Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636502

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636502

ASEAN Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 115 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

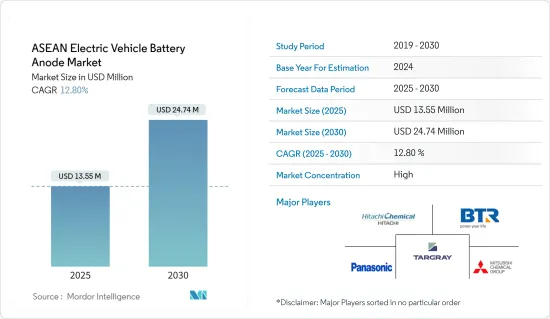

The ASEAN Electric Vehicle Battery Anode Market size is estimated at USD 13.55 million in 2025, and is expected to reach USD 24.74 million by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the ASEAN Electric Vehicle Battery Anode Market is poised for growth, driven by factors such as the rising adoption of electric vehicles, decreasing costs of Li-ion battery raw materials, and supportive government policies.

- However, challenges like limited raw material reserves and supply chain gaps may hinder the market's expansion.

- Yet, with ongoing technological advancements in battery materials and ambitious long-term targets for electric vehicles, significant opportunities await players in the ASEAN Electric Vehicle Battery Anode Market.

- Among the ASEAN nations, Indonesia is set to emerge as a leading player in the electric vehicle battery anode landscape.

ASEAN Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Segment to Dominate the Market

- Initially, the lithium-ion battery industry in Southeast Asia primarily served the consumer electronics sector. This was largely due to the region being home to both a majority of industry players and the minerals essential for Li-ion batteries. However, a significant transformation occurred over time. Electric vehicle (EV) manufacturers began to eclipse the consumer electronics sector, emerging as the primary consumers of lithium-ion batteries, outpacing lead-acid and other battery types. This shift was predominantly fueled by surging EV sales in ASEAN countries and escalating investments in Li-ion batteries and the associated Electric Vehicle Battery Anode Market.

- In nations such as Indonesia, Thailand, Singapore, and Vietnam, the past few decades have seen a meteoric rise of lithium-ion battery technology, especially in the automotive sector. ASEAN nations are increasingly favoring lithium-ion rechargeable batteries, primarily due to their superior capacity-to-weight ratio. Furthermore, lithium batteries in EVs do not emit NOX, CO2, or any other greenhouse gases, resulting in a significantly lower environmental impact compared to conventional internal combustion engine (ICE) vehicles. Given this advantage, ASEAN nations are actively promoting EV adoption and the development of local battery anode manufacturing markets.

- Data from the Organisation Internationale des Constructeurs d'Automobiles highlights a positive trend: both the Philippines and Vietnam saw passenger vehicle sales grow by 16.4% and 2.8% respectively in 2023 compared to 2022. This bodes well for players in the Li-ion Electric Vehicle sector and, by extension, those in the Electric Vehicle Battery Anode Market across ASEAN countries.

- In December 2023, PTT, a prominent oil and gas conglomerate from Thailand, ventured into lithium-ion battery production. This initiative aligns with PTT's broader strategy to create a supply chain for its electric vehicle brand, Neta, and capitalize on Thailand's expanding green car market. PTT officials announced that their joint venture partner, NV Gotion, has established a lithium-ion battery production line in Rayong province, southeast of Bangkok. The facility currently boasts a production capacity of 2 gigawatt-hours per year, with ambitious plans to scale up to 8 gigawatt-hours in the near future, directly catering to the surging demand and subsequently fueling the nation's EV Battery Anode Market.

- In July 2024, Indonesia celebrated the inauguration of its first Li-ion EV battery plant. As the largest economy in Southeast Asia and home to the world's richest Li-ion battery minerals, Indonesia is strategically positioning itself in the global electric vehicle supply chain. This plant, a joint venture between South Korean titans LG Energy Solution (LGES) and Hyundai Motor Group, is set to produce a staggering 10 Gigawatt hours (GWh) of Li-ion battery cells annually. Such a significant development augurs well for stakeholders in the ASEAN Electric Vehicle Battery Anode Market.

