Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693465

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693465

Asia-Pacific Grain Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 267 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

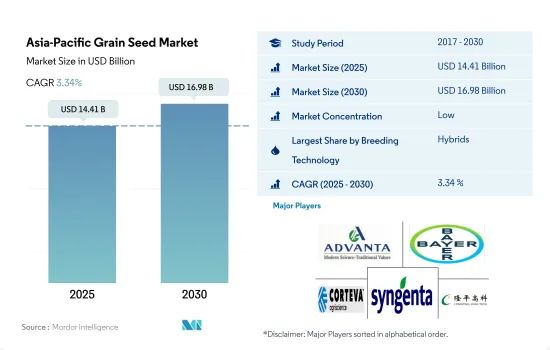

The Asia-Pacific Grain Seed Market size is estimated at 14.41 billion USD in 2025, and is expected to reach 16.98 billion USD by 2030, growing at a CAGR of 3.34% during the forecast period (2025-2030).

The hybrid segment dominates the grain seed market due to high yield and a high degree of resistance to the biotic and abiotic stresses

- In Asia-Pacific, hybrid seeds dominate the grain seed market, with a share of 66.4% in 2022. This was mainly due to the higher yield, improved traits, and a high degree of resistance to the biotic and abiotic stresses of hybrid seeds.

- In the hybrid seed market of the region, grains held a major share of 58.2% in 2022 in terms of value. This was mainly due to the large area under grain cultivation and the large volume of seeds required for planting. The share value of grain seeds is expected to increase during the forecast period owing to the rising adoption of hybrids, especially in corn and rice.

- In hybrid seeds, the non-transgenic seed segment is estimated to be the fastest-growing segment during the forecast period, registering a CAGR of 3.1% due to the non-availability of transgenic hybrids for all the crops and the government ban on the cultivation of transgenic grain crops in many major agricultural countries including India, Australia, and Pakistan.

- Open-pollinated varieties and hybrid derivatives held 33.6% of the grain seed market value in 2022. Open-pollinated varieties are more common in grain crops due to their self-pollination characteristics, whereas the production of hybrids is comparatively difficult.

- In Asia-Pacific, among grain crops, rice dominates the open-pollinated variety's seed market value. Rice accounted for a 58.1% share of the market, followed by corn (15.3%), wheat (14.1%), other grains and cereals (10.2%), and sorghum (2.2%) in 2022.

- The increasing demand for hybrid seeds, their high-yielding potential, and the increasing cultivation are the factors anticipated to drive the market during the forecast period.

The development of hybrid varieties and higher consumption demand are increasing the area under cultivation of cereals and grains

- In Asia-Pacific, China has the largest grain seed market, and it accounted for 62% in terms of value in 2022, with a market value of USD 8.0 billion. China led the cereal production in the global market, with a volume of 633 million metric ton in 2021, and it accounted for 20.6% of the global cereal production in the same year. In 2021, corn had a major share of 42.2% of cereal production. The corn production is being used for ethanol production.

- In 2022, corn held the major share of around 52.6% of cereals and grains seed market. The majority of corn production was used in livestock feeding, with the increased livestock population and rising meat demand.

- India is the largest producer of cereal and also the largest exporter of cereal products globally. Rice (including Basmati and Non-Basmati) occupies the major share in India's total cereals export, with more than 87% during the 2021-2022 period. Other cereals, including wheat, accounted for only a 12% share of the total cereals exported from India during 2021-2022. An increase in the export potential of the crops is estimated to increase the demand for the seeds.

- Domestic and global players in Indonesia have increased their focus on the introduction of hybrid seeds over the past few years, which has significantly boosted market revenues. For instance, in 2021, Bayer Indonesia introduced Arize(R) H 6444 Gold, a revolutionary hybrid rice seed that simultaneously increased yields and protects against Bacterial Leaf Blight (BLB).

- With the increased consumption and demand for grains and the minimum dependency on imports, the plantation area is expanding, which is anticipated to fuel the growth of the grains seed segment during the forecast period.

