Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693475

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693475

Africa Grain Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 230 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

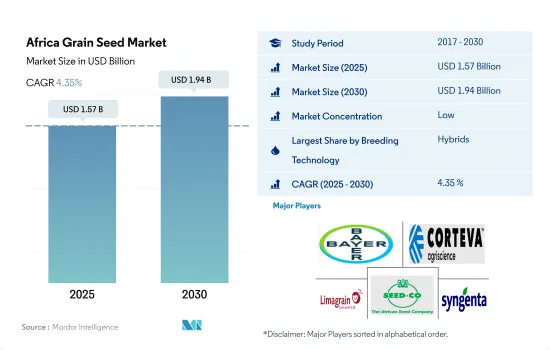

The Africa Grain Seed Market size is estimated at 1.57 billion USD in 2025, and is expected to reach 1.94 billion USD by 2030, growing at a CAGR of 4.35% during the forecast period (2025-2030).

Approval of GMO seeds and increased demand for high-yielding hybrids is estimated to drive the market's growth

- Hybrid varieties dominated the market and held a share of 59.4% in 2022, whereas open-pollinated varieties held a share of 40.6%. This could be mainly attributed to the increased utilization of hybrids to increase the yield and productivity of the crops.

- In 2022, rice and wheat remained the two major crops grown in Africa using open-pollinated varieties and hybrid derivatives, accounting for 98.6% and 98.4% of the respective markets in Africa. The increased research and development of disease-resistant and high-yielding open-pollinated varieties are expected to drive the market's growth.

- Under the hybrids segment, non-transgenic hybrids accounted for 60.4% and transgenic seeds accounted for 39.6% of the region's grains and cereals market in 2022.

- Only five of the 47 countries approved the use of GMO crops, which are South Africa, Burkina Faso, Sudan, Egypt, and Nigeria. GMOs are gradually integrating into modern African agriculture. In Africa, insect-resistant transgenic hybrids accounted for 78.2% of the transgenic seed market in terms of value, and herbicide-tolerant hybrids accounted for 21.8% in 2022. South Africa dominates the African grain seed market in insect-resistant and herbicide-resistant traits. Herbicide-tolerant varieties were approved only in South Africa.

- Corn is the only grain crop cultivated in Africa with the herbicide-tolerant trait. The market value of GM herbicide-tolerant grains is estimated to record a CAGR of 2.4% during the forecast period.

- Approval of genetically modified seeds and increasing demand for high-yielding hybrids are expected to drive the market's growth.

South Africa is the largest grain seed market in Africa due to the large area of grain cultivation in the country

- In 2022, grains and cereals accounted for about 62.6% of the African row crop seed market. The primary reason for the higher market share of grains was the increase in their consumption and the increasing acreage under cultivation.

- South Africa holds the major share of Africa's grain seed market, accounting for about 34.6% of the market in 2022. This was because of the availability of new and improved seed varieties, access to the market, and an increase in the cultivation of highly profitable crops, such as corn. The market share of South Africa is projected to grow during the forecast period.

- Kenya and Ghana are the fastest-growing grain seed markets, which are anticipated to register a CAGR of 6.6% during the forecast period. Rice is the major grain crop, which is in high demand in these countries.

- Corn held the largest share of the African grain seed market, accounting for 49.1% of the market in 2022. South Africa holds the major share of the African corn market, which accounted for 50.3% by value in 2022 due to more area under cultivation, the approval of GM corn for cultivation, and the availability of hybrid varieties from global players suitable for local areas.

- Ethiopia and Nigeria are the fastest-growing wheat markets in the region, which is anticipated to record a CAGR of 5.8% during the forecast period. The increasing area under cultivation of profitable crops and the growing consumption are driving the growth of the market in these countries.

- The increasing cultivation area in Africa and the increasing consumption of grains are the factors anticipated to drive the African grain seed market during the forecast period.

