Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692045

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692045

Asia-Pacific Red Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 239 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

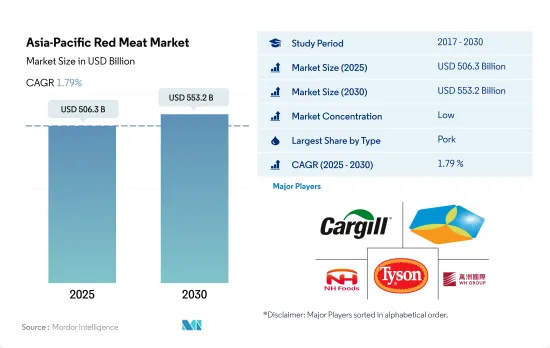

The Asia-Pacific Red Meat Market size is estimated at 506.3 billion USD in 2025, and is expected to reach 553.2 billion USD by 2030, growing at a CAGR of 1.79% during the forecast period (2025-2030).

Advancements in pork production and declining poultry prices are fueling the demand

- The Asia-Pacific red meat market was majorly led by pork meat throughout the study period. It is also anticipated to be the fastest-growing meat type during the forecast period, registering a CAGR of 2.88% by value. This is mainly supported by its growing production rate. It was the most-produced meat type in the region, accounting for a share of 46.8% by value in 2021, and it is anticipated to continue being the highest-produced meat type during the forecast period. As of 2022, China led the global pork production, which was estimated to produce over 50 million metric tons of meat, followed by Vietnam, the second-largest pork meat producer in Asia-Pacific and the seventh-largest globally.

- As of 2022, the second-largest market share by value was occupied by beef, which registered a growth in market sales value by 3.88% from 2017 to 2022, mostly because it was priced less than mutton and pork, making it an affordable addition to people's diets. Beef is the second most widely consumed red meat in Asia, with per capita consumption highest in South Korea, followed by Vietnam. China, Japan, and South Korea import the most beef in Asia. The imports are expected to increase to meet demand unless domestic production is revamped for the better.

- Mutton is the third-largest variety of red meat consumed in the region, with the sales value reaching 4.49% during 2017-2022. For all Asian countries, it has been observed that mutton is costlier than beef, which could have acted as a restraint. However, owing to larger disposable incomes and growing middle-class incomes in South Asian countries, the purchasing power of consumers is expected to increase, thereby implying opportunities for a demand hike for mutton.

Rising working population and increasing household income driving the market

- The red meat market in Asia-Pacific experienced significant growth during the historical period, growing at a value rate of 5.3% from 2020 to 2022. The most consumed meat type in the region is pork, followed by beef and mutton. Across Asia, pork is the primary protein in many cuisines. Most pork consumed in the region is domestically produced, while imports contribute to a sizable portion. China is one of the largest producers and consumers of pork in the world, producing 53.97 million metric tons of pork in 2022. However, production is expected to decline in the next two years, as a devastating outbreak of African swine fever (ASF) can hamper the country's pork supply.

- The Malaysian red meat market is anticipated to witness the fastest growth among the countries in the region, and it is projected to register a CAGR value of 2.19% during the forecast period. The growth will be driven by the development of the processed red meat segment in the country, as the number of employed people grew to 16.16 million in 2022, growing by 29,000 from the 2021 number. The meat supply chain consists of establishments for slaughtering animals, cutting, processing, packaging, and distributing meat for consumption or sale.

- Pork is the fastest-growing meat segment in the region, and it is projected to register a CAGR of 2.12% from 2023 to 2029. The growing household income continues to be a key driver of rising pork consumption. As customers' options for food expand with the rising disposable incomes, the demand for meat is anticipated to increase in developing countries. The per capita consumption of pork meat increased to 15.76 kg per capita in 2022, with the highest consumption in all meat types, as domestic production is increasing.

Asia-Pacific Red Meat Market Trends

Major producing countries are observing growth owing to the increasing export demand

- In Asia-Pacific, the leading producers of beef were China, India, and Australia, with a volume share of 38.71%, 21.49% and 9.28% respectively, in 2022. In China, production grew by 2.74% in 2022 compared to 2021. The production is anticipated to grow in the future, driven by rising cattle herds, particularly on large farms, and strong domestic demand owing to the ongoing pork shortage. High feed costs and lower-cost imports of beef products would have an impact on China's cattle production. Consumer demand for beef products has grown beyond the normal hotel and restaurant trade to include ready-cooked meals.

