Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636518

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636518

South America Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 130 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

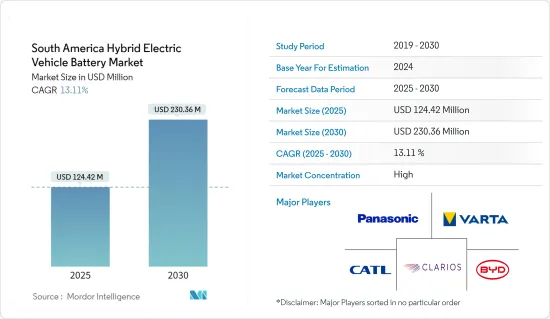

The South America Hybrid Electric Vehicle Battery Market size is estimated at USD 124.42 million in 2025, and is expected to reach USD 230.36 million by 2030, at a CAGR of 13.11% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles due to various supportive government schemes is expected to drive the demand for the South American hybrid electric vehicle battery market during the forecast period.

- On the other hand, the demand-supply mismatch of raw materials is expected to hinder the market's growth during the forecast period.

- Nevertheless, the adoption of solid-state batteries for electric vehicles and automaker-battery manufacturer collaborations are expected to create vast opportunities for the South American hybrid electric battery market in the future.

- Brazil is poised for substantial growth, driven by government initiatives aimed at increasing the number of electric vehicles to curb emissions.

South America Hybrid Electric Vehicle Battery Market Trends

Lithium-ion Batteries to Witness Significant Growth

- During the forecast period, lithium-ion batteries are poised to dominate the South American hybrid electric vehicle battery market. Their rising popularity, outpacing other battery types, can be attributed to a favorable capacity-to-weight ratio, superior performance (including extended life and minimal maintenance), an impressive shelf life, and a notable decrease in price.

- When compared to traditional lead-acid batteries, lithium-ion (Li-ion) batteries showcase distinct technical advantages. Li-ion batteries typically offer over 5,000 cycles, a stark contrast to the 400-500 cycles of lead-acid counterparts. Moreover, Li-ion batteries demand less frequent maintenance and replacement. They also maintain consistent voltage throughout their discharge cycle, ensuring prolonged efficiency for electrical components.

- In recent years, major industry players have ramped up investments, focusing on economies of scale and R&D to boost lithium-ion battery performance. This surge in competition has led to a notable drop in lithium-ion battery prices. Due to technological advancements, manufacturing optimizations, and falling raw material costs, the average price of lithium-ion batteries plummeted from USD 780/kWh in 2013 to USD 139/kWh in 2023. Projections suggest a further dip to approximately USD 113/kWh by 2025 and USD 80/kWh by 2030. Such declining trends in battery costs are likely to make it a lucrative choice among all batteries in the electric vehicle (EV) industry, including hybrid EVs.

- While the lithium-ion battery manufacturing industry in South America is still in its nascent stages, the continent's rich reserves of essential raw materials and the surging demand from diverse end-users signal a rapid market expansion.

- For instance, South America boasts vast lithium reserves, a cornerstone for lithium-ion batteries. The region, often dubbed the Lithium Triangle, encompasses Argentina, Bolivia, and Chile, collectively housing over half of the globe's known lithium reserves. Chile stands out as the primary producer, thanks to its extensive lithium-rich brine deposits in the Atacama Desert. Bolivia, with its massive lithium reserves in Salar de Uyuni, faces extraction challenges, while Argentina's Puna region salt flats also play a significant role. Together, these nations are integral to the global lithium-ion battery production supply chain.

- According to the US Geological Survey, in 2023, lithium production figures were notable: Chile produced around 44,000 metric tons, Argentina contributed 9,600 metric tons, and Brazil added 4,900 metric tons. This combined output underscores South America's pivotal role in the global lithium landscape.

- South American countries are intensifying efforts to deepen their involvement in the electric vehicle supply chain. By capitalizing on their mineral wealth, boosting processing capacities, and eyeing vehicle manufacturing, nations like Argentina, Chile, Bolivia, and Brazil are strategizing to convert more mined lithium into battery chemicals and eventually into batteries and EVs. However, these collaborative efforts don't extend to production or pricing coordination.

