Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683912

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1683912

Europe Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 244 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

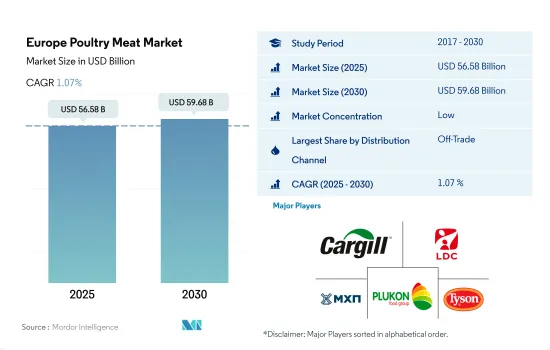

The Europe Poultry Meat Market size is estimated at 56.58 billion USD in 2025, and is expected to reach 59.68 billion USD by 2030, growing at a CAGR of 1.07% during the forecast period (2025-2030).

Increased tourist arrivals propelling the market growth

- The off-trade channel is projected to be the fastest-growing distribution channel in Europe, registering a CAGR of 0.96% by value during the forecast period. This growth is primarily attributed to the growing demand for frozen and processed meat products, such as chicken bites, chicken chips, nuggets, tenderloins, and chicken wings. These poultry products are readily available in most supermarkets and online stores of various brands, such as Tyson Foods, Foster Farms, TGI Fridays, and Avara Foods.

- Poultry meat through on-trade channels registered a CAGR of 2.99% by value from 2017 to 2022 and is anticipated to register a CAGR of 0.81% by value during the forecast period. Poultry meat sales are increasing due to the rise in the number of foodservice outlets and consumers' demand for restaurant food consumption. Services primarily stock frozen and processed poultry meat due to their high quality. Around 426 million nights were spent at tourist accommodation establishments in the European Union in the first quarter of 2023, up by 28% compared with the same period in 2022. About 76 million more hotel nights were spent in the first three months of 2023 compared with one year earlier (+32%). Thus, the increased tourism is fueling the sales of poultry meat in the region.

- The online channel sub-segment is the fastest-growing off-trade channel in the market. It is projected to register a CAGR of 6.40% by value during the forecast period. This is attributed to the increased internet penetration rate in the region. The number of online shoppers has increased considerably over the last few years. In 2022, around 70-75% of the EU population were involved in online shopping. Around 35% ordered meals from restaurants, fast-food chains, and catering services.

Rising consumption of poultry meat boosting the market growth

- In Europe, the overall sales value of poultry meat registered a CAGR of 3.99% by value during 2017-2022. This boost was primarily due to the rising consumption of meat across the region. The region's chicken consumption grew by 5.40% from 2020 to 2022 as the demand through the retail and HRI sectors increased. Over the longer term, consumers' preferences for chicken over other animal proteins grew, which is expected to lead to increased consumption of poultry meat. Generally, it is cheaper to buy chicken meat. Chicken meat is also considered to be healthier, more accessible, and easier to prepare by consumers in Europe.

- Poultry meat is majorly consumed in the Rest of European countries, like Poland, Portugal, the Czech Republic, and Scotland. From 2017 to 2022, the Rest of European poultry meat market registered a growth of 17.80% by value. Poultry meat production consists mainly of chicken broilers (81%) and turkey broilers (14%), which are in demand in the domestic meat processing industry. In addition, the Polish meat processing industry specializes in producing poultry sausages and pates, contributing to the growth of the poultry meat market.

- The Netherlands is anticipated to be the fastest-growing market in Europe. It is projected to witness a CAGR of 1.10% in terms of value during the forecast period. This is attributed to the increasing number of poultry processing plants in the country. For instance, there were 58 poultry meat processing plants in the Netherlands as of 2023, an increase of 1.8% from 2022. Moreover, supportive government policies, such as subsidies and investments in research and development, may further boost the poultry industry's growth in the future.

Europe Poultry Meat Market Trends

Higher production costs and various disease outbreaks are hindering the poultry production

- In 2022, the region experienced a growth of 1.62% in production compared to 2021. Europe is a major importer and exporter of poultry meat, and it is in the process of becoming a major trading partner in the global poultry meat market. Establishing new trade deals is key to expanding the industry and boosting the European economy. An estimated 98% of all EU chicken production consists of broiler meat. The remaining 2% is derived from laying hens and cocks. The poultry production in Russia retrieved after a minimum growth of 0.89% in 2021. In 2022, the market grew by 14.96% compared to 2021. The Russian poultry industry is impacted by factors including a sharp rise in production costs. The price for some feed additives in the Russian market increased by 260% in a Y-o-Y comparison. As a result, the Russian government approved a USD 15 million subsidy to the poultry industry to halt the unprecedented drop in production.

