Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692569

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692569

Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 437 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

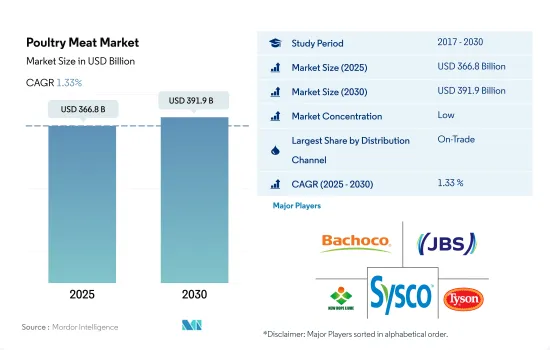

The Poultry Meat Market size is estimated at 366.8 billion USD in 2025, and is expected to reach 391.9 billion USD by 2030, growing at a CAGR of 1.33% during the forecast period (2025-2030).

Increasing demand for poultry meat at restaurants boosting sales through on-trade channels

- Poultry meat sales grew by 5% by value from 2020 to 2022 through various off-trade channels, including supermarkets and internet retailers. Frozen and processed poultry meat sales soared due to the shift in consumer eating trends due to environmental and health concerns. Furthermore, poultry purchases by the United Kingdom and the European Union are likely to reach the pre-Brexit trade level over the coming years, boosted by foodservice recovery and limited production growth due to HPAI outbreaks. Strong domestic demand is driving an increase in poultry meat purchases in the UAE, which is also absorbing around 10% of Brazil's total poultry meat exports.

- The on-trade channel is the major distribution channel in the poultry meat market, registering a growth of 11.85% by value from 2020 to 2022. Poultry meat sales are increasing due to growth in the number of foodservice outlets and consumers' demand for restaurant food. The sales are also in line with increased tourism spending, as in 2022, there were over 960 million tourists traveling internationally, meaning two-thirds (66%) of pre-pandemic numbers were recovered.

- The off-trade channel is projected to be the fastest-growing distribution channel, registering a growth of 1.72% by value during the forecast period. It is primarily attributed to the wide range of product availability of frozen and processed meat products, such as chicken bites, chicken chips, nuggets, tenderloins, and chicken wings. These poultry products are easily available in most supermarkets and online stores of various brands, such as Tyson Foods, Foster Farms, ITC Master Chef, and Suguna Chicken. These sales are growing due to urbanization trends worldwide and the increase in internet users, which reached around 5 billion as of 2022.

Affordability of poultry meat and growing investments in the market will propel the market's growth

- The overall growth of the global poultry meat market observed a CAGR of 4.50%, by value, from 2017 to 2022. The increase in other meat prices, like pork and mutton, has resulted in a rising shift in consumers toward poultry meat. The increasing urbanization and disposable incomes also propel the market growth. With the rise in the demand for protein, the population is seeking sustainable and cheaper protein sources like poultry meat.

- Asia-Pacific dominated the market with a CAGR of 4.95%, by value, from 2017 to 2022. The growing urban population in the region contributed to the high consumption in the region. An increase in availability helps lower prices in the region, which is anticipated to boost the consumption of poultry meat during the forecast period. Markets like China are trying to increase the use of breast meat in products, thus making more use of the entire bird and decreasing the price gap between dark meat and white meat. The region's per capita consumption is still low compared to other major consuming regions, thus leaving space to increase consumption.

- Africa is predicted to be the fastest-growing region that consumes poultry meat, with a projected CAGR of 3.17%, by value, during the forecast period. Chicken demand is income elastic in the region, and it remains a luxury good across dozens of markets on the continent, given low-income levels. The rise in the number of quick-service restaurants and the increase in the number of investments from government and private players is driving the demand for poultry meat. For instance, in 2023, the Government of Ghana committed to investing USD 541 million into the poultry industry to revitalize it and reduce the nation's reliance on poultry imports.

Global Poultry Meat Market Trends

Brazil is anticipated to experience a strong growth in production owing to domestic and international demand

- The global production of poultry saw variable growth during the study period, increasing at a rate of 1.83% in 2022 compared to the previous year. While elevated feed and energy costs have globally impacted profitability, the expansion is fueled by strong demand, as consumers seek affordable animal proteins amidst rising food costs. The largest poultry-producing region is Asia-Pacific, representing 40.75% of the total global production volume in 2022.

- All major producers except China are set to make profits, with Brazil witnessing the most growth. Production in China will stagnate as growth in white feather production offsets a decline in yellow feather production. The demand for affordable chicken products, particularly white-feathered chicken, is expected to increase in 2023 as Chinese consumers switch to a more diverse protein diet. Thai production is set to grow by 3% despite the expected slow recovery in domestic consumption and high production costs caused by supply disruptions for feed grains and day-old chicks. These factors will keep the growth rate below pre-COVID-19 pandemic averages.

- Brazil's production growth will be driven by domestic and global demand. In 2021, it produced 14.34 million tons of poultry meat. Russia and Mexico are also likely to grow due to strong domestic demand. EU production is expected to be only slightly higher due to rising energy costs resulting from outbreaks of highly pathogenic avian influenza (HPAI). The yield for poultry processors is expected to rise with the implementation of technology in production automation, genetical modification, biosecurity advancements, etc. It can improve poultry processing efficiency and optimize material yield through the integration of cyber-physical systems and wireless communication technologies.

Growing poultry demand as a cheaper protein is propelling the prices worldwide

- Prices for poultry significantly increased by 11.31% in 2022 compared to 2017. There was a supply shortage, which caused chicken prices to increase. Another factor driving the price of chicken is the cost of poultry feed. Compared to previous years, the cost of corn and soybeans has been quite high, thus boosting the price of chicken once it reaches a restaurant or grocery store. Poultry prices, particularly chicken breast prices, have skyrocketed due to increasing demand, tighter supply, and a changing supply chain. Wholesale chicken prices continue to rise as demand from restaurants puts pressure on the supply of certain cuts of poultry.

