Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636486

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636486

United States Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

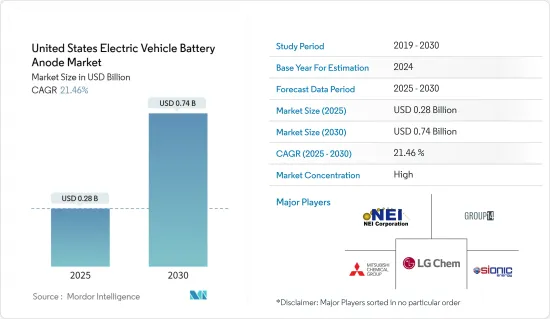

The United States Electric Vehicle Battery Anode Market size is estimated at USD 0.28 billion in 2025, and is expected to reach USD 0.74 billion by 2030, at a CAGR of 21.46% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, supportive government policies and investments in battery manufacturing, and the decreasing price of lithium-ion batteries are expected to drive the market in the forecast period.

- On the other hand, insufficient domestic manufacturing of anode materials is expected to restrain market growth in the future.

- However, ongoing research and advancements in anode materials and efficient electrolytes present promising opportunities for market growth.

United States Electric Vehicle Battery Anode Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- In the United States, all-electric vehicles and PHEVs predominantly utilize lithium-ion batteries, with chemistries that often differ from those in consumer electronics. The reason behind the drastic adoption of such batteries in electric vehicles is their high energy per unit mass and volume relative to other electrical energy storage systems. They also have a high power-to-weight ratio, high energy efficiency, high-temperature performance, long life, and low self-discharge.

- Additionally, falling material prices for lithium-ion batteries are proving advantageous for EV battery manufacturers. As production of EV lithium-ion batteries scales up, the demand for anodes in their manufacturing is set to increase. This trend not only signals a boost in innovation and efficiency within the sector but also strengthens the global competitiveness of EV battery manufacturers.

- For example, in 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh. This decline in battery prices translates to more affordable EVs, spurring adoption and expanding the electric vehicle market share. Such heightened demand will lead to increased consumption of battery components, notably the anode, and propel technological advancements for enhanced battery performance.

- Ongoing R&D initiatives are focused on developing more stable and efficient anode materials for lithium-ion batteries in electric vehicles, further underscoring the anticipated rise in demand for these anodes.

- For instance, in December 2023, Sila Nanotechnologies, Inc., a US-based battery materials firm, partnered with Panasonic to craft electric vehicle batteries featuring silicon anodes. Sila claims their nano-composite silicon anode material could offer a 20% range boost over the conventional graphite-based anodes in today's lithium-ion batteries.

- Looking ahead, with fresh investments pouring into EV lithium-ion battery manufacturing in the United States, the appetite for anode materials is set to surge. For instance, in June 2025, ExxonMobil entered a non-binding memorandum of understanding with SK On, an EV battery developer, to deliver 100,000 metric tons of Mobil Lithium from its inaugural project in Arkansas. ExxonMobil has ambitious plans, targeting lithium supply for approximately 1 million EV batteries annually by 2030, bolstering the U.S. EV supply chain.

- Given the rising adoption of lithium-ion batteries in electric vehicles and the declining prices, the segment for lithium-ion battery anodes is poised for significant growth in the coming years.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- In recent years, the United States electric vehicle (EV) battery manufacturing has surged, due to supportive government policies. These policies, encompassing tax incentives, subsidies, grants, and loans, have played a pivotal role. Notably, federal initiatives like the Advanced Technology Vehicles Manufacturing (ATVM) loan program are channeling funds into the development of cutting-edge battery technologies and their manufacturing facilities.

- With electric vehicle sales on the rise, the government is likely to introduce more policies to further stimulate battery manufacturing. This, in turn, will heighten the demand for EV battery anodes domestically. Data from the International Energy Agency highlights this trend: in 2023, the United States EV car sales reached 1.39 million units, a notable increase from 0.99 million in 2022.

- Moreover, the government is actively pushing for new legislation to expand domestic battery manufacturing. This includes not just the batteries themselves but also crucial components like anodes, cathodes, and separators. Such moves aim to strengthen America's supply chains for EV batteries and facilitate the transition to clean energy.

- For example, in April 2024, Sicona Battery Technologies, hailing from Australia, revealed plans for its inaugural silicon-carbon anode materials production facility in the Southeastern U.S. Looking ahead, Sicona targets an annual output of 26,500 tons by the early 2030s, enough to power over 3.25 million electric vehicles each year.

- Additionally, the government has rolled out multiple initiatives and policies, signaling a bullish outlook on electric vehicle demand. A case in point: in March 2024, the U.S. introduced new regulations on car tailpipe emissions, a move aimed at amplifying EV sales and curbing greenhouse gas emissions. The U.S. Environmental Protection Agency (EPA) projects these regulations could lead to 30 to 56 percent of new cars being electric between 2030 and 2032. This is a shift from the EPA's previous forecast, which anticipated EVs would make up 60 percent of new car sales by 2030, climbing to 67 percent by 2032. Such policies are poised to bolster the demand for electric vehicle battery manufacturing in the coming years.

- In conclusion, with the backing of government policies and investments, the trajectory for battery manufacturing looks promising.

United States Electric Vehicle Battery Anode Industry Overview

The United States electric vehicle battery anode market is semi-consolidated. Some of the major players in the market (in no particular order) include NEI Corporation, Ltd., Group14 Technologies, Sionic Energy, Mitsubishi Chemical Group., and LG Chemical Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50003755

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Insufficient Domestic Manufacturing of Anode Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NEI Corporation, Ltd.

- 6.3.2 Group14 Technologies

- 6.3.3 Sionic Energy

- 6.3.4 Mitsubishi Chemical Group.

- 6.3.5 Sicona Battery Technologies

- 6.3.6 Targray Industries Inc.

- 6.3.7 Sila Nanotechnologies

- 6.3.8 LG Chemical Group

- 6.3.9 Nexeon ltd

- 6.3.10 Amprius Technologies

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Anode Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.