Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693454

North America Grain Seed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 205 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

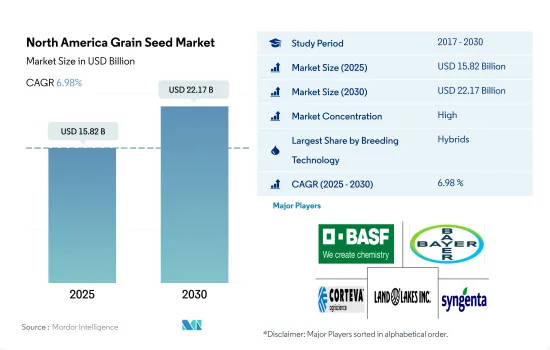

The North America Grain Seed Market size is estimated at 15.82 billion USD in 2025, and is expected to reach 22.17 billion USD by 2030, growing at a CAGR of 6.98% during the forecast period (2025-2030).

Hybrids dominate the market due to advancements in breeding technologies and growing consumer preference for quality produce

- In North America, the hybrid segment dominated the grain seed market, with a share of 76.6% in terms of value in 2022. Hybrids are tailored to specific growing conditions, allowing farmers to choose varieties that perform well in their particular region or environment.

- Among hybrids, the major crop produced is corn, which accounted for about 92.8% of the grain seed market in 2022. This is because hybrid corn seeds consistently produce higher yields compared to open-pollinated varieties, resulting in increased productivity and profitability for farmers.

- New plant breeding techniques are allowing the development of new hybrid varieties with desired traits by modifying the DNA of the seeds and plant cells. Innovations in plant breeding are helping address the challenges farmers face in the field every day. This, in turn, drives the hybrid seed market.

- Open-pollinated seeds exhibit a more comprehensive range of genetic diversity, allowing for flavor, color, and size variations that can appeal to different consumer preferences. As a result, there is a growing demand from organic growers for regenerative agricultural practices.

- Wheat is the second most cultivated crop in the grains and cereals segment, using open-pollinated varieties after corn. It accounted for 40.6% of the grain seed market value of open-pollinated varieties in 2022. This is because open-pollinated varieties offer a wider range of traits and genetic diversity that offer high yield and adaptability to the local environment, which can be valuable for wheat farmers.

- There is an increasing demand for hybrid seeds due to the high yield and less production area required for the same output by open-pollinated varieties, which is expected to drive the growth of hybrid seeds in the market.

The United States dominated the grain seed market in the region, with corn and wheat being major crops

- In 2022, grains and cereals accounted for 57.6% of the North American seed market. The total acreage under grains and cereals in the region in 2022 was 82.7 million hectares, which increased by 1.3% compared to 2021 due to an increase in the number of processing facilities and governments pushing the adoption of self-sufficiency as grains and cereals are a staple food in the diet.

- The United States is the second-largest producer of grains and cereals globally, with corn and wheat being the major contributors. The US corn seed segment accounted for 53.9% of the overall US seed market in 2022.

- Wheat, oats, and barley are the major cereals cultivated in Canada, accounting for more than 14 million hectares in 2022 and producing more than 45 million metric ton of grains. Canada is the fifth-largest producer of wheat, producing more than what is required for consumption. Canada exports wheat to more than 80 countries.

- In 2022, the Mexican grain seed market accounted for a market value of USD 961 million, which increased by 25.4% compared to 2019 due to high international commodity prices and government programs incentivizing small growers to produce basic grains. These factors are boosting Mexico's total grain production, particularly of rice and wheat.

- The grains and cereals seed market of Rest of North America accounted for 3.3% of the region's grains and cereals seed market value in 2022. The total acreage in 2022 was 2.3 million hectares, which has decreased by 3.8% since 2017 due to tropical storms and cyclones in the major producing countries, such as Cuba and Costa Rica.

- The increasing government support and continuous demand for staple food are estimated to boost the seed market in the region during the forecast period, with a CAGR of 6.8%.

