Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687123

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687123

Europe Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 176 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

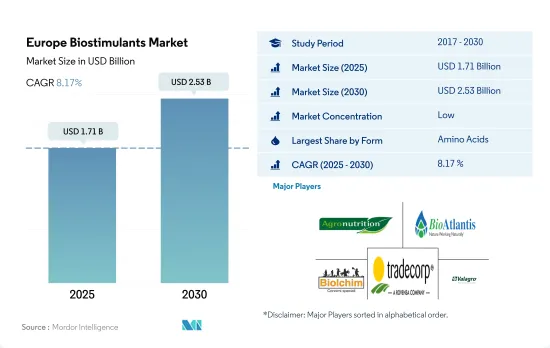

The Europe Biostimulants Market size is estimated at 1.71 billion USD in 2025, and is expected to reach 2.53 billion USD by 2030, growing at a CAGR of 8.17% during the forecast period (2025-2030).

- Biostimulants refer to substances and microorganisms utilized to improve plant growth and development. In Europe, the biostimulant market is projected to experience significant growth, estimated at 53.3%, between 2023 and 2029 Humic acid, fulvic acid, amino acids, protein hydrolysates, seaweed extracts, and other biostimulants, such as plant and animal derivatives, are Europe's most commonly used biostimulants.

- Amino acids hold the largest market share in the European biostimulant market, accounting for 56.7% in 2022. This is attributed to their ability to enhance plant health and tolerance to stress and their chelating effects that protect plants from heavy metals and contribute to micronutrient mobility and acquisition.

- Foliar application of biostimulants is effective through absorption by mesophyll cells via the cuticle and epidermal cells. When supplied via soil, absorption occurs through root epidermal cells and is redistributed via the xylem.

- The biostimulant market for row crops is dominant, holding a share of 78.1% in 2022, and is expected to grow by 62.0% between 2023-2029. This is due to the significant area under cultivation for row crops, occupying 82.3% of the total organic crop area in the region in 2022.

- The growing awareness of the benefits of biostimulants among farmers in enhancing crop resistance to biotic and abiotic stress, improving nutrient absorption, and their application in both organic and non-organic farms are expected to drive the market between 2023-2029.

- The biostimulants market in Europe is dominated by France, which held an 18.0% market share in 2022. French farmers are adopting biostimulants as an alternative to intensive chemical inputs, aligning with public policy objectives to reduce chemical use in agriculture.

- Italy is the second-largest and the fastest-growing market. It is projected to have a 7.0% CAGR between 2023 and 2029. Italy's high adoption of organic farming, with 15.0% of agricultural land under organic farming, is contributing to the market growth. Germany is the third-largest market, with a 12.4% market share, and the formation of clear regulations by regulatory bodies may further strengthen the market.

- The formation of clear regulations by the regulatory bodies may further help in strengthening the biostimulants market in the country. In May 2020, the European Commission's Farms to Fork Strategy stated that organic is a key sector to achieve the European Green Deal's food ambitions. The strategy also stated that the market for organic food is set to continue and, therefore, organic farming needs to be further promoted. The EU has developed strict standards to encourage organic farming and advance ecological safety, contributing to the growth of the biostimulants market.

- Biostimulants are becoming more widely adopted as people become more aware of the negative effects of chemically produced pesticides and fertilizers on human health. Biostimulants are also non-toxic and do not contaminate the soil, further contributing to their growing adoption throughout Europe.

Europe Biostimulants Market Trends

European Green Deal is majorly contributing for increasing organic cultivation across the region

- European countries are increasingly promoting organic farming, and the amount of land under organic farming has significantly increased over the last ten years. In March 2021, the European Commission launched an organic action plan to achieve the European Green Deal target of reaching 25% of agricultural land under organic farming by 2030. Austria, Italy, Spain, and Germany are among the leading countries in the European region. As of 2022, Italy has 15.0% of the agriculture area under organic farming, which is higher than the average of the European Union (7.5%).

- In 2021, there were 14.7 million ha of organic land in the European Union (EU). The agricultural production area is divided into three main types of use: arable land crops (mainly cereals, root crops, and fresh vegetables), permanent grassland, and permanent crops (fruit trees and berries, olive groves, and vineyards). The area of organic arable land was 6.5 million ha in 2021, 46% of the EU's total organic agricultural area.

- The organic areas of cereals, oilseeds, protein crops, and pulses in the EU increased by 32.6% between 2017 and 2021, amounting to more than 1.6 million ha. With 1.3 million ha in production, perennial crops accounted for 15% of the organic land in 2020. Olives, grapes, almonds, and citrus fruits are a few examples of crops in this group. As of 2022, Spain, Italy, and Greece are major growers of organic olive trees, with 197,000, 179,000, and 47,000 ha in production, respectively. Both olives and grapes are crucial for Europe's agricultural industry because they can be turned into specialty products that are in demand locally and internationally. The increasing trend in organic acreage in the region is expected to strengthen the organic sector in Europe further.

Growing demand and rising the per capita spending on organic products in the region

- Consumers in Europe are purchasing more goods that are made using natural materials and methods. Even though organic food only makes up a small fraction of the EU's agricultural production, it is no longer a niche sector. The European Union represents the second-largest single market for organic goods internationally, with an average per capita spending of USD 74.8 annually. Europe's per capita spending on organic food doubled in the last decade. In 2020, Swiss and Danish consumers spent the most on organic food (USD 494.09 and USD 453.90 per capita, respectively).

- Germany is the largest organic food market in the European region and the second-largest market in the world after the United States, accounting for a market size of USD 6.3 billion in 2021, with a per capita consumption of USD 75.6. The country accounted for 10.0% of the global organic food demand and is further estimated to register a CAGR of 2.7% between 2021 and 2026.

- The organic food market in France witnessed strong growth, with a 12.6% rise in retail sales in 2021. According to Global Organic Trade, the country's per capita spending on organic food was USD 88.8 in 2021. In 2018, as recorded by the Agence BIO/Spirit Insight Barometer, 88% of French people consumed organic products. The preservation of health, environment, and animal welfare are the primary justifications for consuming organic foods in France. The organic market has begun to grow in several other nations, including Spain, the Netherlands, and Sweden, with the opening of organic stores. The growth in organic sales was triggered post-COVID-19 pandemic, with consumers paying more attention to health issues and knowing the negative effects of conventionally grown food.

Europe Biostimulants Industry Overview

The Europe Biostimulants Market is fragmented, with the top five companies occupying 5.76%. The major players in this market are Agronutrition, BioAtlantis Ltd, Biolchim SPA, Trade Corporation International and Valagro (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55372

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 AGLUKON Spezialduenger GmbH & Co.

- 6.4.2 Agronutrition

- 6.4.3 Atlantica Agricola

- 6.4.4 BioAtlantis Ltd

- 6.4.5 Biolchim SPA

- 6.4.6 Bionema

- 6.4.7 Ficosterra

- 6.4.8 Green Has Italia S.p.A

- 6.4.9 Trade Corporation International

- 6.4.10 Valagro

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.