- The Indian market saw a growth of around 3.69% in 2022 compared to 2021, owing to the growing export demand and marginally higher domestic consumption. In 2023, India was expected to consume 779 million kg of beef, an increase of 1.84% from 2022, driven largely by its affordable pricing. For the supply and promotion of quality meat, the regulatory bodies in the nation are encouraging farmers' cooperatives to play an important role, including the promotion of backward integration and contract farming.

- In March 2023, the number of cattle slaughtered in Australia increased 13.5% to 1.7 million compared to the previous year. Beef production in the March 2023 quarter increased 11.3% to 524,335 tons compared to the same period in 2022. In 2022, Australia produced approximately 1.9 million tons of carcass weight (cwt) of beef and veal, and in the same year, Australia exported 67% of its total beef and veal production. The plentiful grazing pasture in the country supported the production of grass-fed cattle. In 2022, 2.7 million grain-fed cattle were marketed, accounting for 47% of all adult cattle slaughtered.

Beef prices are growing at a steady pace in the region owing to the large production base

- In 2022, beef prices in the region were up by 0.96% compared to 2021. This rise in prices was owing to the heated geopolitical conditions, supply imbalance and demand for global commodities, increasing energy prices, and logistic barriers. The beef price index saw a decrease in 2023, reaching 118.48 in June and falling from 135.83 during the same period in 2022, which is anticipated to stabilize the beef prices in the region.

- The price of beef in China highly impacts the Asia-Pacific market, owing to China being the largest producer of beef in the region. The price of beef in China increased at an average of 2.02% throughout the review period compared to a regional average growth rate of 1.40%. The country also imports a good amount of beef from Brazil, which is mainly used in preparing industrialized products and other popular dishes. In 2023, the country saw a decrease in imports owing to the increase in local production, thus stabilizing the prices. The beef prices in the region experience a spike during the festive season. In countries like Indonesia, in 2022, beef prices ranged from USD 9.75 to USD 6.96/kg, whereas it was around USD 11.84/kg during Eid and Ramadan.

- Australia is among the top three producers of beef in the region and a major source of premium beef in the region. More than 60% of the beef produced annually in Australia is exported to the global market. The price of young Australian cattle in the market jumped by 132% in about two years, reaching USD 7.99 in October 2021. Importers from countries such as Indonesia and Vietnam struggled with a combination of a strong Australian currency and rising cattle prices. However, despite the rise in CIF (cost, insurance, and freight), retail beef prices were steady in both Indonesia and Vietnam.

Asia-Pacific Red Meat Industry Overview

The Asia-Pacific Red Meat Market is fragmented, with the top five companies occupying 5.30%. The major players in this market are Cargill Inc., COFCO Corporation, NH Foods Ltd, Tyson Foods Inc. and WH Group Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 90340

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Price Trends

- 3.1.1 Beef

- 3.1.2 Mutton

- 3.1.3 Pork

- 3.2 Production Trends

- 3.2.1 Beef

- 3.2.2 Mutton

- 3.2.3 Pork

- 3.3 Regulatory Framework

- 3.3.1 Australia

- 3.3.2 China

- 3.3.3 India

- 3.3.4 Japan

- 3.4 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 4.1 Type

- 4.1.1 Beef

- 4.1.2 Mutton

- 4.1.3 Pork

- 4.1.4 Other Meat

- 4.2 Form

- 4.2.1 Canned

- 4.2.2 Fresh / Chilled

- 4.2.3 Frozen

- 4.2.4 Processed

- 4.3 Distribution Channel

- 4.3.1 Off-Trade

- 4.3.1.1 Convenience Stores

- 4.3.1.2 Online Channel

- 4.3.1.3 Supermarkets and Hypermarkets

- 4.3.1.4 Others

- 4.3.2 On-Trade

- 4.3.1 Off-Trade

- 4.4 Country

- 4.4.1 Australia

- 4.4.2 China

- 4.4.3 India

- 4.4.4 Indonesia

- 4.4.5 Japan

- 4.4.6 Malaysia

- 4.4.7 South Korea

- 4.4.8 Rest of Asia-Pacific

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 5.4.1 Allanasons Private Limited

- 5.4.2 Cargill Inc.

- 5.4.3 Charoen Pokphand Foods Public Co. Ltd

- 5.4.4 COFCO Corporation

- 5.4.5 F & G Foods Pte Ltd

- 5.4.6 JBS SA

- 5.4.7 Muyuan Foods Co., Ltd.

- 5.4.8 New Hope Liuhe Co. Ltd

- 5.4.9 NH Foods Ltd

- 5.4.10 Tyson Foods Inc.

- 5.4.11 WH Group Limited

6 KEY STRATEGIC QUESTIONS FOR MEAT INDUSTRY CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.