- Data from the Thailand Automotive Institute (TAI) reveals a remarkable surge in electric vehicle registrations in Thailand. In 2023, registrations reached 170,000, a significant jump from 84,570 in 2022. Given that over 95% of these vehicles are powered by Li-ion technology, this growth underscores the dominance of the Li-ion segment in Thailand's Electric Vehicle Battery Anode Market.

- In conclusion, the evidence strongly indicates that the lithium-ion battery segment is poised to dominate the ASEAN Electric Vehicle Battery Anode Market.

Indonesia to Dominate the Market

- Indonesia aims to cut CO2 emissions by 29%, equating to approximately 303 million tons, by the year 2030. With rising concerns over carbon emissions and reliance on fossil fuels, Indonesia views the introduction of electric vehicles (EVs) as a viable solution. This shift is poised to unlock substantial opportunities for the Electric Vehicle Battery Anode Market in the nation.

- Moreover, the Indonesian government is actively courting major global EV players to invest domestically. For instance, in May 2024, at the World Water Forum in Bali, Indonesia's coordinating minister for maritime affairs and investment revealed that Tesla's CEO is contemplating a proposal from the Indonesian government to set up an EV battery plant in the nation. This move would significantly bolster Jakarta's ambition to emerge as a dominant player in EV anode production.

- In November 2023, discussions between the U.S. and Indonesia centered on forging a partnership focused on critical minerals, with an emphasis on trading metals essential for electric vehicle (EV) batteries.

- In September 2024, the Indonesian Foreign Affairs Ministry expressed its intent to expand collaborations on critical minerals for EV battery production, this time engaging with African nations. At the Indonesia-Africa Forum (IAF), the ministry's Director General underscored Indonesia's vast demand for critical minerals, not only for EV batteries but also for related components like cathodes and anodes. The ministry also pointed out an active collaboration in lithium, especially between Mining Industry Indonesia (MIND ID) and Tanzania. These endeavors hint at a robust growth potential for Indonesia's Electric Vehicle Battery Anode Market.

- Data from the United Nations COMTRADE reveals that even as a nation rich in battery minerals, Indonesia's imports of Li-ion batteries have surged and remained elevated. In 2023, the value of imported Li-ion batteries reached USD 27.59 million, a slight uptick from USD 27.57 million in 2022. This trend underscores a strong demand for Li-ion batteries in Indonesia's EV sector and highlights the nation's burgeoning capacity for Electric Vehicle Battery Anode manufacturing.

- In May 2024, Australia's Syrah Resources Group dispatched 10,000 metric tons of natural graphite fines from its Balama graphite operation in Mozambique. The shipment was destined for BTR New Energy Materials' new plant in Indonesia. As Indonesia ramps up its infrastructure for EV battery production and associated anode materials, this shipment follows a trial container sent in March. This move not only marks a pivotal moment in Syrah's diversification strategy but also cements its position as a global leader in supplying natural graphite and active anode materials (AAM).

- Given these developments, it's evident that Indonesia is solidifying its foothold in the ASEAN Electric Vehicle Battery Anode Market.

ASEAN Electric Vehicle Battery Anode Industry Overview

The ASEAN Electric Vehicle Battery Anode Market is semi-consolidated. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Targray Technology International Inc., Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, and Panasonic Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003831

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.1.3 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Battery type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other technology

- 5.2 By Material Type

- 5.2.1 Silicon

- 5.2.2 Graphite

- 5.2.3 Lithium

- 5.2.4 Other Materials

- 5.3 Geography

- 5.3.1 Malaysia

- 5.3.2 Indonesia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BTR New Material Group Co., Ltd

- 6.3.2 Shenzhen Dynanonic Co., Ltd.

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Northern Graphite Corporation

- 6.3.6 Panasonic Corporation

- 6.3.7 Targray Technology International Inc.

- 6.3.8 Epsilon Advanced Materials Pvt. Ltd.

- 6.3.9 Volt14 Solutions Pte Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Anode Material

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.