Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692067

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692067

India Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 195 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

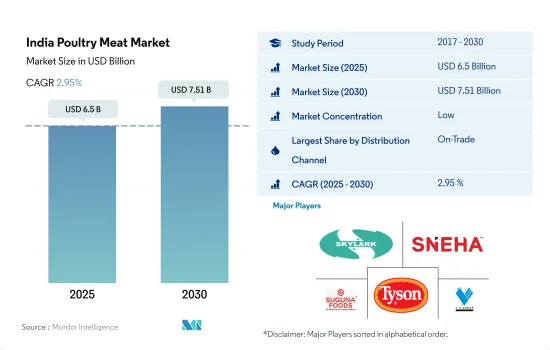

The India Poultry Meat Market size is estimated at 6.5 billion USD in 2025, and is expected to reach 7.51 billion USD by 2030, growing at a CAGR of 2.95% during the forecast period (2025-2030).

Expansion of poultry meat product portfolio by startups driving the market

- In India, poultry meat is registering a huge growth. Startups such as Licious, Meatigo, and TenderCuts are also offering poultry meat products online, which has attracted many consumers in the country. FreshToHome startup is currently present in 28 cities, including metros, and has expanded to 56 Indian cities with a total of 100 stores. The startup delivers nearly 2 million orders every month. FreshToHome currently sells close to 25,000 tonnes of produce a year. Similarly, Zappfresh is an online meat store based in Gurugram. The brand offers fresh chicken, as well as ready-to-cook and ready-to-eat variants, and delivers nearly 2,000-2,500 orders a day, with an average ticket size of INR 600.

- Off-trade is the fastest-growing distribution channel through which poultry meat is consumed in India, and it is projected to register a CAGR of 4.16% by value during the forecast period. As poultry meat is the most preferred and most-consumed meat in India, consumers prefer to eat it at home and purchase it mostly in fresh form. Consumers also get additional benefits, such as discounts, if they purchase in bulk quantity. These factors contributed to the growth of poultry meat through off-trade channels in the country.

- On-trade is the major distribution channel through which poultry meat is consumed in India. The overall sales through the on-trade channel increased by around 14% from 2018 to 2021. Foodservice channels, such as KFC and Domino's Pizza, also added new meat products to their menus, and they are expected to add more to cater to the demand over the coming years. The growing number of these foodservice outlets also aids the growth of the poultry meat market. Thus, the on-trade channel is contributing exponentially to the growth of poultry meat in India.

India Poultry Meat Market Trends

Poultry production is anticipated to grow despite the hit by surging feed prices and outbreaks

- Poultry meat production observed a favorable growth rate of 30.08% between 2017 and 2022. However, the Y-o-Y growth rate in 2023 was 12.48%. The slower growth in production rate was majorly an impact of the unexpected bird flu and the rise in feed prices. Due to a shortage of supplies, the price of maize and soymeal increased by approximately 35% in 2022.

- Consumption of poultry meat is anticipated to increase as consumers are drawn not only to the competitive pricing but also to product consistency, flexibility, and higher protein/lower fat content. In general, organized and unorganized sectors contribute around 80% and 20% to the poultry industry, respectively. In India, the poultry industry is growing due to rising incomes, a fast-growing middle class, and the development of vertically integrated poultry manufacturers that have lowered consumer prices by reducing production and marketing expenses. Key factors that are expected to shape the future of the Indian poultry industry include integrated production, the market shift from live birds to refrigerated and frozen products, and policies that guarantee competitively priced supplies of corn and soybeans.

- The development of high-yield broilers (2.4 to 2.6 kg per week at six weeks of age) along with a standardized package of practices in terms of nutrition, accommodation, management, and disease prevention have led to a dramatic increase in broiler production in India (8 to 10% per year) over the past 40 years. In a market where prices are volatile, the rising feed costs are expected to potentially drive up the overall production expenses. The easy availability of nutritious poultry feeds, like maize, jawar, fish meal, and rice bran, is expected to improve the feed conversion ratio.

Rising production costs are impacting the profitability of the industry

- The Indian poultry market prices grew by 0.96% in 2022 compared to the previous year. During the first half of 2022, chicken prices decreased as heatwave conditions across the country had a severe impact on the poultry industry, with chicken prices plunging by 50% as farmers sold off their chickens in the market due to worries that high temperatures could kill them.

- The Indian poultry industry has come a long way in the last few years in terms of brand-building and adding value to chicken meat. However, in general, around 91% of the Indian chicken meat market is still sold through the wet market and the open wholesale market in a perfectly competitive environment. In such conditions, the price is the only difference between any two products. As a result, the poultry farmer is most likely to fall prey to the competition from other producers, sell his produce at a low price, and suffer losses despite the performance efficiency. The rise in import prices due to freight, transport, labor, and associated costs resulted in a spike in poultry meat prices.

- The demand for broiler chicken exceeds the supply in the HORECA sector. Wholesale broiler chicken prices increased in the fiscal year 2022-23. Broiler meat prices ranged between USD 1.69/kg and 1.75/kg during the fiscal year 2022-23. However, the supply shortage during the fiscal year 2022-23 caused the prices of corn and soy meal (two essential chicken feeds) to increase by around 35%; it was unlikely to decline in 2023. Hence, margins are anticipated to decrease for the second consecutive year. The price rise has already compelled processors and the foodservice sector to revise the prices of chicken rolls, chicken biriyani, chicken curry, etc.

India Poultry Meat Industry Overview

The India Poultry Meat Market is fragmented, with the top five companies occupying 15.70%. The major players in this market are Skylark Hatcheries Private Limited, Sneha Farms Pvt. Ltd., Suguna Foods Private Limited, Tyson Foods Inc. and VH Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90368

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Poultry

- 3.2 Production Trends

- 3.2.1 Poultry

- 3.3 Regulatory Framework

- 3.3.1 India

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Canned

- 4.1.2 Fresh / Chilled

- 4.1.3 Frozen

- 4.1.4 Processed

- 4.1.4.1 By Processed Types

- 4.1.4.1.1 Deli Meats

- 4.1.4.1.2 Marinated/ Tenders

- 4.1.4.1.3 Meatballs

- 4.1.4.1.4 Nuggets

- 4.1.4.1.5 Sausages

- 4.1.4.1.6 Other Processed Poultry

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Al Arif Foods

- 5.4.2 Godrej Industries Ltd.

- 5.4.3 India Broiler Group Pvt. Ltd

- 5.4.4 ITC Limited

- 5.4.5 Skylark Hatcheries Private Limited

- 5.4.6 Sneha Farms Pvt. Ltd.

- 5.4.7 Suguna Foods Private Limited

- 5.4.8 Tyson Foods Inc.

- 5.4.9 VH Group

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.