Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636506

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636506

Europe Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 115 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

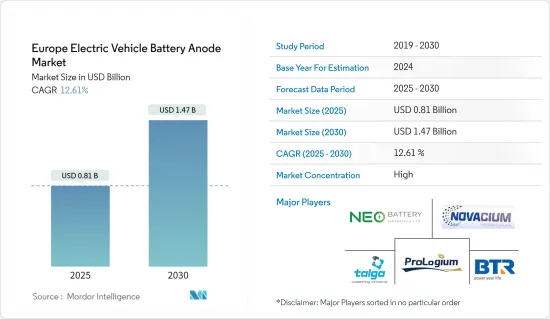

The Europe Electric Vehicle Battery Anode Market size is estimated at USD 0.81 billion in 2025, and is expected to reach USD 1.47 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

Key Highlights

- In the coming years, the Europe electric vehicle battery anode market is poised for growth, driven by the rising adoption of electric vehicles, decreasing costs of battery raw materials (leading to lower prices for Li-ion batteries), and supportive government policies.

- Conversely, challenges such as limited raw material reserves and gaps in the supply chain may hinder the growth of the Europe electric vehicle battery anode market.

- However, advancements in battery anode technologies and ambitious long-term targets for electric vehicles present significant opportunities for players in the European electric Vehicle Battery Anode Market.

- Among the key players in Europe, France is set to experience notable growth in the Europe electric vehicle battery anode market.

Europe Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery Segment to Dominate the Market

- In the early days of the lithium-ion battery industry, consumer electronics were the primary market. However, over time, electric vehicle (EV) manufacturers emerged as the leading consumers of these batteries, driven by a surge in EV sales, particularly in plug-in hybrid electric vehicles (PHEVs). This growing demand for lithium-ion batteries in the EV sector bolstered the market for battery anode materials.

- Over the past decade, Europe has seen a meteoric rise in the adoption of lithium-ion batteries, especially in the automotive sector. Countries like France, the UK, Germany, Italy, and Spain are increasingly favoring lithium-ion rechargeable batteries, due to their superior capacity-to-weight ratio. Moreover, lithium batteries in EVs produce no emissions of NOX, CO2, or other greenhouse gases, resulting in a significantly lower environmental impact compared to traditional internal combustion engine (ICE) vehicles. Recognizing this advantage, several European nations are actively promoting lithium-ion technology-driven EVs and fostering the development of the Electric Vehicle Battery Anode Market through subsidies and government initiatives.

- Bloomberg reported that in 2023, global average prices for lithium-ion battery packs used in electric vehicles (EVs) fell to USD 139/kWh, a 13% drop from the previous year. This decline followed a trend of rising prices in earlier years. With ongoing technological advancements and improved manufacturing efficiencies, prices are projected to continue their downward trajectory. Forecasts indicate a price drop to USD 113/kWh by 2025, and an even steeper decline to USD 80/kWh by 2030. Such trends bolster the dominance of the lithium-ion battery segment in Europe's Electric Vehicle Battery Anode Market during the forecast period.

- According to the International Energy Agency (IEA), in 2023, electric vehicle sales in the United Kingdom, predominantly utilizing lithium-ion battery technology (over 95% share), reached 450,000, up from 370,000 in 2022. Given this robust growth in the battery electric vehicle sector, lithium-ion batteries, with their distinct advantages, are poised to capture a significant share of Europe's Electric Vehicle Battery Anode Market.

- In June 2024, Stora Enso and Altris unveiled their partnership aimed at establishing a sustainable battery value and materials chain in Europe. Their collaboration focuses on integrating Stora Enso's Lignode, a hard carbon solution, as an anode material in Altris' sodium-ion battery cells. These cells are designed for both motive and stationary power storage. Lignode, as described by Stora Enso, is a sustainable hard carbon derived from lignin, a pulp manufacturing byproduct. This novel anode material boasts compatibility with both lithium-ion and sodium-ion batteries, marking it as a more sustainable choice compared to conventional anode solutions.

- Given these developments, it's evident that the lithium-ion battery segment is set to dominate Europe's Electric Vehicle Battery Anode Market in the coming years.

France to Dominate the Electric Vehicle Battery Anode Market in Europe

- France, a leading developed nation, has taken on the monumental challenge of significantly reducing its greenhouse gas emissions in recent years. In addition to integrating renewable energy sources into its energy mix, France has prioritized tackling vehicular emissions as a key strategy in its fight against climate change. This focus has opened up lucrative opportunities for players in the EV battery anode market. Numerous foreign companies have set up operations in France, consistently expanding their manufacturing capabilities.

- On October 14th, 2024, at the Paris Motor Show, ProLogium Technology, a frontrunner in lithium ceramic battery innovation, unveiled the world's first EV battery featuring a 100% silicon composite anode. This revolutionary battery can be charged in a mere 8.5 minutes. Such advancements underscore the burgeoning anode market in Europe, with companies actively innovating in EV battery anode materials.

- In May 2024, AnteoTech, a clean energy tech firm, revealed that a prominent electric vehicle maker will adopt its battery anode technology in their prototype batteries. At the 14th International Advanced Automotive Battery Conference (AABC) in Strasbourg, AnteoTech held talks with battery manufacturers, including a meeting with EV1's project management team. EV1, a global electric vehicle manufacturer, is evaluating the integration of Anteo XTM technology into its vehicles. AnteoTech highlights that EV1 has confirmed that Anteo XTM not only reduces their input costs but also boosts the performance of their proprietary anode.

- In August 2024, Novacium SAS, a French subsidiary focused on green engineering of silica and silicon-based anode materials, reached a pivotal milestone in battery innovation. Their latest batteries, combining graphite with a refined third-generation (GEN3) silicon-based anode, achieved a capacity of over 4,030 mAh. This is nearing the world record of 4,095 mAh for 18650 batteries. With this feat, Novacium SAS becomes one of only three companies worldwide to report 18650 battery capacities surpassing 4,000 mAh. Such milestones bolster the prospects of the EV battery anode material market in France.

- Data from the International Energy Agency (IEA) reveals that in 2023, France saw electric vehicle sales hit 470,000, up from 340,000 in 2022, with over 95% relying on Li-ion battery technology. Given this surge in the battery electric vehicle sector, lithium-ion batteries, with their distinct advantages, are poised to command a substantial share of the Electric Vehicle Battery Anode Market in France.

- Consequently, these developments position France as a pivotal player in the European Electric Vehicle Battery Anode Market in the coming years.

Europe Electric Vehicle Battery Anode Industry Overview

The Europe Electric Vehicle Battery Anode Market is moderately consolidated. Some of the major players in the market (in no particular order) include BTR New Material Group Co., Ltd., Novacium SAS, ProLogium Technology Co., Ltd, Talga Group, and NEO Battery Materials Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003835

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Favorable Government Policies

- 4.5.1.3 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Battery type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other technology

- 5.2 By Material Type

- 5.2.1 Silicon

- 5.2.2 Graphite

- 5.2.3 Lithium

- 5.2.4 Other Materials

- 5.3 Geography

- 5.3.1 France

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Nordic countries

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BTR New Material Group Co., Ltd

- 6.3.2 Novacium SAS

- 6.3.3 ProLogium Technology Co., Ltd

- 6.3.4 Talga Group

- 6.3.5 NEO Battery Materials Ltd

- 6.3.6 IPCEI European Battery Innovation

- 6.3.7 Vianode

- 6.3.8 Epsilon Advanced Materials Pvt. Ltd.

- 6.3.9 Altech Batteries Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Advancement in Anode Material

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.