Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636280

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636280

United Kingdom Electric Vehicle Battery Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

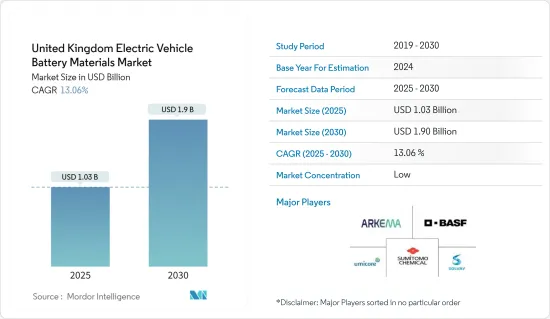

The United Kingdom Electric Vehicle Battery Materials Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.90 billion by 2030, at a CAGR of 13.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing electric vehicle (EV) sales and supportive government policies and regulations are expected to drive the demand for electric vehicle battery materials during the forecast period.

- On the other hand, the lack of raw material reserves can significantly restrain the growth of the electric vehicle battery materials market.

- Nevertheless, technological advancements in batteries like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for electric vehicle battery materials market players in the near future.

United Kingdom Electric Vehicle Battery Materials Market Trends

Growing Electric Vehicle (EVs) Sales Drives the Market

- In the United Kingdom (UK), rising electric vehicle (EV) sales are driving up the demand for EV battery materials. As the country embraces electric vehicles, the need for key battery components like lithium, cobalt, nickel, and graphite is surging. This heightened demand is not only stimulating local production but also attracting investments, thereby strengthening the UK's battery material supply chain.

- The UK is making a concerted shift towards clean energy, with electric vehicles taking center stage. Over recent years, EV sales in the region have seen exponential growth. For instance, the International Energy Agency (IEA) reported that in 2023, the UK sold 450,000 electric vehicles, marking a 21.62% increase from 2022. With the UK government launching several initiatives and projects, EV sales are projected to soar, consequently driving up the demand for battery materials.

- The UK government is actively nurturing the EV market through subsidies, tax incentives, and stringent emission regulations. These initiatives not only support the battery material sector but also elevate the nationwide demand for EVs. With ambitious targets set, the government envisions a fourfold surge in EV sales in the near future.

- As a testament to its commitment, the UK rolled out a Zero-Emission Vehicle (ZEV) mandate in 2023. This mandate stipulates that by 2030, 80% of new cars and 70% of new vans should be zero-emission, achieving a complete transition by 2035. Additionally, the sale of new petrol and diesel vehicles will halt by 2030, with all new vehicles required to be zero-emission by 2035. Such measures are set to accelerate both EV production and the demand for battery materials in the coming years.

- Furthermore, the UK's competitive EV landscape is driving innovations in battery technology. Local firms and research entities are investing in advanced materials, targeting improved energy density, longevity, and safety. Collaborations among major regional players aim to develop cutting-edge battery solutions, signaling a robust demand for EV batteries in the coming years.

- For instance, in January 2024, Microsoft, in partnership with the Pacific Northwest National Laboratory (PNNL) under the US Department of Energy, introduced a revolutionary material. This discovery, made using a combination of artificial intelligence (AI) and supercomputing, could reduce lithium consumption in batteries by an impressive 70%. Researchers also emphasize its potential to significantly enhance battery efficiency, particularly for electric vehicles (EVs) and related domains. Such advancements are poised to boost the demand for sophisticated EV batteries and, in turn, elevate the need for battery materials in the region.

- Given these developments, it's clear that the UK's initiatives and projects are set to not only bolster EV demand but also substantially increase the need for EV battery materials in the foreseeable future.

Lithium-Ion Battery Type Dominate the Market

- The growing production of lithium-ion batteries for electric vehicles (EVs) has significantly influenced the battery materials market. This surge in lithium-ion battery manufacturing has driven up the demand for lithium, with its discovery in various regions directly impacting raw material costs.

- Key market players, recognizing this trend, are ramping up investments in lithium reserves and R&D endeavors. Their goal is to bolster lithium-ion battery production and meet the escalating demand for battery raw materials. As new reserves are discovered, prices for lithium-ion batteries are notably declining.

- For instance, in 2023, battery prices dropped significantly to USD 139/kWh, marking a 13% decrease. With ongoing technological advancements and manufacturing efficiencies, experts predict prices could dip to USD 113/kWh by 2025 and plummet further to USD 80/kWh by 2030.

- Governments in the United Kingdom are actively promoting lithium-ion battery production for electric vehicles, driven by rising environmental concerns. With a strong focus on net-zero carbon emission targets, the government has launched numerous projects to boost lithium-ion battery production, aiming to meet the region's growing EV demand.

- In May 2023, Tata Motors, the owner of Jaguar Land Rover, announced plans for a state-of-the-art electric car battery plant in Somerset, southwest England, with investments reaching billions. Such strategic moves are set to accelerate the adoption of lithium-ion batteries as a pivotal clean energy source, amplifying the demand for battery materials in the foreseeable future.

- In recent years, the UK has been leading the charge in developing advanced battery recycling technologies for lithium-ion batteries. Companies and research institutions are innovating efficient methods to recover valuable materials like lithium, cobalt, and nickel from used batteries.

- In March 2024, Altilium, a UK company specializing in sustainable battery waste recycling, announced a collaboration with Nissan. This partnership aims to implement advanced recycling technologies, targeting a reduction in the carbon footprint of new UK-made batteries and a decrease in reliance on imported raw materials. This initiative, part of the Advanced Propulsion Centre's (APC) GBP 30 million (USD 38 million) project, saw Altilium securing a notable grant of GBP 15 million (USD 19 million). Such initiatives not only accelerate the production of lithium-ion raw materials but also bolster the future production of EV battery materials.

- Given these advancements and initiatives, a significant increase in the demand for EV battery materials is anticipated during the forecast period.

United Kingdom Electric Vehicle Battery Materials Industry Overview

United Kingdom's electric vehicle battery materials market is semi-fragmented. Some key players (not in particular order) are Sumitomo Chemical Co., Ltd., BASF SE, Arkema SA, Solvay SA, Umicore SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003567

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Dependence on Raw Material Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Others

- 5.2 Material

- 5.2.1 Cathode

- 5.2.2 Anode

- 5.2.3 Electrolyte

- 5.2.4 Separator

- 5.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 BASF SE

- 6.3.3 Arkema SA

- 6.3.4 Solvay SA

- 6.3.5 Umicore SA

- 6.3.6 Mitsubishi Chemical Group Corporation

- 6.3.7 Fiamm Energy Technology

- 6.3.8 ENTEK International LLC

- 6.3.9 Johnson Matthey

- 6.3.10 Epsilon Adavnced Material

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancements in Battery Technology

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.