- The German poultry production industry is famous for the short distances between farms and slaughterhouses. The poultry is processed under strict hygienic conditions. The processing is also subject to supervision by a vet. Poland is also a major producer in the region. A major share of Polish chicken meat production is exported primarily to the food service industry.

- Polish poultry production was expected to face significant challenges with higher feed and energy costs in 2023. The industry operates on a short 2-3-month production cycle, which is very reactive to outside events. According to the European Food Safety Authority (EFSA), as of June 2022, there had been 2,398 outbreaks of highly pathogenic avian influenza (HPAI) in 36 European countries, leading to the culling of 46 million birds. The impacts were most severe in ducks, turkeys, and laying hens.

Higher production costs and supply disruptions due to the Russia-Ukraine conflict are leading to price growth

- The prices of poultry in the region grew by 11.53% from 2017 to 2022. The poultry price hike in the region has resulted in a combination of strong demand, tight supply, high input costs, and overall inflation. In 2022, imports of poultry into the EU largely remained constant. Additional imports from the United Kingdom, Brazil, Thailand, and China compensated for the loss of imports brought on by Russia's military aggression on Ukraine in 2022. As the foodservice industry returned to normalcy with ease in restrictions, the price of poultry meat increased in 2022, with a projected 1.5% rise in the total European poultry imports.

- Higher local poultry prices in the EU are helping competitors, such as Brazil, to gain more EU market share. Brazil was also expected to export around 35% more poultry to the EU in 2023. Ukraine, which benefitted from a suspension of duties due to the ongoing war with Russia, was exporting to the EU at higher volumes in 2022 than in 2021.

- The cost of poultry feed is also driving the price of chicken. The costs of corn and soybeans have been higher than in previous years, boosting the price of chicken once it reaches a restaurant or grocery store. Animal feed accounts for up to 55% of the farm gate value of poultry. Therefore, higher-priced poultry may disproportionately impact lower-income families during the forecast period. The broiler prices in the EU during the first half of 2023 varied from USD 1.85/kg of carcass to USD 4.27/kg. The average prices of broilers in the EU grew by 3% in the first half of 2023 compared to the previous year. In June 2023, the Netherlands recorded the lowest price of USD 1.81/kg for carcasses, and Denmark had the highest price of USD 4.45/kg for carcasses.

Europe Poultry Meat Industry Overview

The Europe Poultry Meat Market is fragmented, with the top five companies occupying 11.63%. The major players in this market are Cargill Inc., Lambert Dodard Chancereul (LDC) Group, MKHP, PRAT, Plukon Food Group and Tyson Foods Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50001602

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Poultry

- 3.2 Production Trends

- 3.2.1 Poultry

- 3.3 Regulatory Framework

- 3.3.1 France

- 3.3.2 Germany

- 3.3.3 Italy

- 3.3.4 United Kingdom

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Form

- 4.1.1 Canned

- 4.1.2 Fresh / Chilled

- 4.1.3 Frozen

- 4.1.4 Processed

- 4.1.4.1 By Processed Types

- 4.1.4.1.1 Deli Meats

- 4.1.4.1.2 Marinated/ Tenders

- 4.1.4.1.3 Meatballs

- 4.1.4.1.4 Nuggets

- 4.1.4.1.5 Sausages

- 4.1.4.1.6 Other Processed Poultry

- 4.2 Distribution Channel

- 4.2.1 Off-Trade

- 4.2.1.1 Convenience Stores

- 4.2.1.2 Online Channel

- 4.2.1.3 Supermarkets and Hypermarkets

- 4.2.1.4 Others

- 4.2.2 On-Trade

- 4.2.1 Off-Trade

- 4.3 Country

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 United Kingdom

- 4.3.8 Rest of Europe

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 2 Sisters Food Group

- 5.4.2 Cargill Inc.

- 5.4.3 Gruppa Cherkizovo, PAO

- 5.4.4 JBS SA

- 5.4.5 Lambert Dodard Chancereul (LDC) Group

- 5.4.6 MKHP, PRAT

- 5.4.7 PHW Group

- 5.4.8 Plukon Food Group

- 5.4.9 Rothkotter Group

- 5.4.10 Societe Bretonne de Volaille

- 5.4.11 Tyson Foods Inc.

- 5.4.12 Veronesi Holding S.p.A.

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.