Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693438

Grain Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 527 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

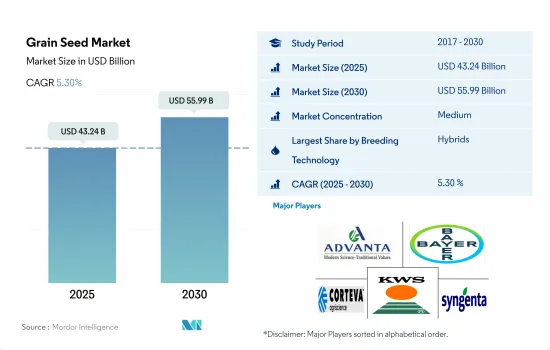

The Grain Seed Market size is estimated at 43.24 billion USD in 2025, and is expected to reach 55.99 billion USD by 2030, growing at a CAGR of 5.30% during the forecast period (2025-2030).

Hybrids dominated the grain seed market due to higher yield and adoption of GM crops in major growing countries

- Hybrids dominated the global grain seed market in 2022, capturing a significant 64.1% share. This dominance can be attributed to their desirable traits, including higher yields, insect resistance, herbicide tolerance, and drought tolerance.

- Within the hybrid category, transgenic crops accounted for 49.3% of the market's value, while transgenic hybrids claimed a slightly higher share of 50.6%. In 2022, Asia-Pacific emerged as the leader in non-transgenic grain seeds, commanding a sizable 55.4% market share. Notably, countries like India, with restrictions on genetically modified (GM) food crops, heavily rely on non-transgenic hybrids to bolster farm productivity.

- Within the transgenic hybrid segment, herbicide-tolerant hybrids took the lion's share, reaching 51% in 2022. Herbicide-tolerant seeds are exclusively authorized for rice and corn cultivation. GM corn, for instance, incorporates a gene from a bacterium, rendering it resistant to a range of broad-spectrum herbicides.

- Globally, open-pollinated varieties and hybrid derivatives accounted for 35.9% of the grains and cereals seed market in 2022. In this landscape, Asia-Pacific emerged as a key consumer, claiming 32.5% of the open-pollinated varieties of the global grain seed market in 2022.

- Companies are significantly investing in new plant technologies to meet the rising demand for advanced varieties. These sought-after varieties exhibit adaptability to diverse climates, high yield potential, disease resistance, and drought tolerance. The availability of such improved traits in new varieties is expected to drive seed demand in the coming years.

Corn dominates the grain and cereal seed market due to high demand from the processing industry and commercial usage of seeds

- The grains and cereals segment was the largest segment, and it accounted for 56.4% of the global seed market in 2022. The market value is estimated to grow by 43.7% between 2023 and 2030. Corn was the major grains and cereals crop. It accounted for a market value of USD 21.8 billion in 2022. It is mainly associated with higher demand from the processing industry in ethanol production.

- North America is the leading producer of grains. In 2022, grains and cereals accounted for 57.6% of the North American seed market. The total acreage under grains and cereals in the region in 2022 was 82.7 million hectares, which increased by 1.3% compared to 2021 due to an increase in the processing facilities and governments pushing the adoption of self-sufficiency as grains and cereals are the staple food in the diet.

- In Asia-Pacific, China has the largest grain seed market, and it accounted for 62% in terms of value in 2022, with a market value of USD 8.0 billion. In 2022, Asia-Pacific held about 74.3% of the global rice seed market. China and India accounted for about 37.6% of the global rice seed market in 2022 due to high consumption (about 65% of the population consumes rice in these countries).

- Europe was the largest wheat producer globally, accounting for 45.3% of the global wheat seed market in 2022. France, Germany, the United Kingdom, Ukraine, and Russia held the largest share in the region, accounting for 30.1% of the global wheat seed market in 2022.

- The increased demand for grains and cereals from processing industries, higher export value for the crops, and an increase in the population are the factors estimated to drive the seed market value during the forecast period.

Global Grain Seed Market Trends

Increased demand for grains for consumption and from food and feed industries led to increased area under cultivation

- The grains and cereals segment dominated global cultivation, covering an expansive 1 billion hectares in 2022. Wheat, corn, and rice emerged as the primary grain crops, witnessing widespread cultivation. Between 2017 and 2022, the cultivation area saw a 1.9% uptick, primarily driven by the rising global demand for grains as staple foods.

- Wheat is the leading grain crop, occupying approximately 20.5% of the total grain crop area in 2022. It thrives as a staple food in temperate and subtropical regions. Asia-Pacific, buoyed by favorable climates and robust demand from consumers and the processing industry, held the largest wheat cultivation area.

- Corn is also one of the major grain crops, accounting for 209.0 million hectares in 2022. Its cultivation area witnessed a 4.3% surge from 2017 to 2022, propelled by heightened demand from the food and feed industries. Corn finds its footing across tropical, sub-tropical, and temperate climates, with variants like field corn, sweet corn, popcorn, and baby corn. In 2022, Asia-Pacific and North America, commanding over half of the global acreage, i.e., 51.9%, emerged as the powerhouses of corn production.

