Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693583

Asia-Pacific Military Helicopters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 187 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

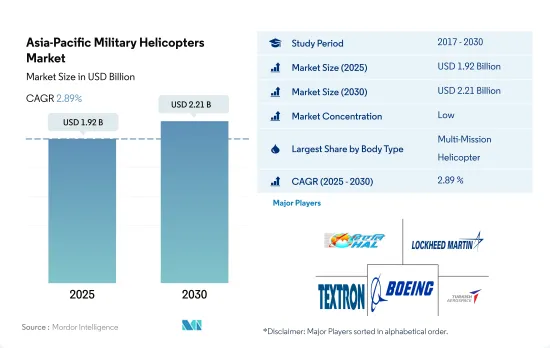

The Asia-Pacific Military Helicopters Market size is estimated at 1.92 billion USD in 2025, and is expected to reach 2.21 billion USD by 2030, growing at a CAGR of 2.89% during the forecast period (2025-2030).

The multi-mission helicopters are expected to dominate the rotorcraft segment due to the large number of procurements

- Rotorcraft demand is fueled by increasing military conflict, terrorism, border disputes, territory breaches, and violations. To gain a military advantage over the opposition, major armed forces in the region, such as China and India, are focusing on upgrading their aging helicopter fleets and acquiring technologically advanced platforms to enhance their combat capabilities.

- In 2022, rotorcraft accounted for 52% of the total aircraft deliveries in the region. In terms of military helicopter procurements from 2017 to 2022, 490 military helicopters were procured in Asia-Pacific.

- In Asia-Pacific, China, Japan, and India are expected to purchase most of the helicopters during the forecast period. China is expected to purchase over 500 Russian Mi-17 helicopters. By 2039, Japan plans to purchase 150 Bell 412 helicopters. Around 90 helicopters are being planned to be purchased by India, including 24 MH-60Rs, 34 Dhruv ALHs, 26 SA-315s, and six AH-64Es. All these helicopters are expected to be delivered by 2028.

- In 2022, training and transport rotorcraft accounted for 2% and 11% of the total rotorcraft aircraft deliveries in the region. South Korea planned to procure 29, and Australia plans to procure 36 AH-64E attack helicopters by 2023 and 2027, respectively. Small nations such as Indonesia intend to procure 14 H225M and nine Bell 412i helicopters, respectively, while Malaysia may acquire six MD 530 and three AW 139 helicopters. Around 1093 rotorcraft are expected to be delivered in the region during the forecast period.

Rising modernization of defense forces is leading to a surge in demand for military helicopters

- Several countries in Asia-Pacific are actively modernizing their defense forces to enhance their combat capabilities, leading to a surge in demand for military helicopters. In terms of military helicopter procurements during 2017-2022, 462 military helicopters were procured in Asia-Pacific. China procured most of the helicopters in the region with a share of 46%. Followed by China and India, South Korea has the largest share, with 20% and 9%, respectively.

- Additionally, the expansion of defense budgets in the region is a significant driver of this modernization drive. In 2022, the combined military expenditure of countries in Asia and Oceania was USD 575 billion. This was 2.7% more than in 2021. The growth in spending in 2022 was mostly attributed to increases in expenditure by China, India, and Japan, which together accounted for almost 73% of regional spending.

- Furthermore, the demand for multi-role helicopters in the region is on the rise as various governments are seeking versatile platforms that can perform a wide range of missions. Multi-role helicopters offer flexibility and cost-effectiveness by reducing the need for multiple specialized platforms, and this trend is driving the procurement of these helicopters. China, Japan, and India plan to procure the highest number of helicopters. China will procure 500 Mi-17 helicopters from Russia. Japan will procure 150 Bell 412 helicopters by 2039. India will procure around 102 helicopters, including 24 MH-60R, 34 Dhruv ALH, 26 SA-315, 12 Dornier 228, and 6 AH-64E. All these helicopters will likely be delivered by 2030. With such developments in place during 2023-2030, a total of 1,093 helicopters are expected to be procured by various armed forces in the region.