Africa Grain Seed Market Trends

Corn is the largest row crop cultivated in Africa and increasing due to government support and the significance of corn as a main food source

- Grains and cereals are the major crops cultivated in the region as they are staple food crops. The area under cultivation for these crops accounted for 126.5 million hectares in 2022; there was an increase of 3.2% between 2017 and 2022. Favorable climatic conditions, higher consumption demand as a staple food, corn demand from the feed industries, and export potential drive farmers to grow more grains in the region.

- Corn is the major grain crop cultivated in the region, which accounted for 34.0% of the grain crop's area in 2022. The cultivation area of corn increased by 10.7% during 2016-2022 because of its ability to generate higher yields and greater demand for consumption from the processing and feed industries in the region. Moreover, Sorghum is one of the major staple food crops in the region. The area under cultivation of sorghum increased by 2.1% from 2017 to 2022 due to the increase in consumption and the growing demand for millet crops, including sorghum, due to their health benefits.

- In Africa, the cultivation area of rice increased from 15.1 million hectares in 2016 to 16.0 million hectares in 2022. Rice is cultivated in 40 African countries, and it is a staple food for the majority of the population in Africa. According to the Africa Rice Center, rice production in Africa is increasing at a Y-o-Y growth rate of 6%, which is anticipated to increase further during the forecast period. The other grains cultivated in the region include wheat, barley, oats, millets, and rye. The availability of improved seeds has helped growers cultivate more barley than wheat, as less water is required to cultivate. Therefore, increasing the demand for grains for home consumption and feeding livestock is anticipated to boost grain cultivation area in Africa.

Disease resistance is a popular trait in African corn and wheat cultivation due to the significant impact of insects and diseases on crop productivity and agricultural sustainability in the region

- Corn is an important grain crop cultivated in Africa. It is a high-profit crop with high demand from food, feed, and other industries. Therefore, there is an increasing demand for seeds with disease resistance, wider adaptability, early maturity, and drought tolerance to overcome environmental damage and biotic and abiotic stresses.

- In 2020, the International Maize and Wheat Improvement Center (CIMMYT) initiated a five-year long-term project (2020-2025) AGG (Accelerating Genetic Gains in Maize and Wheat) in the African region. This project uses innovative methods that improve breeding efficiency and precision to produce climate-resilient, pest- and disease-resistant, highly nutritious varieties targeted to farmers' needs.

- In Africa, companies such as Bayer Ag, Limagrain, and Seed Co. have introduced a wide range of cultivars that are resistant to grey leaf spot disease of corn, rusts in maize and wheat, Septoria leaf blight in wheat, and other powdery mildew resistant cultivars.

- Ethiopia, Egypt, and Kenya are the major wheat-producing countries in Africa. In wheat, leaf rust is the major disease that causes severe yield losses. The varieties with disease-resistant qualities minimize yield loss. Therefore, the demand for leaf rust-resistant varieties is anticipated to rise in the region. Moreover, with the growing domestic demand, farmers have also been focused on cultivating wheat cultivars with wider adaptability traits and high protein and gluten content.

- Therefore, developing disease-resistant traits to protect the crop is projected to help grow the seed market and increase the growers' profit in the future.

Africa Grain Seed Industry Overview

The Africa Grain Seed Market is fragmented, with the top five companies occupying 36.52%. The major players in this market are Bayer AG, Corteva Agriscience, Groupe Limagrain, Seed Co Limited and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92538

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Corn & Wheat

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Corn

- 5.2.2 Rice

- 5.2.3 Sorghum

- 5.2.4 Wheat

- 5.2.5 Other Grains & Cereals

- 5.3 Country

- 5.3.1 Egypt

- 5.3.2 Ethiopia

- 5.3.3 Ghana

- 5.3.4 Kenya

- 5.3.5 Nigeria

- 5.3.6 South Africa

- 5.3.7 Tanzania

- 5.3.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Capstone Seeds

- 6.4.5 Corteva Agriscience

- 6.4.6 Groupe Limagrain

- 6.4.7 S&W Seed Co.

- 6.4.8 Seed Co Limited

- 6.4.9 Syngenta Group

- 6.4.10 Zambia Seed Company Limited (Zamseed)

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.