Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693571

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693571

North America Military Helicopters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 146 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

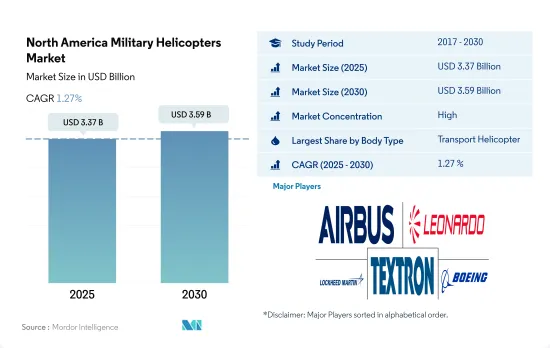

The North America Military Helicopters Market size is estimated at 3.37 billion USD in 2025, and is expected to reach 3.59 billion USD by 2030, growing at a CAGR of 1.27% during the forecast period (2025-2030).

Geopolitical challenges and rising defense budgets are the driving factors of the rotorcraft market

- The increase in defense spending across North America has significantly impacted the military helicopter market. Governments are allocating substantial resources to modernize their military capabilities, including upgrading helicopter fleets. As the nature of warfare evolves, defense spending is being directed toward acquiring cutting-edge helicopters equipped with the latest avionics, sensors, and weaponry. The defense expenditure of North America surged around 1% from 2021 to USD 904 billion in 2022.

- Additionally, the United States, Canada, and Mexico face numerous geopolitical challenges and perform counter-terrorism operations. Hence, these countries seek to enhance their aerial capabilities to respond effectively to these threats, which has contributed to the demand for military helicopters. As of 2022, in terms of the active fleet, the US accounted for 92% of the total rotorcraft in North America, while Canada, Mexico, and the Rest of North America accounted for 2%, 3%, and 3%, respectively. Some of the most procured helicopter models are 824 AH-64 Apache attack helicopters and over 513 CH-47D/F/MH-47G, 383 H145 (UH-72A/B), 2,312 S-70/EH/HH/MH/UH-60, 289 MV-22, and 489 S-70/MH-60R/S.

- To improve border security and buy cutting-edge weaponry and technologies, several countries in the region have increased their military budget, which may aid the future expansion of military rotorcraft procurement. For instance, in 2023, the United States planned to procure 119 rotorcraft, including CH-47 Chinook, UH-60 Black Hawk, CH-53K, AH-1Z, and MH-139A. The Mexican government ordered 11 helicopters (four H225M and seven UH-60M) for its Mexican Air Force. As a result of these advancements, the countries in the region are expected to take delivery of 588 rotorcraft.

Rising defense budgets and geopolitical conflicts are driving the demand for helicopter procurement in the region

- Countries in North America, particularly the United States, have been among the first to develop advanced helicopters to counter geopolitical conflicts. Nearly 94% of the military expenditures in the Americas region come from North America. In 2022, the region's defense expenditure totaled USD 912 billion. North America's military expenditures were largely accounted for by the United States (96%), followed by Canada and Mexico, with 3% and 1%, respectively.

- With increased military budgets, various countries in the region may facilitate the expansion of military rotorcraft procurement in the future. In 2023, the United States plans to purchase 119 rotorcraft, including the CH-47 Chinook, the UH-60 Black Hawk, the CH-53K, and the AH-1Z. The Mexican government ordered 11 helicopters (four H225M and seven UH-60M) for the Mexican Air Force.

- As of 2022, in terms of active fleet size, North America held approximately 29% of the total rotorcraft worldwide. Out of the entire region, the United States stood first, operating 92% of rotorcraft, of which 38% are multi-mission helicopters, 58% are transport helicopters, and 4% are other helicopters. The country was followed by Mexico, which operates 3% of fixed-wing aircraft, of which 56% are multi-mission helicopters, 39% are transport helicopters, and 31% are other helicopters. Canada followed Mexico, operating 2% of fixed-wing aircraft, of which 64% are multi-mission helicopters, 21% are transport helicopters, and 16% are other helicopters.

