PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911360

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911360

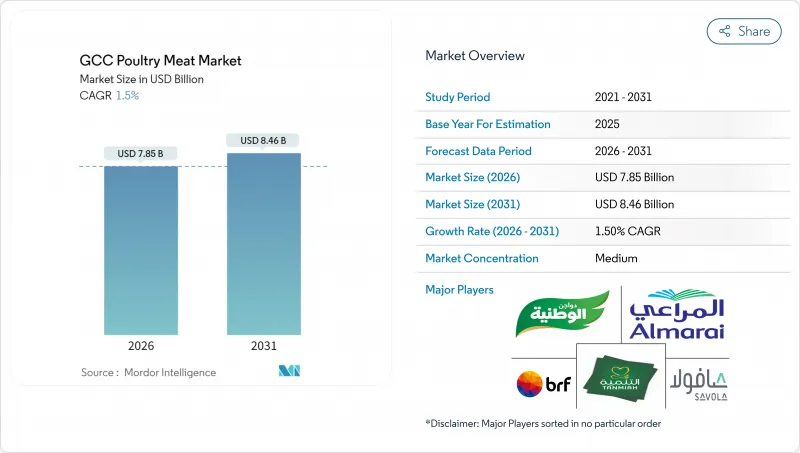

GCC Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC poultry meat market is expected to grow from USD 7.73 billion in 2025 to USD 7.85 billion in 2026 and is forecast to reach USD 8.46 billion by 2031 at 1.5% CAGR over 2026-2031.

This growth trajectory is bolstered by Saudi Arabia's ambition for 80% self-sufficiency, an uptick in per-capita protein consumption, and targeted investments in state-of-the-art production facilities. As health consciousness rises in the GCC, consumers are increasingly leaning towards protein-rich diets and healthier meat choices. This includes a preference for halal, organic, and lean poultry products. While frozen poultry dominates in volume, the swiftest growth is seen in processed formats, catering to time-sensitive consumers seeking convenience. Demand for standardized cuts is surging, fueled by quick-service restaurants (QSRs) and app-based delivery platforms. Enhanced biosecurity measures, coupled with advancements in automation, breeding technologies, and processing, are yielding benefits: reduced mortality rates, decreased production costs, and heightened output efficiency. In a bid to bolster food security, GCC governments, with Saudi Arabia at the forefront, are championing domestic poultry production. They're doing this through a mix of subsidies, land acquisition facilitation, equipment loans, and overhauling feed and livestock subsidy frameworks. While challenges like feed-grain price fluctuations and rising refrigeration energy costs pose profitability hurdles, the landscape is brightened by vertical integration and tech adoption, which are refining scale economics in the GCC poultry arena.

GCC Poultry Meat Market Trends and Insights

Rapid growth in per-capita poultry consumption

In the GCC, increasing disposable incomes and rapid urbanization are significantly boosting per capita poultry consumption, surpassing traditional levels. In 2023, Saudi Arabia recorded an annual poultry consumption of 43.40 kg per person, alongside achieving an impressive 71% self-sufficiency in poultry production. The demographic shift toward younger, urban populations, coupled with the growing adoption of Western dietary habits, is driving a notable rise in protein demand. This trend is particularly evident in major cities such as Dubai, Riyadh, and Doha, where expatriate communities play a pivotal role in shaping consumption patterns. The resulting supply-demand imbalances are creating opportunities for local producers to expand their production capacities and for international suppliers to capitalize on their established cold-chain logistics. Additionally, the UAE's heavy reliance on poultry imports opens the door for regional producers to strategically position themselves in the market. By adopting competitive pricing strategies and leveraging their proximity, these producers can effectively capture a larger share of the growing market.

Growing popularity of processed, value-added, and convenience products

In the GCC, consumers are increasingly opting for quick and easy meal solutions, influenced by busier lifestyles, a growing female workforce, and urban living. As of 2024, the World Bank reported that 54% of women aged 15 and older in the UAE participate in the labor force. To meet this demand, the poultry industry is offering processed and ready-to-cook/eat products that deliver convenience without compromising nutrition or taste. With the rise of dual-income households, consumer preferences are shifting from traditional whole-bird purchases to ready-to-cook and ready-to-eat poultry products. These value-added options, including marinated cuts, pre-seasoned items, breaded and frozen chicken parts, and ready meals, not only provide diverse culinary choices but also appeal to a broader consumer base. Innovations in flavors, packaging sizes (such as mini and family packs), and preparation methods further enhance their attractiveness and consumption frequency. Almunajem Foods has expanded its manufacturing facility by adding three production lines for 18 SKUs, increasing its capacity to 15,000 metric tons annually for processed poultry products. This structural shift is highlighted by the segment growth, with marinated tenders and ready-to-cook portions gaining popularity among time-conscious consumers. Modern retail formats are allocating more shelf space to these higher-margin products, fostering a cycle of increased availability and adoption.

Volatile global feed commodity prices compressing producer margins

Feed costs, which represent 60-70% of total poultry production expenses, make producers highly susceptible to fluctuations in commodity prices. This challenge is particularly pronounced in the GCC region, where a heavy reliance on imported feed ingredients exacerbates the issue. The added burden of transportation costs and currency fluctuations further amplifies the effects of base commodity price changes, creating additional financial strain. Smaller producers, in particular, face notable competitive disadvantages. They often lack the operational scale required to hedge against price volatility or to negotiate long-term supply contracts, leaving them more exposed to market risks. Furthermore, climate-related disruptions in key grain-producing regions are intensifying price volatility and increasing uncertainties within the supply chain. These disruptions compel producers to maintain higher working capital reserves to manage risks effectively. As a result, many producers may have no choice but to pass on these increased costs to consumers, further impacting the market dynamics.