North America Grain Seed Market Trends

Corn-dominated grains and cereals area in the North America as there is an increased demand from the processing industries

- In North America, the area under cultivation of grains and cereals segment in 2022 accounted for 82.7 million ha, which increased by 1.3% from the previous year due to solid demand for cereals as a staple food. Corn was cultivated under 45.6 million ha in 2022 among all the grains and cereals. It is mainly attributed to high yields compared with other crops in the region and has suitable soil and agroclimatic conditions for the cultivation of corn. Except in Canada, the region's major countries have the majority of land under corn production because corn has many applications, such as animal feed, ethanol production, staple consumption, and biofuel production, which is driving the demand for the crop in the country.

- Wheat was the second-largest crop grown in the region, cultivated under 25.0 million ha in 2022. North Dakota was ranked the first leading wheat production state, with about 299.9 million bushels produced in 2022. Furthermore, Being the largest country in the region, the United States had around 55.5 million ha under the production of grains and cereals in 2022. The major grains-producing states are Kansas, North Dakota, Montana, Washington, Oklahoma, Idaho, Texas, Oregon, Minnesota, and South Dakota.

- In Canada, the area under grains and cereals increased by 11.2% between 2022 and 2017, with the increase under wheat and barley. Wheat accounted for 60.8% of the grains and cereals production area in 2022. The acreage increased due to the rise in demand and the shift in farmers' preference from corn and other cereals to wheat, as wheat is the primary staple consumed in the country. Thus, increased demand for grains and cereal crops in the region from processing industries drives market growth.

Increasing usage of disease resistant and wider adaptability traits are driving the growth of grain seed market in the region

- Rice and corn are the most hybridized crops in North America, registering significant demand for different traits that reduce the cost of inputs and have a high yield in severe climatic conditions such as drought.

- Disease-resistant traits are the most demanded corn traits by the growers in the region. These traits are being used by them to protect the crop from turcicum, white spot diseases, gray leaf spot, common rust, goss wilt, and Anthracnose stalk rot diseases. Other traits such as insect resistance and wider adaptability also have a high demand to protect from major insects infecting maize crops are moths, such as cutworms, armyworms, and borers, followed by beetles such as grubs and weevils, which grow in the off-season and different soil conditions. For instance, product brands such as Winfield and Dekalb contain these corn traits.

- Rice is one of the largest produced and exported crops from North America, particularly the United States. To earn high profit by increasing the yield of the crop by 30%-40% and higher production, the growers are demanding rice seed varieties with traits such as disease resistance, abiotic stress tolerance, wider adaptability, and drought tolerance. The traits offered by seed companies such as Bayer AG's Arize provide resistance to bacterial diseases, early maturity, and produce high quantities during abiotic stress.

- Factors such as the increased consumption of corn and rice, an increase in the availability of hybrids, and high demand for resistance to diseases and increasing yield are expected to drive the market's growth in the region.

North America Grain Seed Industry Overview

The North America Grain Seed Market is fairly consolidated, with the top five companies occupying 75.62%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Land O'Lakes Inc. and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92516

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Cultivation

- 4.1.1 Row Crops

- 4.2 Most Popular Traits

- 4.2.1 Rice & Corn

- 4.3 Breeding Techniques

- 4.3.1 Row Crops

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Breeding Technology

- 5.1.1 Hybrids

- 5.1.1.1 Non-Transgenic Hybrids

- 5.1.1.2 Transgenic Hybrids

- 5.1.1.2.1 Herbicide Tolerant Hybrids

- 5.1.1.2.2 Insect Resistant Hybrids

- 5.1.1.2.3 Other Traits

- 5.1.2 Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1 Hybrids

- 5.2 Crop

- 5.2.1 Corn

- 5.2.2 Rice

- 5.2.3 Sorghum

- 5.2.4 Wheat

- 5.2.5 Other Grains & Cereals

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Advanta Seeds - UPL

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 DLF

- 6.4.6 Groupe Limagrain

- 6.4.7 KWS SAAT SE & Co. KGaA

- 6.4.8 Land O'Lakes Inc.

- 6.4.9 S&W Seed Co.

- 6.4.10 Syngenta Group

7 KEY STRATEGIC QUESTIONS FOR SEEDS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.