Asia-Pacific Grain Seed Market Trends

The demand for grains and cereals as staple food consumption and the ideal climate for cultivation has made them the largest segment in the region

- Grains and cereals are the major crops cultivated in the region, as some of them are staple foods. The area under cultivation for these crops accounted for 80.8% of the total row crops area in the region in 2022. Favorable climatic conditions, higher consumption demand as a staple food, corn demand from the feed industries, and export potential drive farmers to grow more grains in the region. The area under grains and cereals accounted for 676.5 million hectares in 2022, which increased by 1.6% since 2017. Among the grains and cereals, rice is the major staple food crop cultivated in the region, as Asia-Pacific is the major global producer. In 2022, the area under rice cultivation was 143.2 million hectares, which increased from 138.0 million hectares in 2017. Abundant rainfall during the summer and monsoon seasons provides ideal conditions for rice growing in the region.

- Wheat is another major grain crop cultivated in the region. In 2022, Asia-Pacific wheat acreages accounted for 97.5 million hectares, an increase of 1.5% from 2017. India and China occupy the major cultivated areas in the region, with 3.1 million ha and 23.8 million hectares in 2022, respectively. Moreover, the acreage under corn cultivation was 67.6 million hectares in 2022, representing 10.0% of the total grain crop area. Factors driving the corn in terms of acreage are its ability to produce higher yields and greater demand from the processing and feed industries.

- Other major grain crops in the region are sorghum and barley. Australia is the major producer of barley. The area under barley cultivation increased by 23% from 2017 to 2022, increasing the demand for Australian barley globally for use in beer brewing and distilling and as a high-quality, clean animal feed.

Drought tolerant and disease resistance are the major traits helping in increasing the market growth in the region

- Corn is an important crop cultivated by growers because it is high-profiting. The growers have a high demand for traits such as weed control, improved grain quality, early maturity, lodging tolerance, resistance to leaf curl and early rots, and broader adaptability to different regions and climate conditions. For instance, companies such as BASF SE and Syngenta provide traits that help increase resistance to diseases such as early rots and leaf diseases and higher productivity. These seed varieties are witnessing high demand because no other sprays or alternatives exist to resist the diseases. Furthermore, the other major traits, such as color, height, and the number of grains per cob, are popular for high returns for growers.

- China and India are major rice producers globally and have a high demand for seeds resistant to diseases such as seedling blight, grain rot, and other bacterial diseases. For instance, brands such as Bayer AG's Arize Tej Gold provide resistance to seeding blight, and Vina Seed's Thein Uu8 variety provides resistance to different diseases such as blast and sheath blight. Furthermore, the crop is affected by different pests such as Tryporyza incertulas and Gundhi bugs.

- Drought tolerant trait is one of the major produced traits by seed companies as there have been changes in the climatic conditions which has led to high demand for this seed variety by the growers. For instance, in 2022, China suffered drier conditions than normal rainfall conditions, which is expected to help in increasing the demand for drought-tolerant seed varieties.

- Factors such as low water due to climatic conditions, pests, and diseases affecting the growth of crops are expected to help introduce new seed varieties during the forecast period.

Asia-Pacific Grain Seed Industry Overview

The Asia-Pacific Grain Seed Market is fragmented, with the top five companies occupying 19.76%. The major players in this market are Advanta Seeds - UPL, Bayer AG, Corteva Agriscience, Syngenta Group and Yuan Longping High-Tech Agriculture Co. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92528

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Rice & Corn

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Corn

- 5.2.2 Rice

- 5.2.3 Sorghum

- 5.2.4 Wheat

- 5.2.5 Other Grains & Cereals

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 Bangladesh

- 5.3.3 China

- 5.3.4 India

- 5.3.5 Indonesia

- 5.3.6 Japan

- 5.3.7 Myanmar

- 5.3.8 Pakistan

- 5.3.9 Philippines

- 5.3.10 Thailand

- 5.3.11 Vietnam

- 5.3.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 DCM Shriram Ltd (Bioseed)

- 6.4.5 Groupe Limagrain

- 6.4.6 Jiangsu Zhongjiang Seed Industry Co. Ltd

- 6.4.7 Kaveri Seeds

- 6.4.8 KWS SAAT SE & Co. KGaA

- 6.4.9 Syngenta Group

- 6.4.10 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.