- Rice, claiming 15.3% of the global grain crop area in 2022, saw its cultivation area inch up from 162.6 million hectares in 2017 to 165.3 million hectares in 2022. Asia-Pacific reigned supreme as the global rice producer due to abundant rainfall during the summer and monsoon seasons, thus creating an ideal rice-growing environment.

- This surge in cultivation areas is projected to fuel the growth of the seed market in the coming years, aligning with the rising demand.

The demand for disease-resistant rice, as it remains a staple food, and for corn with disease resistance and enhanced adaptability is rising to cater to the expanding needs of farmers

- Rice consumption in Asia-Pacific is significant, with people in the region typically having it as a daily meal. China and India stand out as major global rice producers. Given the changing climate, seed companies are increasingly focusing on developing drought-tolerant varieties, responding to a surge in demand from growers. In 2022, China faced drier conditions than usual, further fueling the demand for drought-tolerant seeds. In a notable move, Corteva Agriscience introduced its brand, Brevant, to the Indian market in 2020, featuring traits like wider adaptability and drought tolerance.

- The United States, Mexico, and China are key corn producers on a global scale, with corn being a lucrative crop for growers due to its high profitability. Traits such as weed control, enhanced grain quality, early maturity, lodging resistance, and adaptability to diverse agro-climatic conditions are in high demand. Industry leaders like Bayer AG, KWS SAAT SE & Co. KGaA, and Syngenta are delivering seed varieties that offer resistance to diseases like early rots and leaf diseases, which are critical for increasing yield, especially in the absence of effective sprays or other control methods. In Asia-Pacific, growers also prefer traits that influence corn's physical attributes, such as kernel color, stalk height, and grain count per cob.

- Factors like water scarcity, pest challenges, and disease outbreaks are expected to drive the introduction of new seed varieties and fuel market growth in the coming years.

Grain Seed Industry Overview

The Grain Seed Market is moderately consolidated, with the top five companies occupying 42.69%. The major players in this market are Advanta Seeds - UPL, Bayer AG, Corteva Agriscience, KWS SAAT SE & Co. KGaA and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92500

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Rice & Corn

- 4.2.2 Wheat & Sorghum

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Corn

- 5.2.2 Rice

- 5.2.3 Sorghum

- 5.2.4 Wheat

- 5.2.5 Other Grains & Cereals

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Breeding Technology

- 5.3.1.2 By Crop

- 5.3.1.3 By Country

- 5.3.1.3.1 Egypt

- 5.3.1.3.2 Ethiopia

- 5.3.1.3.3 Ghana

- 5.3.1.3.4 Kenya

- 5.3.1.3.5 Nigeria

- 5.3.1.3.6 South Africa

- 5.3.1.3.7 Tanzania

- 5.3.1.3.8 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Breeding Technology

- 5.3.2.2 By Crop

- 5.3.2.3 By Country

- 5.3.2.3.1 Australia

- 5.3.2.3.2 Bangladesh

- 5.3.2.3.3 China

- 5.3.2.3.4 India

- 5.3.2.3.5 Indonesia

- 5.3.2.3.6 Japan

- 5.3.2.3.7 Myanmar

- 5.3.2.3.8 Pakistan

- 5.3.2.3.9 Philippines

- 5.3.2.3.10 Thailand

- 5.3.2.3.11 Vietnam

- 5.3.2.3.12 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Breeding Technology

- 5.3.3.2 By Crop

- 5.3.3.3 By Country

- 5.3.3.3.1 France

- 5.3.3.3.2 Germany

- 5.3.3.3.3 Italy

- 5.3.3.3.4 Netherlands

- 5.3.3.3.5 Poland

- 5.3.3.3.6 Romania

- 5.3.3.3.7 Russia

- 5.3.3.3.8 Spain

- 5.3.3.3.9 Turkey

- 5.3.3.3.10 Ukraine

- 5.3.3.3.11 United Kingdom

- 5.3.3.3.12 Rest of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Breeding Technology

- 5.3.4.2 By Crop

- 5.3.4.3 By Country

- 5.3.4.3.1 Iran

- 5.3.4.3.2 Saudi Arabia

- 5.3.4.3.3 Rest of Middle East

- 5.3.5 North America

- 5.3.5.1 By Breeding Technology

- 5.3.5.2 By Crop

- 5.3.5.3 By Country

- 5.3.5.3.1 Canada

- 5.3.5.3.2 Mexico

- 5.3.5.3.3 United States

- 5.3.5.3.4 Rest of North America

- 5.3.6 South America

- 5.3.6.1 By Breeding Technology

- 5.3.6.2 By Crop

- 5.3.6.3 By Country

- 5.3.6.3.1 Argentina

- 5.3.6.3.2 Brazil

- 5.3.6.3.3 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 Florimond Desprez

- 6.4.5 Groupe Limagrain

- 6.4.6 KWS SAAT SE & Co. KGaA

- 6.4.7 RAGT Group

- 6.4.8 S&W Seed Co.

- 6.4.9 Syngenta Group

- 6.4.10 Yuan Longping High-Tech Agriculture Co. Ltd

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.