Asia-Pacific Military Helicopters Market Trends

Increased border tensions and the need for new aircraft has led to a surge in defense expenditure

- Asia-Pacific spent a total of USD 569 billion on military expenditures. Geopolitical conflicts such as border issues between China and India, internal security challenges, maritime surveillance, and counter-terrorism operations are some of the factors aiding the growth of the fixed-wing aircraft fleet of the countries in this region. The rise in military spending in China and India was the main cause of the increase in 2022. The combined military spending of the two nations in the region in 2022 was 66%. The increase in defense spending of the nations over the past ten years was driven by economic growth and territorial disputes.

- Major military powers, including India, China, Japan, and South Korea, are present in the Asia-Pacific region and are yearly growing their defense budgets. This budget includes a significant portion for the improvement and expansion of air superiority, which is driving the growth of military aviation in the region. For instance, in the budget of FY 2023, the Indian government allocated about 10% more for the Indian Air Force compared to the previous budget, including payments for the new Rafale fighters and the manufacturing of Sukhoi-30MKIs and Tejas fighters.

- The increased military spending in the Asia-Pacific region is intended to gain an advantage in several political and border conflicts, such as the tension in the South China Sea with many regional sovereign entities and border conflicts between India-China and India-Pakistan. The defense spending of major countries in China is expected to cross over USD 400 billion by 2030.

Fleet modernization and new procurements are projected to improve the APAC's military active fleet

- By the end of 2022, there were 15,543 active aircraft in the Asia-Pacific region, of which fixed-wing aircraft accounted for 60% while rotorcraft accounted for the remaining fleet. China, India, Japan, and South Korea together accounted for 55% of the total active fleet in the region.

- In 2020, the average aircraft fleet age in Asia-Pacific amounted to 9.5 years, which was projected to increase by 2030, when the average aircraft fleet age across the region was expected to be 10.7 years. The older aircraft, some of which date back to the 1960s, have been slowly phased out by the Indian Air Force. The MiG 21 and MiG 27 have been the backbone of the Indian Air Force (IAF). The average age of these aircraft is around 45 years. Australia's two fighter aircraft, FA-18 and F-35, have been in service for the last 16 years and 8 years, respectively.

- Countries such as China, India, and South Korea are expanding their aircraft fleet size to fulfill the demands of modern warfare. They may continue to produce and acquire next-generation aircraft during the forecast period. The regional armed forces are also enhancing the capabilities of helicopters with cutting-edge technology to obtain military superiority over the external threat.

- Asia Pacific's active fleet increased by 3% in 2022 compared to 2017. Indonesia and Thailand accounted for 63% of the total fleet in Southeast Asia. In the coming years, the aircraft fleet may increase as major countries like Thailand, Malaysia, Singapore, Indonesia, and the Philippines plan to procure over 135 aircraft. The active fleet of the region is expected to expand at a healthy rate during the forecast period.

Asia-Pacific Military Helicopters Industry Overview

The Asia-Pacific Military Helicopters Market is fragmented, with the top five companies occupying 39.56%. The major players in this market are Hindustan Aeronautics Limited, Lockheed Martin Corporation, Textron Inc., The Boeing Company and Turkish Aerospace Industries (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92733

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.2 Active Fleet Data

- 4.3 Defense Spending

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Multi-Mission Helicopter

- 5.1.2 Transport Helicopter

- 5.1.3 Others

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 China

- 5.2.3 India

- 5.2.4 Indonesia

- 5.2.5 Japan

- 5.2.6 Malaysia

- 5.2.7 Philippines

- 5.2.8 Singapore

- 5.2.9 South Korea

- 5.2.10 Thailand

- 5.2.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Hindustan Aeronautics Limited

- 6.4.3 Leonardo S.p.A

- 6.4.4 Lockheed Martin Corporation

- 6.4.5 MD Helicopters LLC.

- 6.4.6 Textron Inc.

- 6.4.7 The Boeing Company

- 6.4.8 Turkish Aerospace Industries

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.