- In April 2023, BYD Co Ltd, China's leading electric vehicle manufacturer, announced plans for a USD 290 million lithium cathode factory in Chile's Antofagasta region, as reported by Chile's economic development agency, CORFO. Such investments are expected to proliferate in the coming years.

- In mid-2023, the Argentinean government revealed plans for its inaugural lithium-ion battery plant. This facility will utilize lithium carbonate sourced and processed locally by US mining giant Livent Corporation. Constructed by YPF Tecnologia (Y-TEC), a subsidiary of the state-owned YPF, the plant signifies Argentina's move to add value to its rich lithium reserves. With a USD 7 million investment, the facility aims for an annual production capacity of 13MWh, translating to 1,000 stationary energy storage batteries. Additionally, it seeks to foster technology transfer with local firms eyeing lithium-ion battery production.

- Given their lightweight nature, rapid charging capabilities, extended charging cycles, decreasing costs, and the region's abundant lithium reserves, lithium-ion batteries are set for rapid growth in the coming years.

Brazil to Witness Significant Growth

- Brazil is poised to emerge as a dominant player in the South American hybrid electric vehicle (HEV) battery market in the near future. This surge is primarily fueled by the escalating demand for batteries across diverse sectors, notably electric mobility. Furthermore, the country's burgeoning EV industry is bolstered by supportive government initiatives and technological strides.

- Recently, Brazil has seen a swift uptick in EV adoption, thanks to government-backed incentives. Illustrating this momentum, Brazil's EV car sales soared to approximately 52,000 units in 2023, a substantial leap from 18,500 units in 2022. This surge in EV sales is set to bolster batteries for the HEV market in the years ahead.

- Starting in January 2024, Brazil imposed a 10% tax on imported 100% electric vehicles (EVs), with plans to escalate this to 18% in July and a steep 35% by July 2026. In response, several Chinese automakers are ramping up local investments. Notably, BYD is establishing a manufacturing complex, eyeing production by late 2024 or early 2025, while Great Wall Motor's plant is set to commence operations in 2024. Such moves are poised to bolster Brazil's domestic EV manufacturing and, consequently, the demand for HEV batteries.

- Echoing a global trend, Brazil is actively working to curb carbon emissions and lessen its fossil fuel reliance. To facilitate this shift towards electric mobility, the government has rolled out various subsidies and incentives. A testament to this commitment is the Green Mobility and Innovation Programme launched in late 2023, offering over BRA 19 billion in tax incentives from 2024 to 2028 for companies pioneering low-emission transport technologies. Such endeavors are set to propel the EV landscape, including HEVs, thereby invigorating the HEV battery market.

- Brazil's advancements in battery raw materials are poised to fortify its HEV battery supply chain. For instance, in May 2024, AMG Critical Materials, a prominent lithium supplier, unveiled plans to expand its mining operations in Brazil. Their lithium concentrate plant, currently ramping up from 90,000 mt/year, is on track to hit a full capacity of 130,000 mt/year by Q4 2024.

- In another significant move, Sigma Lithium, a local mining entity, declared a USD 99.4 million investment in February 2024, with backing from the National Development Bank. Sigma's second plant in Minas Gerais aims to nearly double its output to 510,000 metric tons annually. Such developments are set to bolster Brazil's lithium-ion battery supply chain.

- Given these dynamics, Brazil's HEV battery market is on the brink of substantial growth in the forthcoming years.

South America Hybrid Electric Vehicle Battery Industry Overview

The South America hybrid electric vehicle battery market is semi-consolidated. Some of the key players in the market (not in any particular order) include Panasonic Holdings Corporation, Clarios (Formerly Johnson Controls International PLC), VARTA AG, Contemporary Amperex Technology Co. Limited, and BYD Company Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003886

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Favourable Government Policies

- 4.5.1.2 Growing Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Colombia

- 5.3.3 Argentina

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Clarios (Formerly Johnson Controls International PLC)

- 6.3.4 LG Energy Solutions Ltd

- 6.3.5 VARTA AG

- 6.3.6 Panasonic Holdings Corporation

- 6.3.7 Duracell Inc.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Solid-State Batteries for Electric Vehicles

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.