- In 2024, US broiler production is expected to increase again as feed prices are expected to decrease, but broiler prices may decrease only slightly. Projected turkey prices in 2023 remained unchanged for the first half of the year, but prices are expected to decrease in 2024 as production continues to recover from highly pathogenic avian influenza (HPAI). The national wholesale price for compound broilers averaged 140.15 cents/lb in April 2023, which was down by 27 cents/lb from April 2022 but up by 10 cents from March 2023. In April, the average wholesale price for frozen whole turkeys was 169.93 cents/lb. This continues the flattening trend seen in 2023, as opposed to the recent increase throughout the year.

- In Thailand, the fourth-biggest exporter after the United States, Brazil, and the European Union, the price of birds was USD 1.82 per kilogram during the first half of 2022, depicting a one-third increase in six months. Wholesale frozen chicken prices in Brazil were USD 2.12 per kilogram on May 2023, which was more than double their 10-year average.

Poultry Meat Industry Overview

The Poultry Meat Market is fragmented, with the top five companies occupying 15.31%. The major players in this market are Industrias Bachoco SA de CV, JBS SA, New Hope Liuhe Co. Ltd, Sysco Corporation and Tyson Foods Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92393

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Poultry

- 3.2 Production Trends

- 3.2.1 Poultry

- 3.3 Regulatory Framework

- 3.3.1 Australia

- 3.3.2 Bahrain

- 3.3.3 Canada

- 3.3.4 China

- 3.3.5 France

- 3.3.6 Germany

- 3.3.7 India

- 3.3.8 Italy

- 3.3.9 Japan

- 3.3.10 Kuwait

- 3.3.11 Mexico

- 3.3.12 Oman

- 3.3.13 Qatar

- 3.3.14 Saudi Arabia

- 3.3.15 United Arab Emirates

- 3.3.16 United Kingdom

- 3.3.17 United States

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Canned

- 4.1.2 Fresh / Chilled

- 4.1.3 Frozen

- 4.1.4 Processed

- 4.1.4.1 By Processed Types

- 4.1.4.1.1 Deli Meats

- 4.1.4.1.2 Marinated/ Tenders

- 4.1.4.1.3 Meatballs

- 4.1.4.1.4 Nuggets

- 4.1.4.1.5 Sausages

- 4.1.4.1.6 Other Processed Poultry

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

- 4.3 Region

- 4.3.1 Africa

- 4.3.1.1 By Form

- 4.3.1.2 By Distribution Channel

- 4.3.1.3 By Country

- 4.3.1.3.1 Egypt

- 4.3.1.3.2 Nigeria

- 4.3.1.3.3 South Africa

- 4.3.1.3.4 Rest of Africa

- 4.3.2 Asia-Pacific

- 4.3.2.1 By Form

- 4.3.2.2 By Distribution Channel

- 4.3.2.3 By Country

- 4.3.2.3.1 Australia

- 4.3.2.3.2 China

- 4.3.2.3.3 India

- 4.3.2.3.4 Indonesia

- 4.3.2.3.5 Japan

- 4.3.2.3.6 Malaysia

- 4.3.2.3.7 South Korea

- 4.3.2.3.8 Rest of Asia-Pacific

- 4.3.3 Europe

- 4.3.3.1 By Form

- 4.3.3.2 By Distribution Channel

- 4.3.3.3 By Country

- 4.3.3.3.1 France

- 4.3.3.3.2 Germany

- 4.3.3.3.3 Italy

- 4.3.3.3.4 Netherlands

- 4.3.3.3.5 Russia

- 4.3.3.3.6 Spain

- 4.3.3.3.7 United Kingdom

- 4.3.3.3.8 Rest of Europe

- 4.3.4 Middle East

- 4.3.4.1 By Form

- 4.3.4.2 By Distribution Channel

- 4.3.4.3 By Country

- 4.3.4.3.1 Bahrain

- 4.3.4.3.2 Kuwait

- 4.3.4.3.3 Oman

- 4.3.4.3.4 Qatar

- 4.3.4.3.5 Saudi Arabia

- 4.3.4.3.6 United Arab Emirates

- 4.3.4.3.7 Rest of Middle East

- 4.3.5 North America

- 4.3.5.1 By Form

- 4.3.5.2 By Distribution Channel

- 4.3.5.3 By Country

- 4.3.5.3.1 Canada

- 4.3.5.3.2 Mexico

- 4.3.5.3.3 United States

- 4.3.5.3.4 Rest of North America

- 4.3.6 South America

- 4.3.6.1 By Form

- 4.3.6.2 By Distribution Channel

- 4.3.6.3 By Country

- 4.3.6.3.1 Argentina

- 4.3.6.3.2 Brazil

- 4.3.6.3.3 Rest of South America

- 4.3.1 Africa

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 BRF S.A.

- 5.4.2 Cargill Inc.

- 5.4.3 Charoen Pokphand Foods Public Co. Ltd

- 5.4.4 Continental Grain Company

- 5.4.5 Fujian Sunner Development Co. Ltd

- 5.4.6 Hormel Foods Corporation

- 5.4.7 Industrias Bachoco SA de CV

- 5.4.8 JBS SA

- 5.4.9 Koch Foods Inc.

- 5.4.10 New Hope Liuhe Co. Ltd

- 5.4.11 Sysco Corporation

- 5.4.12 The Kraft Heinz Company

- 5.4.13 Tyson Foods Inc.

- 5.4.14 Wen's Food Group Co. Ltd

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.