- In a move to boost domestic PHEV battery production, the Thai government, in November 2023, introduced the "EV3.5" subsidy program. This initiative offers a subsidy of up to USD 2,760 per battery produced, valid from 2024 to 2027.

- The primary objective is two fold: to entice foreign investments and cement Thailand's stature as a pivotal player in the Southeast Asian plug-in hybrid vehicle battery manufacturing landscape. Given the current dominance of Chinese plug-in hybrid vehicle brands and the growing interest from European counterparts, this strategic move is poised to redefine Thailand's trajectory in the swiftly evolving plug-in hybrid vehicle battery sector.

- Battery technology advancements are crucially shaping the plug-in hybrid vehicle market in ASEAN. Innovations, especially in lithium-ion batteries, are boosting energy density, extending life cycles, and enabling faster charging, thereby enhancing the allure of plug-in hybrids.

- Given these dynamics, the passenger vehicle segment is poised for growth in the coming years.

Indonesia is Expected to Dominate the Market

- Driven by factors such as government policies, economic growth, consumer behavior, and technological advancements, the Indonesian segment of the ASEAN plug-in hybrid electric vehicle (PHEV) battery market is undergoing a notable transformation. As Southeast Asia's largest economy, Indonesia's burgeoning automotive market holds immense promise for the plug-in hybrid electric vehicle sector.

- Through policies and initiatives, the Indonesian government is actively working to reduce carbon emissions and champion sustainable transportation. These efforts, including tax incentives, subsidies, and crucially, the development of charging infrastructure, aim to alleviate the higher upfront costs typically associated with plug-in hybrid electric vehicles.

- The Indonesian Ministry of Industry has rolled out purchase subsidies for electric and hybrid vehicles, including electric motorbikes. Furthermore, there's a push to subsidize converting traditional combustion-engine motorbikes to electric. New battery-electric vehicle purchases can benefit from a generous subsidy of USD 5,130, while conventional hybrids enjoy a subsidy that's half that amount.

- Over the past decade, breakthroughs in battery technology and manufacturing have accelerated the adoption of lithium-ion batteries in Indonesia's hybrid electric vehicle landscape. These advancements have not only reduced costs but also enhanced performance and reliability, making lithium-ion batteries a favored choice for both manufacturers and consumers.

- Recently, lithium-ion battery and cell pack prices have been on a downward trajectory, appealing to end-user industries. After a minor uptick in 2022, prices resumed their decline in 2023, with lithium-ion battery packs hitting a historic low at USD 139/kWh, marking a 14% decrease.

- Moreover, the rise of local manufacturing facilities for plug-in hybrid electric vehicle batteries is poised to drive down production costs. This, in turn, is set to make plug-in hybrid electric vehicles more accessible to consumers. Coupled with government incentives and technological strides, this economic pivot towards affordable and sustainable transportation is primed to spur substantial growth in Indonesia's plug-in hybrid electric vehicle market.

- For example, in June 2023, Indonesia sealed a significant agreement with four prominent Chinese automakers - Hapco Neta, Wuling, Chery, and Xiaokang - positioning Indonesia as a potential electric vehicle export hub. In talks with Chery Automobile, there's a clear intent to explore research avenues for manufacturing plug-in hybrid electric vehicles (PHEVs) domestically. Given their enhanced fuel efficiency over traditional hybrids, plug-in hybrid electric vehicles are already popular in China. Chery has ambitious plans, targeting a rollout of 100,000 electric vehicles by 2030.

- Given these developments, Indonesia is poised to lead the market in the coming years.

ASEAN Countries Plug-in Hybrid Electric Vehicle Battery Industry Overview

The ASEAN Countries Plug-in Plug-in Hybrid Electric Vehicle Battery Market is semi-fragmented. Some of the key players in this market (in no particular order) are LG Energy Solution, Contemporary Amperex Technology Co Ltd., BYD Company, HDS Global Pte Ltd, and 3K Battery

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003556

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 High Battery Replacment Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Singapore

- 5.3.2 Philippines

- 5.3.3 Vietnam

- 5.3.4 Thailand

- 5.3.5 Malaysia

- 5.3.6 Indonesia

- 5.3.7 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Company

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Toshiba Corporation

- 6.3.6 Enersys Sarl

- 6.3.7 Exide Industries Ltd

- 6.3.8 HDS Global Pte Ltd

- 6.3.9 3K Battery

- 6.3.10 Clarios, LLC

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Continued Research and Development In New Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.