Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683917

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683917

United Kingdom Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 208 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

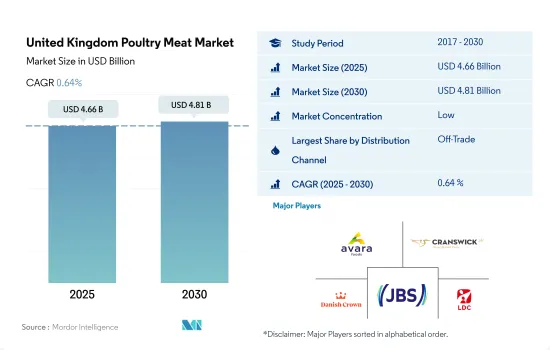

The United Kingdom Poultry Meat Market size is estimated at 4.66 billion USD in 2025, and is expected to reach 4.81 billion USD by 2030, growing at a CAGR of 0.64% during the forecast period (2025-2030).

Expansion of leading retail chains is driving the market

- In the United Kingdom, the off-trade distribution channel is the primary channel through which poultry meat products are consumed most in the country. Of all the sub-types of the off-trade channel, supermarkets and hypermarkets are the major channels. Supermarkets held the largest market share of 64.2% by value in 2022. The growth of these retail formats, along with factors like business expansion and the increase in supermarkets and hypermarkets, positively impacted the poultry products market in the United Kingdom. With the popularity of the discounters, the grocery retail market was dominated by Tesco, Sainsbury's, Asda, and Morrisons supermarkets. Tesco was the largest retailer in Great Britain, with a market share of 27.5%, and Sainsbury's with 15.2% in 2022.

- Poultry meat dishes in restaurants in the UK, including chicken wings, chicken nuggets, and chicken lollipops, are popular in the country. Poultry meat consumption registered a sales growth of 16.85% by value from 2018 to 2022 through the on-trade channel, owing to the high meat consumption in the country. The special recipes and tastes of popular fast-food chains like McDonald's, KFC, and Subway are preferred by consumers, affecting sales positively. As of 2022, the United Kingdom had the highest number of Subway restaurants in Europe, at 2,209 locations.

- In the off-trade channel, online channels comprise the fastest-growing segment in the market. It is projected to register a CAGR of 6.39% by value during the forecast period. Thus, there has been an increase in the number of online grocery shops in response to the rising number of internet users, which is anticipated to drive online sales of dairy products during the forecast period. As of 2022, only 13% of grocery shopping was conducted online in the UK.

United Kingdom Poultry Meat Market Trends

Labor shortage is highly affecting the industry

- The UK poultry production decreased by 1.88% in 2022 from 2021. The UK's domestic poultry population is made up of a variety of species, predominantly fowls and turkeys, but also ducks and geese. Guinea fowls and quail are used less often. However, in 2022, the poultry population in the United Kingdom declined by 1.0%, reaching 188 million birds; breeding and laying fowl declined by 0.5%, reaching 53 million birds compared to 2021. Similarly, broilers (table chickens) experienced a 0.5% decrease in 2022 compared to 2021, reaching 126 million birds, representing just over two-thirds of the total poultry population.

- Currently, there are 1,132 poultry breeds recognized around the world, 58% of which are in Europe. In Europe, 204 poultry breeds are already critical, and 34 are extinct. In the UK, there are over 280 poultry breeds (33 ducks, 23 geese, 124 fowls, 63 miniatures, 20 bantams, and 18 turkeys), all of which, apart from a few recent imported exotics, are officially recognized as a breed and standardized by the Poultry Club of Great Britain. The UK poultry meat industry is struggling with labor shortages across the farming and processing sectors.

- The producers are concerned about the impact of Brexit on staple products. As a result of labor shortages, UK producers are producing a limited range of products for UK customers. The average vacancy rate was over 16% of the total workforce in 2021, and the number of gaps is on the rise. Brexit has had a knock-on effect on the industry, with many producers having to reduce weekly chicken output by 5-10%; all-year-round turkey output dropped by 10% in 2021 compared to 2020. Christmas turkey production was estimated to have dropped by 20% in 2021.

Brexit and the Russia-Ukraine conflict inflated the prices in the United Kingdom

- The prices of poultry in the UK rose by 10.18% from 2017 to 2022. Chicken is the most widely consumed meat in the UK, with people eating it more than beef, lamb, or pork. Chicken's low cost has made it the meat of choice across the country. However, the average retail cost of chicken rose by 31 p/kg in May 2022, nearly 12% more expensive than it was a year ago, reaching USD 3.2/kg. War in Ukraine, increased energy prices, and Brexit are a few of the reasons why poultry prices increased in the UK.

- The farm gate prices increased by nearly 50% in 2022 compared to the previous year. The cost of production in the country has become increasingly expensive due to rising electricity, fuel, vaccines, packaging, and other costs. In 2022, for a small facility, the electricity bill increased from USD 200 per month to more than USD 600 per month, and the cardboard boxes used to store chickens increased from USD 800 per 1,000 to more than USD 1,000 per 1,000. The vaccines needed for the chickens also increased by 8% in the same year. Furthermore, the cost of feed increased in the previous year. This was due to a surge in the prices of wheat and soy, which are often used in the feed production process, due to the unsuccessful harvests and the Russia-Ukraine War; the countries together account for approximately 30% of the world's wheat supply.

- In recent months, fast food outlets such as Nando's and KFC have seen their prices rise. The average retail price of refrigerated oven-ready chicken increased from a low of USD 2.69/kg to USD 4.2/kg in the past two years. For example, in December 2021, a box of chicken wings was priced at USD 22, which increased to USD 27 to 28 per box in May 2022.

United Kingdom Poultry Meat Industry Overview

The United Kingdom Poultry Meat Market is fragmented, with the top five companies occupying 18.65%. The major players in this market are Avara Foods Ltd, Cranswick plc, Danish Crown AmbA, JBS SA and Lambert Dodard Chancereul (LDC) Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001607

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Poultry

- 3.2 Production Trends

- 3.2.1 Poultry

- 3.3 Regulatory Framework

- 3.3.1 United Kingdom

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Canned

- 4.1.2 Fresh / Chilled

- 4.1.3 Frozen

- 4.1.4 Processed

- 4.1.4.1 By Processed Types

- 4.1.4.1.1 Deli Meats

- 4.1.4.1.2 Marinated/ Tenders

- 4.1.4.1.3 Meatballs

- 4.1.4.1.4 Nuggets

- 4.1.4.1.5 Sausages

- 4.1.4.1.6 Other Processed Poultry

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 2 Sisters Food Group

- 5.4.2 Avara Foods Ltd

- 5.4.3 Blackwells Farm

- 5.4.4 Copas Traditional Turkeys

- 5.4.5 Cranswick plc

- 5.4.6 Danish Crown AmbA

- 5.4.7 Donald Russell Ltd

- 5.4.8 Gressingham Foods

- 5.4.9 JBS SA

- 5.4.10 Lambert Dodard Chancereul (LDC) Group

- 5.4.11 Salisbury Poultry (Midlands) Ltd.

- 5.4.12 Wild Meat Company

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.