- With the ongoing procurements and modernization plans, the United States may continue to lead the market and generate significant demand for new rotorcraft. During the forecast period, a total of 588 aircraft are expected to be procured by the country.

North America Military Helicopters Market Trends

Geopolitical threats are the main reason behind the increase in defense spending in the region

- In 2022, the US accounted for 39% of global defense spending military spending increased by USD 877 billion in 2022, or 0.7%. The total includes military assistance to Ukraine, estimated at USD 19.9 billion. In 2022, the US released the Department of the Air Force budget, which outlined that for FY 2023, the budget request is approximately USD 194.0 billion, a USD 20.2 billion or 11.7% increase from the FY 2022 request. This funding includes aircraft R&D, aircraft acquisition, initial spares, and aircraft support equipment. The funding for FY 2023 includes the purchase of 61 F-35, 24 F-15EX, 79 logistics and support aircraft, 119 rotary wing aircraft, and 12 UAV/UAS.

- Over the past few years, Canada also has demonstrated a commitment to increase defense spending to address growing security concerns and modernize its military equipment. The country recognizes the need to adapt to emerging threats, such as cyber warfare and asymmetric challenges, while maintaining conventional defense capabilities. Canada spent USD 26.9 billion on its military in 2022, which was 3.0 % higher than the previous year. Out of the total government spending, the country has allocated 1.2% of its share to the military. As per the Budget 2022, the announcement government will offer more than USD 8 billion for new funding to Canada's national defense over the next five years.

- In Mexico, the use of military forces to combat criminal activity remains the primary driver of military spending in the sub-region. Mexico's defense spending in 2022 was USD 8.5 billion, a decrease of 9.7% compared to 2021. Spending on the National Guard increased by 35% in 2021, accounting for 16% of total military spending. The country's defense expenditure was 0.6% of its GDP in 2022.

Fleet modernization and the rising need for modernization of aircraft are the driving factors in North America

- As of December 2022, North America had an active fleet of 13,676 aircraft and helicopters. Competition in technology is accelerating between China and the United States as both countries are increasingly focused on the R&D of emerging technologies to prepare for future warfare. The United States has the biggest fleet of military aircraft in the region and globally, with a total of 13,300 operational fleets. A considerable chunk of this fleet is made up of combat helicopters (42%) and combat planes (21%). In contrast, training planes and helicopters account for 20%, while transport planes make up only 7%. Meanwhile, tankers and special mission aircraft each represent 5% of the fleet.

- By the end of 2022, Canada had an active fleet of about 356 aircraft and rotorcraft. Of these total 356 aircraft, the most procured fleet is training aircraft/helicopters, accounting for 132, followed by 120 combat helicopters, 63 combat aircraft, 28 transport aircraft, 27 special mission aircraft, and 6 tanker aircraft. Canada has selected F-35s to replace its CF-18 fighter jets, which are scheduled to retire by 2032. If the F-35 deal is finalized, Canada plans to start procuring the new jets in 2025. Mexico had an active fleet of 468 aircraft as of December 2022. Of these total 468 aircraft, the most procured fleet is training aircraft, and helicopters accounted for 203 aircraft, followed by 157 combat helicopters, 46 transport aircraft, 25 special mission aircraft, and 36 combat aircraft. As transnational criminal organizations and drug cartels largely occupy the country, the country utilizes military helicopters to fight drug traffickers.

North America Military Helicopters Industry Overview

The North America Military Helicopters Market is fairly consolidated, with the top five companies occupying 99.96%. The major players in this market are Airbus SE, Leonardo S.p.A, Lockheed Martin Corporation, Textron Inc. and The Boeing Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92665

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.2 Active Fleet Data

- 4.3 Defense Spending

- 4.4 Regulatory Framework

- 4.5 Value Chain Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Multi-Mission Helicopter

- 5.1.2 Transport Helicopter

- 5.1.3 Others

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 United States

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Airbus SE

- 6.4.2 Leonardo S.p.A

- 6.4.3 Lockheed Martin Corporation

- 6.4.4 MD Helicopters LLC.

- 6.4.5 Textron Inc.

- 6.4.6 The Boeing Company

7 KEY STRATEGIC QUESTIONS FOR AVIATION CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.