Other drivers and restraints analyzed in the detailed report include:

- Rapid growth of QSR and food-delivery platforms driving value-added poultry demand

- Expansion of modern retail and e-commerce cold-chains

- High energy costs for refrigeration inflating frozen poultry landed prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Frozen products held the largest market share at 40.92% in 2025. Frozen poultry, known for its extended shelf life, enables consumers and businesses to store products longer without the risk of spoilage. This feature is especially critical in the GCC, where challenging climate conditions and logistical issues make frozen products a practical option for both retail and foodservice sectors. The processed poultry segment is on a growth path, recording a 1.79% CAGR through 2031. Reflecting the industry's focus on value-added processing, JBS launched a USD 50 million chicken nugget facility in Jeddah in November 2024.

Fresh and chilled segments appeal to consumers in premium retail channels and traditional wet markets due to their perceived quality and nutritional value. Canned poultry primarily serves institutional clients and emergency food supplies, remaining a niche category. Processed subcategories exhibit varied growth trends, with nuggets and tenders gaining popularity due to demand from quick-service restaurants (QSRs), while deli meats and sausages address evolving breakfast and snacking preferences. Halal certification under GSO 993:2015 standards supports the segment's growth by creating barriers for non-compliant processors and enabling premium pricing for certified products. Additionally, meatballs and marinated products are becoming popular among home cooks seeking convenience without compromising traditional flavors.

The GCC Poultry Market Report is Segmented by Form (Fresh/Chilled, Frozen, Canned, Processed), Distribution Channel (On-Trade, Off-Trade), and Geography (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Al-Watania Poultry

- Almarai Food Company

- BRF S.A.

- Emirates National Food LLC

- JBS S.A.

- Tanmiah Food Company

- The Savola Group

- Al Munajem Foods

- Fakieh Poultry Farms

- Sunbulah Group

- Radwa Food Production Co.

- Entaj Poultry

- Golden Chicken Farm Factory Co.

- Qatar Meat Production Co.

- A Saffa Foods

- Al Kabeer Group

- Widam Food Company

- Americana Group

- Osool Poultry Company

- Al Rawdah (Emirates Modern Poultry)

- Al Ain Farms

- Al-Ghurair Foods

- Addoha Poultry

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth in per-capita poultry consumption

- 4.2.2 Growing popularity of processed, value-added, and convenience products

- 4.2.3 Rapid growth of QSR and food-delivery platforms driving value-added poultry demand

- 4.2.4 Expansion of modern retail and e-commerce cold-chains

- 4.2.5 Introduction of controlled-environment vertical broiler farms

- 4.2.6 Mandatory halal traceability standards boosting premium brand penetration

- 4.3 Market Restraints

- 4.3.1 Volatile global feed commodity prices compressing producer margins

- 4.3.2 High energy costs for refrigeration inflating frozen poultry landed prices

- 4.3.3 Rising consumer experimentation with plant-based chicken analogues

- 4.3.4 Tightening ESG-linked lender covenants limiting leverage for smaller farms

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Form

- 5.1.1 Fresh / Chilled

- 5.1.2 Frozen

- 5.1.3 Canned

- 5.1.4 Processed

- 5.1.4.1 Nuggets

- 5.1.4.2 Deli Meats

- 5.1.4.3 Sausages

- 5.1.4.4 Tenders/marinated

- 5.1.4.5 Meatballs

- 5.1.4.6 Others

- 5.2 By Distribution Channel

- 5.2.1 On-Trade

- 5.2.2 Off-Trade

- 5.2.2.1 Supermarkets and Hypermarkets

- 5.2.2.2 Convenience Stores

- 5.2.2.3 Online Channel

- 5.2.2.4 Others

- 5.3 By Country

- 5.3.1 Bahrain

- 5.3.2 Kuwait

- 5.3.3 Oman

- 5.3.4 Qatar

- 5.3.5 Saudi Arabia

- 5.3.6 United Arab Emirates

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Al-Watania Poultry

- 6.4.2 Almarai Food Company

- 6.4.3 BRF S.A.

- 6.4.4 Emirates National Food LLC

- 6.4.5 JBS S.A.

- 6.4.6 Tanmiah Food Company

- 6.4.7 The Savola Group

- 6.4.8 Al Munajem Foods

- 6.4.9 Fakieh Poultry Farms

- 6.4.10 Sunbulah Group

- 6.4.11 Radwa Food Production Co.

- 6.4.12 Entaj Poultry

- 6.4.13 Golden Chicken Farm Factory Co.

- 6.4.14 Qatar Meat Production Co.

- 6.4.15 A Saffa Foods

- 6.4.16 Al Kabeer Group

- 6.4.17 Widam Food Company

- 6.4.18 Americana Group

- 6.4.19 Osool Poultry Company

- 6.4.20 Al Rawdah (Emirates Modern Poultry)

- 6.4.21 Al Ain Farms

- 6.4.22 Al-Ghurair Foods

- 6.4.23 Addoha Poultry

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK